Despite its trade impasse with the U.S., China has reported a string of positive economic data in recent weeks. Indeed, the stimulus deployed as part of China’s domestic policy pivot, along with increased government borrowing, resulted in some of the intended effects, including real GDP growth of 5.2% in Q2. While this growth is promising, we feel that current figures still do not point to the robust recovery from 2021’s real estate crackdown that many had hoped for. We visited several Chinese cities in April and May to ascertain the bottom-up realities affecting growth. Our observations fall into three categories: confirmation of China’s policy pivot, assessment of the results thus far, and the effects on China’s labour conditions.

China’s Policy Pivot in Action

The fallout from the collapse of China’s real estate sector includes deflated asset bubbles, shrinking financial and tech sectors, excess manufacturing capacity, high youth unemployment, weak domestic demand, and deflation (click here for additional details on China’s economic conditions). At the September 2024 Politburo meeting, President Xi acknowledged the critical role that boosting income and consumption will play in the country’s next phase of growth. With this, the Politburo promised meaningful measures to invigorate the domestic economy.

In the days that followed, the Ministry of Finance (MoF) announced a plan to issue 2 trillion yuan ($284 billion) of ultra-long, special sovereign bonds. Local governments were urged to “issue and make good use” of these bonds and local special notes to drive investment. The effects of this stimulus likely emerged early this year as Figure 1 shows that the growth services private investment easily outpaced those in the manufacturing sector (see additional insights on China’s EV manufacturing industry here).

Figure 1

Recent data show that growth in services investment is outpacing growth in manufacturing and green infrastructure investments (China private investment in fixed assets, year-over-year % change).

Source: Macrobond and PGIM.

