After a two-year period in which global real estate values dropped nearly 20% from their peak, the tide is turning. A new cycle began taking shape in late 2024, preceding four positive quarters that appear to be the early-stage foundation of a recovery. Moderating inflation, lower financing costs, and healthy property fundamentals are creating smoother conditions for price discovery and increased transaction activity. While lower financing costs buoy many asset classes, real estate stands at a unique crossroads. Real estate valuations have yet to materially recover, reinforcing potential for outsized returns as conditions normalise and capital redeploys.

STRONG RECOVERIES FOLLOW DOWNTURNS

Private real estate has consistently delivered strong returns over the long term, with only three extended periods of contraction since 1977. Robust recoveries followed each downturn, lasting 12 to 15 years and delivering 11% average annual returns, which is 2.8% above the long-term average of 8.2%. This pattern suggests that the current market environment could present an attractive opportunity for long term investors to allocate capital to private real estate.

FAVOURABLE SUPPLY/DEMAND DYNAMICS

The rapid rise of interest rates during 2022-2023, coupled with increased construction costs from tariffs on building materials, have weighed heavily on the construction pipeline. Constrained new supply and persistent tenant demand create compelling opportunities for income resilience and value creation. This fundamental imbalance positions well located private real estate to deliver durable performance for discerning investors.

RATE CUTS SERVE AS AN ADDITIONAL CATALYST

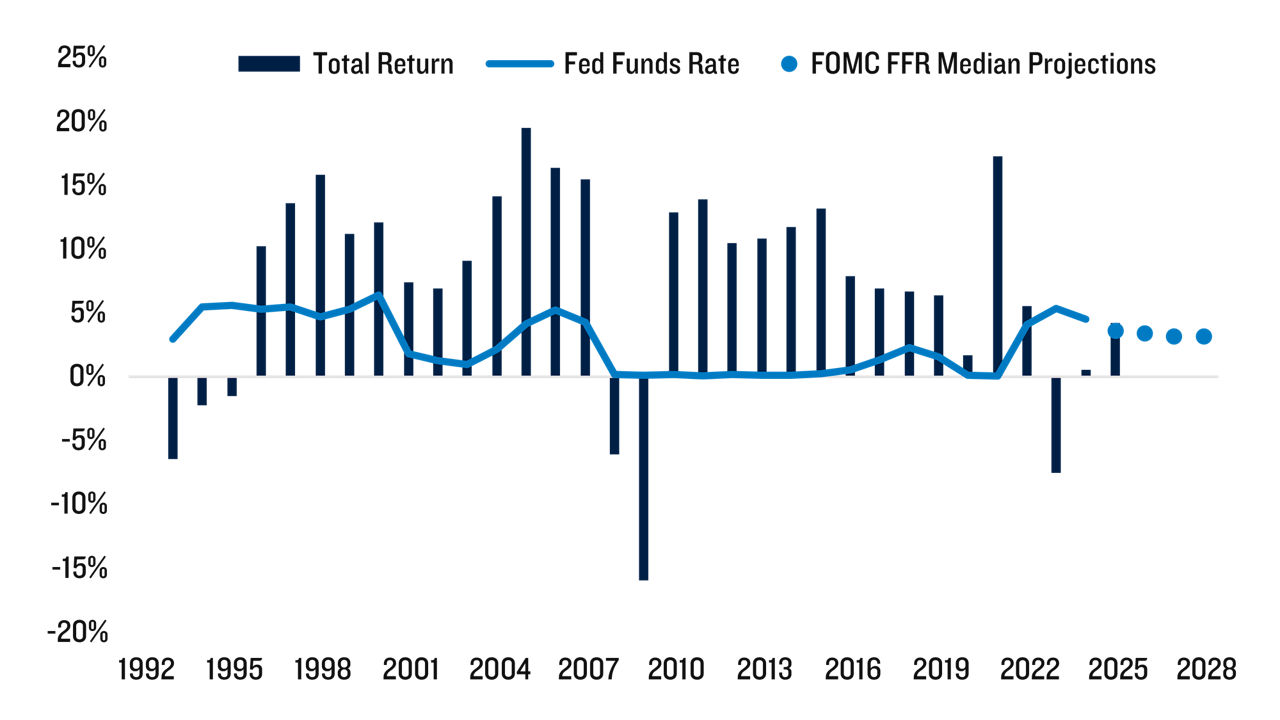

Periods of declining interest rates are typically followed by rising property valuations, creating a favourable backdrop for appreciation. Cheaper capital also encourages transaction activity and increases investor demand, supporting value growth.

STRONG RETURNS TEND TO FOLLOW RATE CUTS

Source: NCREIF, St Louis Fed, PGIM as of 30/9/2025. Past performance is no guarantee of future results.

RECOVERY REMAINS UNEVEN ACROSS SECTORS

This environment favours an active approach. We see structural opportunities in the following sectors:

Residential: The U.S. faces a 4.7-million unit housing deficit. Elevated rates curbed construction and ownership, boosting demand for rental properties.

Industrial: Rapid expansion created oversupply in low-barrier markets, but supply growth is cooling. Longer term, we remain bullish on growth because the adoption rate of consumer spending through e-commerce will continue to fuel industrial demand.

Necessity-based retail: Retail rents have increased steadily over the past five years. Grocery-anchored and essential retail see strong traffic, high occupancy, and premium risk-adjusted valuations. Growing suburbs support store-based access to staples.

Specialty: Data centres, senior living, and student housing may prove more resilient in a variety of economic scenarios. Demand for data centres continues to outpace supply. Aging demographics and rising healthcare needs fuel consistent demand for senior living communities and medical outpatient buildings, while affordable housing shortages boost demand for manufactured homes.

Related Insights

-

Steady Currents, Hidden WavesPGIM asset managers reveal key factors shaping their 2026 outlooks, offering insights to help investors capitalize on market stability and uncover growth beneath the surface.

Read More

-

2026 Real Estate OutlooksThe 2026 global real estate landscape continues to highlight how opportunities are country, capital, sector, style and submarket specific, with diverse investment themes across regions.

Read More

-

Moving in on Private Real Estate's RecoveryPGIM’s Brandon Short explores why the current market offers a timely entry point for private real estate investments.

Read More

References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. The securities referenced may or may not be held in the portfolio at the time of publication and, if such securities are held, no representation is being made that such securities will continue to be held.

The views expressed herein are those of PGIM investment professionals at the time the comments were made, may not be reflective of their current opinions, and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute investment advice or an offer to sell or a solicitation to buy any securities mentioned herein. Neither PFI, its affiliates, nor their licensed sales professionals render tax or legal advice. Clients should consult with their attorney, accountant, and/or tax professional for advice concerning their particular situation. Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

5050779

_Darin-Hero)

_Rick-Hero)