Introduction

Many cities are highly indebted as they face mounting challenges. Meanwhile, developing world cities often lack institutions for collecting tax revenues. With their importance growing, cities must square the circle between creating thriving economies and meeting society’s needs. It’s a time for strategies that tackle key issues such as affordable housing, climate change and crime.

Source: 2024 Financial State of the Cities, Truth in Accounting. Data to 2022 fiscal year end.

In a recent ranking of global cities, New York, London and San Jose, respectively, claimed the top three places.

They were judged by economics, human capital, quality of life, environment and governance. But as the importance of cities grows, their future success depends on how well they tackle society’s challenges.

Global Cities Index

Urban population will swell to 6 billion by 2045, up from 4.4 billion, according to the World Bank.

Much of this growth is happening in developing Asia and Africa; however, increasing migration is also likely to drive population growth in cities across Europe and developed Asia.

Source: World Bank, 2024

Driven largely by population growth and climate change, cities are the places where it’s most urgent to tackle society’s looming challenges.

They are crowded places, often built near water and vulnerable to flooding. As magnets for migrants, they are also places that magnify social inequality.

Yet higher taxes are not always an option for cities looking for ways to solve their problems.

Already, high-tax U.S. cities such as New York and San Francisco have seen people leaving for lower-tax destinations like Florida and Texas.

KEY ISSUES FOR CITIES

At a defining time, these are among key issues cities face, all of which require funding to overcome:

HOUSING AFFORDABILITY

Urban inequality is evident in the cost of housing. Acquiring property is prohibitively expensive in many cities, and since COVID-19 rents have also spiked.

New York City is the most expensive U.S. city, with 66.9% of income spent on rent, followed by Miami at 42.0% and Fort Lauderdale at 36.8%, according to Moody’s Analytics. In terms of the cost of buying a house, Hong Kong is most expensive, with house prices equal to 18.8 times annual income.

Source: Moody’s Analytics, Q1 2023; Demographia, 2023

Least-Affordable Housing Markets

QUALITY OF LIFE

70%

800M

6.7M

ESSENTIAL INFRASTRUCTURE

49.5%

of urban residents worldwide have convenient access to public transportation.

Source: UN Sustainable Transport Conference, Beijing, October 2021

36%

of the global urban population is not connected to sewers, while elsewhere aging systems need replacing.

Source: UN, 2023

Contrast in cities’ crime rates

Mexican cities such as Colima and Zamora recently had the dangerous distinction of having the most murders per population, while Hong Kong and Glendale, California, had the lowest, according to one ranking. Keeping cities safe is a key responsibility of government. Failure to do so undermines a city’s economy and social fabric.

*Source: Statista, 2021; Berkshire Hathaway Travel Protection, 2023

Cities are delicate ecosystems.

Dynamic cities like Dubai and Singapore are successfully deploying strategic urban planning to attract human capital and drive economic prosperity. Only established as modern cities in the past 60 years, both have high individual wealth, low crime and good transport infrastructure.

Among prominent civic leaders today is Anne Hidalgo, Paris's first female mayor.

She won the 2023 ULI Prize for Visionaries in Urban Development after introducing low emission zones and big increases in social housing.

In Detroit, a local business leader is credited with leading the city’s revitalization.

The urban transformation includes public and private investments in innovation districts, and disused downtown office buildings being converted into accommodation. Fast-growing developing-world cities can learn from solutions such as these.

Source: WEF, 2023; Reuters, 2024

To solve the problem of affordability, cities are introducing a range of measures, which often require a rethinking of some regulations.

In Paris, for instance, the ratio of social housing is set to increase from 25% in 2024 to 45% by 2035, including converting old offices to housing.

In Africa, cities are turning to public-private partnerships to build affordable homes.

In Sierra Leone, there is a project to build 5,000 homes, and in Rivers State, Nigeria, more than 1,000 houses have been built in Port Harcourt, the state capital.

Source: LSE, 2024

Cities as far apart as Barcelona, Melbourne and Shanghai are looking to enhance quality of life through concepts such as the "15-minute city."

This creates cities where everything a resident needs can be reached within 15 minutes by foot or bike.

The better the quality of life and more prosperous a city, the lower the crime rate tends to be.