Assessment of the Domestic Emphasis

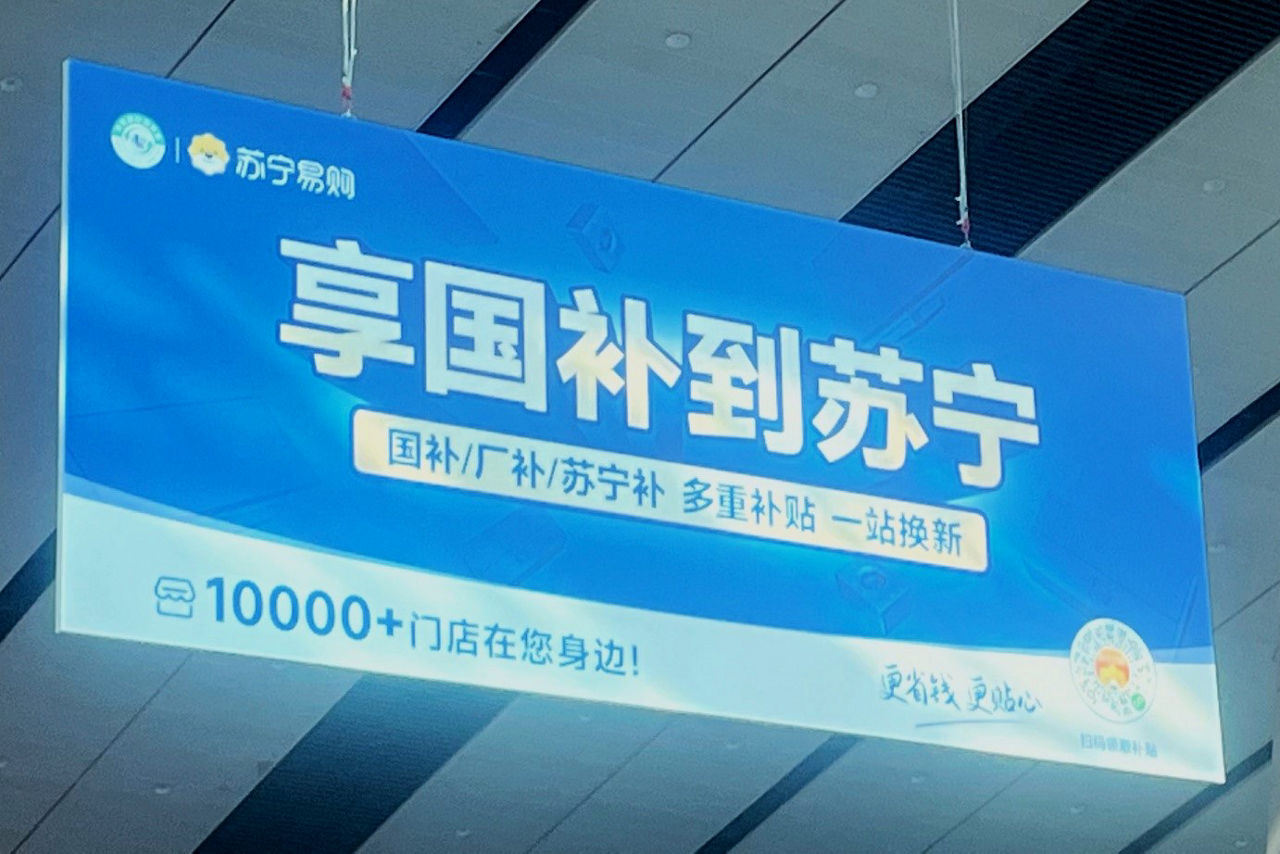

In addition to the fiscal stimulus, China’s pivot also consists of various tactics to boost domestic demand, including a national campaign to promote subsidised spending on home appliances, electronics, and even dining. The campaign is intended to redirect Chinese-consumer demand preferences towards domestic brands and experiences (see photo below).

In Shanghai, the government budgeted RMB500 million for consumption vouchers, facilitated by mini apps on payments platforms that distribute vouchers for dining, travel, movies, and sports. We observed strong demand for retail and food & beverage during our trips, which has been confirmed by recent data as China’s retail sales grew by +6.4% (YoY) in May versus consensus expectations of +4.9% and +5.1% (YoY) in April.

Lingering Labour Issues

Despite the unprecedented focus on consumers and significant investment in the services sector, we remain cautious on the Chinese consumer due, in part, to the continued high youth unemployment rate of ~16% (Figure 2).

Figure 2

China’s youth unemployment rate easily exceeds the national average (China's unemployment rate, %).

Source: Macrobond and PGIM. The series of “Aged 16-24, excluding students” begins in December 2023.

While young consumers have a higher propensity to spend on dining and services, they continue to be constrained by income and employment uncertainty. In fact, more young people in China are opting for temporary or project-based jobs (a.k.a., gig employment) to tide them over until they find longer-term roles. We anecdotally see a direct correlation between the rise in delivery riders in the online retail space and the weak job market. Given that consumption is often fueled by a drive for instant gratification, there is intense competition among online retail platforms to out-deliver in terms of speed and service. Therefore, the industry is reliant on a vast network of delivery riders who compete for higher ratings on the basis of availability, even as driver commission fluctuates per order.

Conclusion

The findings from our trip add context to our macroeconomic assessments of China, particularly as it pertains to the potential for future policy action. While Beijing set a growth target of 5% for 2025, we think officials will likely tolerate some growth downside, but will want to avoid a recession or a sharp rise in unemployment. Although we had anticipated a cumulative growth hit from tariffs of close to 1% to play out over a couple of quarters, China’s economic activity is showing a remarkable degree of resilience to higher tariffs and the accompanying uncertainty.

Indeed, trans-shipments are buoying aggregate export volumes and the ongoing consumer support programs are buoying areas of domestic consumption. At this point, China’s underlying growth momentum of 4.0-4.5%, as conveyed by official data, may fall short of the 5% target. However, Beijing’s pledge for an aggregated fiscal impulse of ~2% of GDP—coupled with PBoC’s pledge of 1.5% GDP equivalent of liquidity provisioning and localised spending rollouts—reduces the urgency for further immediate policy support. Yet, if economic activity slows and/or labour conditions remain weak, we think the State Council stands ready to inject further stimulus in the second half of 2025. Future trips will provide additional colour on the effectiveness of these potential initiatives.

Source(s) of data (unless otherwise noted): PGIM, as of July 2025.

References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. The securities referenced may or may not be held in the portfolio at the time of publication and, if such securities are held, no representation is being made that such securities will continue to be held.

The views expressed herein are those of PGIM investment professionals at the time the comments were made, may not be reflective of their current opinions, and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute investment advice or an offer to sell or a solicitation to buy any securities mentioned herein. Neither PFI, its affiliates, nor their licensed sales professionals render tax or legal advice. Clients should consult with their attorney, accountant, and/or tax professional for advice concerning their particular situation. Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

4785217