Shifts in fiscal policy, productivity gains, and market dynamics have potential to define the investment landscape in 2026. Key considerations in PGIM's Multi-Asset Outlook include:

- Macro Environment: Risk assets continue to benefit from a supportive macro backdrop, with themes from 2025—rising fiscal spending, technology-driven investment, and ample liquidity—expected to persist.

- Global Growth: Signs of resilience and gradual acceleration are emerging, supported by cumulative interest rate cuts since 2024, even as global activity remains below trend.

- Central Banks: Diverging policies dominate, with the U.S. Federal Reserve maintaining a cautious stance on rate cuts, the European Central Bank pausing as inflation nears target, and the Bank of Japan gradually raising rates amid fiscal concerns.

- Currency: The U.S. dollar saw its steepest decline since 2017, driven by shifting interest rate differentials, while the yen remained flat despite significant rate moves in Japan.

- Corporate Earnings: Earnings remain robust globally, with U.S. productivity gains driving growth and emerging markets projected to deliver 18% earnings growth in 2026.

- Emerging Markets: Positioned to benefit from resilient global growth and trade dynamics, though political risks and tariff uncertainties remain key considerations.

- Commodities: Strong returns in 2025 are expected to broaden in 2026, supported by elevated inflation, fiscal-driven demand, and favorable momentum.

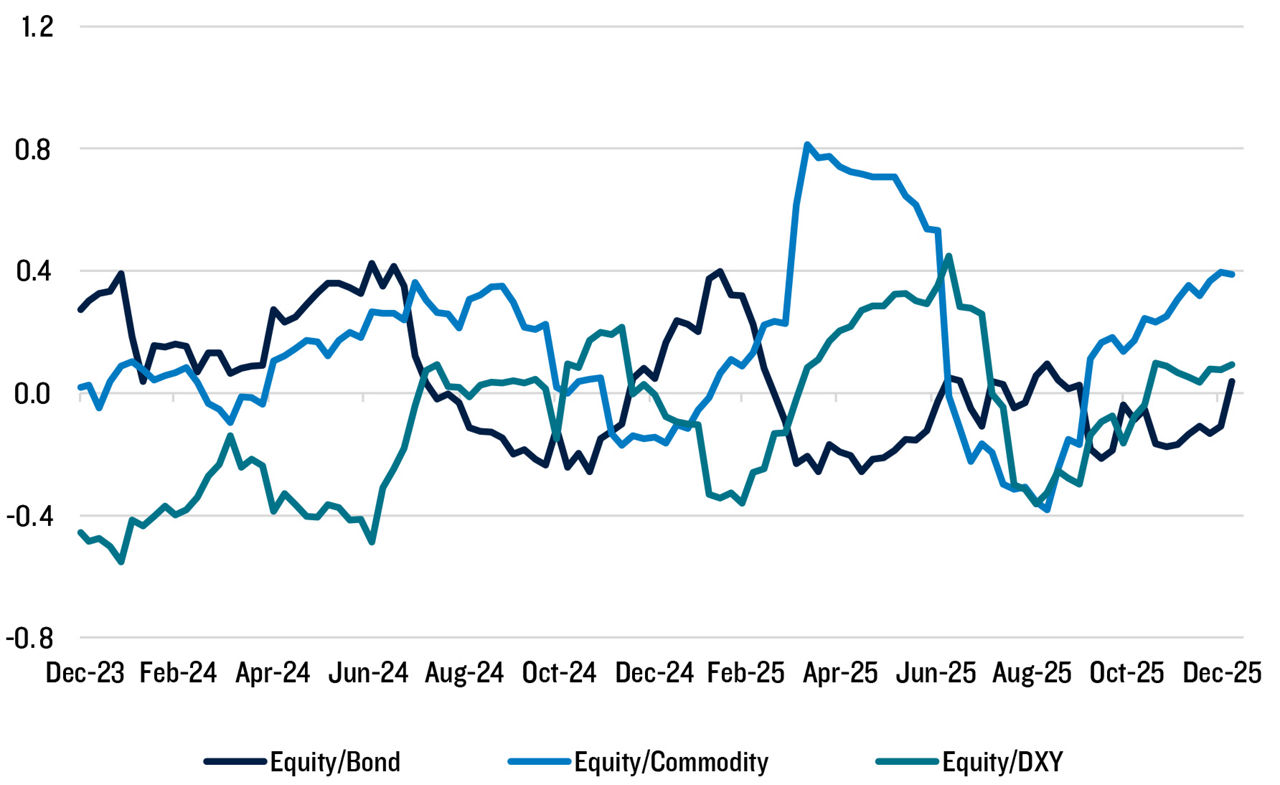

- Asset Allocation: Diversification across asset classes remains critical, with stock-bond correlation anchoring portfolios and commodities providing stability during inflationary or geopolitical stress.

Cross-Asset Correlations

Source: PGIM, Bloomberg as of December 31, 2025.