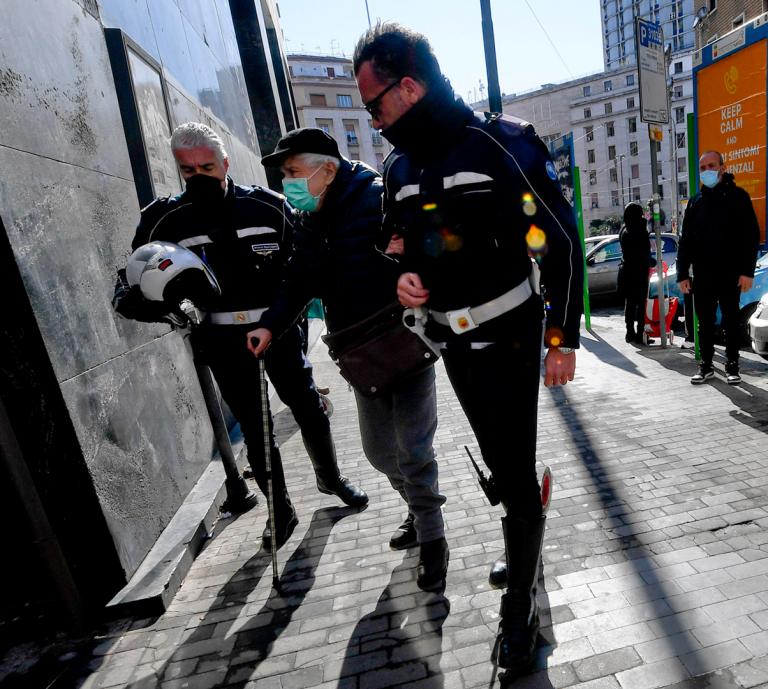

Cities such as Abu Dhabi and Doha are cutting crime with well-equipped police and harsh penalties for criminals.

Cities are also seeking to manage the risk of flooding and forest fires.

These risks are making some homes uninsurable, especially in U.S. states such as California and Florida, as well as parts of Australia. For fast-growing cities, the solutions take many forms – from sea walls to fire breaks, stricter planning laws and early warning systems.

Turning to carbon, cities are driving down CO2 by making buildings and transport more eco-efficient.

Many have pledged to ensure all buildings, old or new, will meet net-zero standards by 2050. Rather than constructing new buildings, planners are prioritizing repurposing old ones. In transport, more than 700 subway systems worldwide have committed to halving emissions by 2030. Other ways they are cutting carbon are threefold: cleaning up the power sources, increasing electrification and encouraging alternatives to cars like public transport.

Source: C40, 2021

Smart city infrastructure is being used to ease traffic congestion, optimize energy use and make up for a lack of sewers.

Singapore’s "Smart Nation" program puts technology at the center of the city state: streamlining transportation, health management and even water conservation.

It’s transforming Singapore, driving technological innovation and improving quality of life. In Europe, Copenhagen has invested in intelligent transport systems to achieve its vision of 75% of all trips in the city being by bike, on foot or on public transportation. Smart sewers, too, are deploying sensors, data analysis and weather forecasts to prevent sewage overflows.

Source: McKinsey, 2023; EPA, 2023

Many cities are in no position to fund the coming essential and substantial investment.

In the U.S., 53 cities do not have enough money to pay their bills, according to a study by Truth in Accounting. Additionally, China’s municipal debt crisis is well known, as are UK cities’ financial difficulties. In the developing world’s fast-growing cities, there is also often a shortage of funding due to low tax revenues.

Source: 2024 Financial State of the Cities, Truth in Accounting, 2023

$15 TRILLION

The estimated gap in global infrastructure investment by 2040 – much of it in cities.

This provides a generational opportunity for private capital. By 2040, there will be an estimated $15 trillion gap between projected infrastructure investment

– much of it in cities – and the amount needed. However, that is just infrastructure; cities’ requirements are far wider.

Source: Global Infrastructure Hub, 2018

Broadly speaking, the opportunities for private capital lie in three areas:

1. Cities in the developed and developing world are turning increasingly to public-private partnerships.

This includes blended finance, to build housing and large infrastructure projects. Infrastructure projects may range from public buildings, such as schools or hospitals, to transportation like railways, airports or roads.

2. Cities raise financing through municipal bonds.

Municipal bonds finance day-to-day expenditures and public projects, while social bonds are used to fund social projects like schools and hospitals.

3. As cities around the world expand and repurpose existing buildings, opportunities are likely to emerge for real estate investment.

These may vary from building affordable homes in developing cities such as those in Nigeria and Sierra Leone, to converting downtown offices into housing in U.S. cities like Detroit.

CONCLUSION

As cities' roles grow globally, so too are they the places where today's biggest challenges must be tackled.

Solving these issues will improve quality of life, boost investor confidence and foster economic growth. Cities must urgently reimagine themselves. It's a time for balancing debt, demographics and dreams.