Many institutional investors have a Chief Risk Officer assisting the CIO to measure and monitor portfolio volatility. However, for many long-term investors (e.g., pensions, sovereign wealth funds and defined contribution plans) volatility comes and goes and volatility risk is rarely life-threatening. In contrast, liquidity events can create a sudden and unexpected need to raise cash and can threaten a fund's survival. Liquidity risk can force a CIO to make undesirable and often costly portfolio decisions.

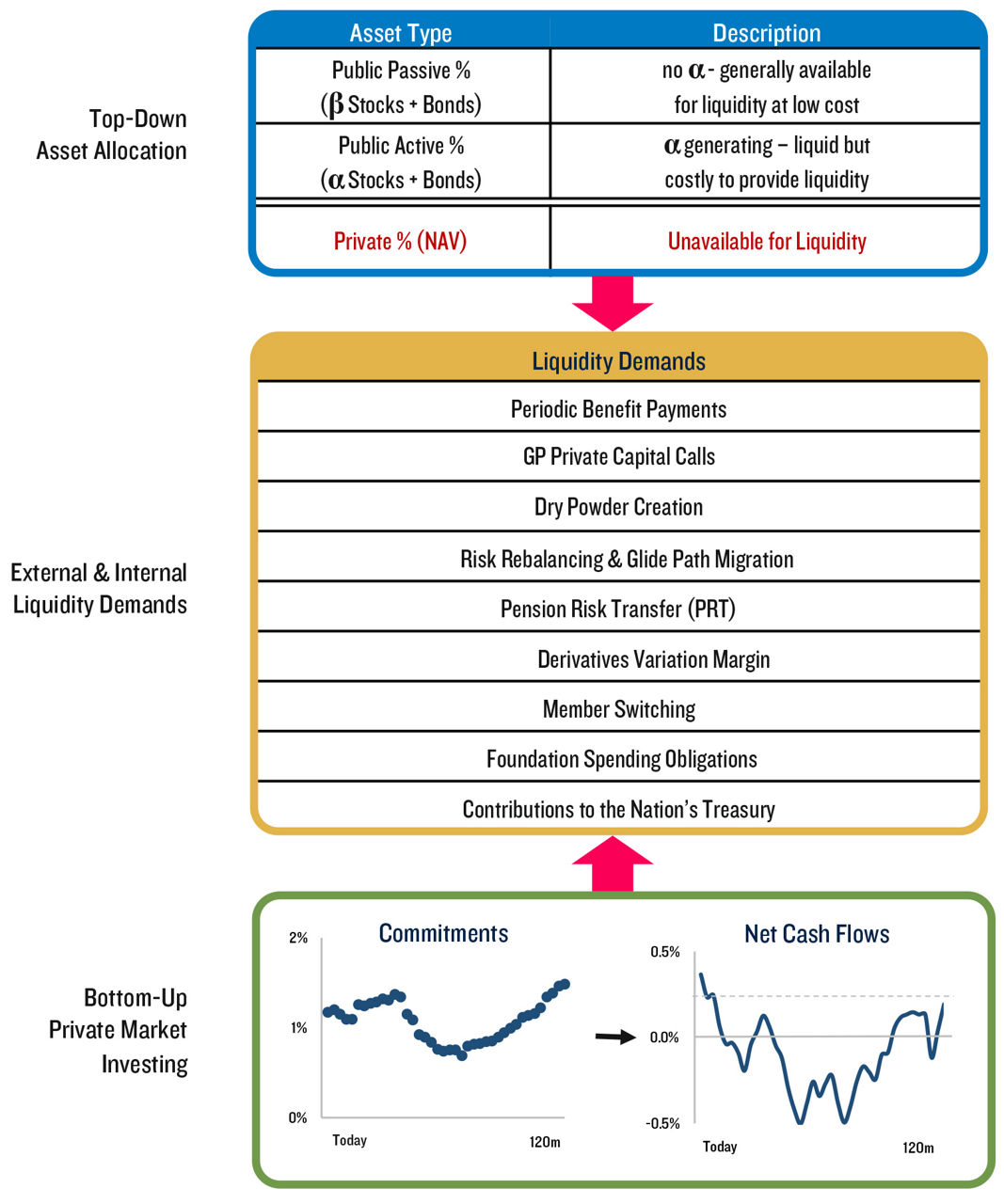

What makes fund liquidity management particularly challenging are: (1) the need to integrate all aspects of a fund's liquidity demands and sources: top-down asset allocation, bottom-up private market deal-making activities, and internal and external operations and (2) the need for a long horizon in a world brimming with large and growing portfolio allocations to illiquid private assets.

Both liquidity demands and liquidity sources are evolving. A robust liquidity management function, working closely with other investment and risk officers at a fund, should constantly adapt to the dynamics of the market and regulatory environment and surveil any emerging liquidity demands and sources. Currently, a fund's liquidity management may be fragmented or ad hoc, putting the fund at risk. Given the importance of liquidity management, why do we not observe many funds with a dedicated liquidity management team, or perhaps even a designated Chief Liquidity Officer? While a new and separate chief liquidity management function may generate cumbersome organizational overlaps and internal confusions within a fund, the long-term benefits are likely worth the effort and stress. The ability to have a dedicated chief liquidity officer will likely depend on the type and the size of a specific institutional fund. For smaller funds, the CIO may select an existing officer and formalize their liquidity management coordinator role. Ultimately, it is the fund's decision whether now is the time to either appoint a chief liquidity officer, beef up liquidity management expertise and analytics, or confirm and validate that the existing investment and risk management teams can adequately analyze, monitor and manage overall fund liquidity.