Portfolio Positioning During High Inflation

Asset owners have become accustomed to investing amid relatively low inflation during the last three decades. But with inflation at its highest level since 1981 and prices continuing to rise, it's possible that inflation could remain elevated for the next several years. Given such a scenario, what are the implications on portfolio returns that asset owners should consider? To address this question, we conducted an analysis of historical and projected portfolio returns, assuming inflation remains elevated for the next five years, incorporating varying allocation parameters. Our analysis was underpinned by our Capital Market Assumptions (CMAs) projected over a period of five years (rather than our typical 10-year projections) and demonstrated that increasing allocations to real assets with a positive direct exposure to inflation could potentially help investors better position their portfolios to reap meaningfully improved outcomes.

Historical and Forecast Outcomes

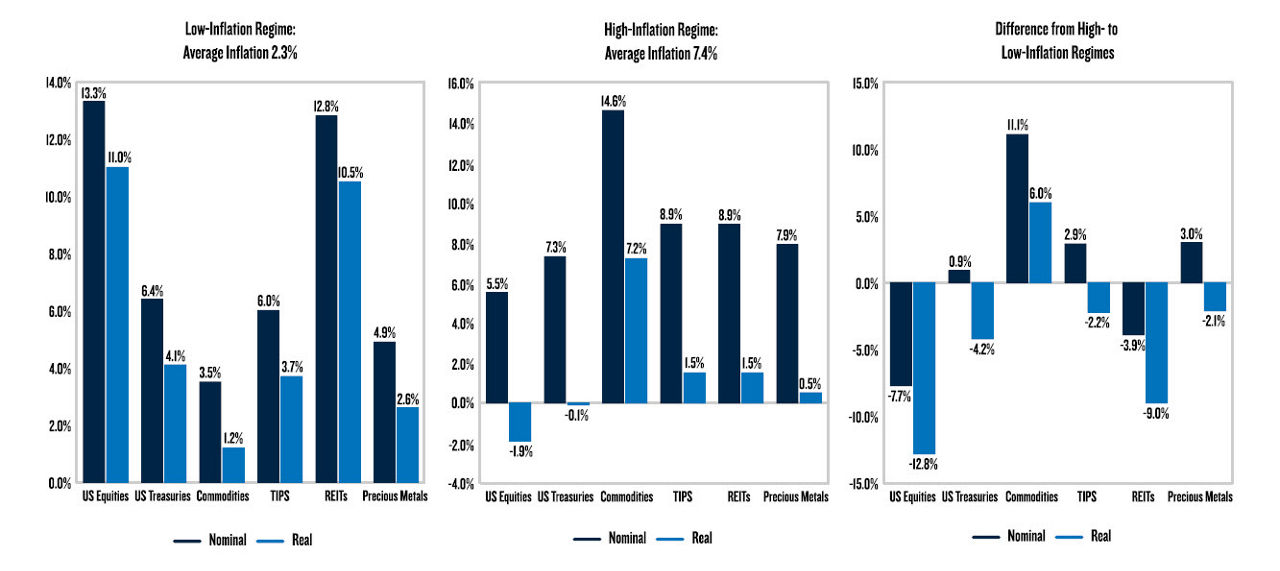

Studies show that stocks and bonds typically experience negative real returns in periods of high inflation, while real assets, like commodities, perform much better1. Our evaluation of asset class performance between 1973 and 2021 found that equities and bonds delivered subdued returns during high-inflation regimes, particularly compared to commodities. Figure 1 shows that both equities and bonds produced negative real returns in periods where inflation was above 4%, while inflation-hedging assets, such as Treasury Inflation-Protected Securities (TIPS), Real Estate Investment Trusts (REITs), precious metals, and commodities provided positive real returns. Commodities in particular stood out with markedly improved nominal and real returns in the high-inflation regime versus the low-inflation regime.

Figure 1: Historical Return Outcomes in Low- and High-Inflation Regimes Q2 1973-Q4 2021

In addition to divergent outcomes for asset class returns in high- and low-inflation regimes, the correlation of asset classes diverged notably amid low- and high-inflation environments, as presented in Table 1. For example, a positive correlation of 0.3 was seen between US Treasuries and equities during periods of high inflation, and a negative correlation of -0.3 during periods of lower inflation. Similarly, commodities exhibited a positive correlation of 0.3 with equities during low-inflation periods, but in high-inflation periods they provided a diversifying exposure to equities with a correlation of -0.3.

Table 1: Conditional Correlations by Inflation Regime - Q2 1973-Q4 2021

Table 2 summarizes our five-year CMA forecast outcomes. US equities, US Treasuries, and investment grade bonds all showed deterioration in expected returns in a high-inflation regime compared to a low-inflation regime. Conversely, all real assets produced improved returns in the high-inflation regime.

Table 2: Five-Year Capital Market Assumptions for Low- and High-Inflation Regimes

Given the impact inflation can have on asset class returns, we evaluated the historical and forecast portfolio outcomes of a balanced portfolio (55% equities, 35% bonds, and a 10% allocation to a basket of real assets consisting of TIPS, commodities, and REITs) and a real asset portfolio (equally weighted between TIPS, commodities, and REITs) during periods of lower and higher inflation.

The results for the balanced portfolio showed significantly lower risk-adjusted returns in the high-inflation regime, both on a forecast and historical basis, with negative real return outcomes. As expected, the real asset portfolio had materially better return outcomes in the higher- inflation regime. Likewise, it had much better performance in the higher-inflation regime than the benchmark balanced fund portfolio on both a historical and forecast basis.

Optimized Allocations

We then built optimized portfolios in order to generate more attractive forecast outcomes relative to benchmarks. For the balanced allocation, we created two portfolios: one with fairly tight allocation constraints, and one with more relaxed individual asset and group constraints. We also allowed an off-benchmark allocation to precious metals for both the balanced and the real asset portfolios, given their attractive inflation exposure.

Given the stronger forecast returns for US equities relative to fixed income and real assets in the low-inflation scenario, the optimized balanced portfolio sought to enhance return while maintaining risk-adjusted return by allocating more to equities under both sets of constraints and reducing allocations to both fixed income and real assets.

Results for the optimized balanced portfolios under the elevated-inflation regime are materially different than in the low-inflation scenario, particularly in the case of more relaxed constraints, indicating that in an environment of elevated inflation, there is an argument to be made for broader constraints that allow for a greater weighting to real assets.

Results for the optimized real asset portfolio do not provide returns that are as attractive as the balanced portfolio for a low-inflation regime. However, amid a high-inflation regime, the expected and historical outcomes are superior to those of the balanced portfolio. The optimization increases the expected return significantly by allocating to precious metals and REITs and away from TIPS and commodities. For detailed analysis, weighting, and return characteristics of these optimizations, see our white paper, Portfolio Implications of a Higher US Inflation Regime.

Putting it all Together:

A prolonged period of higher inflation has important implications for investor outcomes. Strategic allocations like a 60/40 split between equities and nominal bonds have historically delivered negative real returns in periods of elevated inflation. Our forward-looking CMA framework incorporating an assumption of 5% inflation for the next five years also indicates that it could be challenging for a traditional balanced portfolio concentrated in stocks and bonds to deliver positive real returns. The good news is that there are public market allocation options to real assets that perform materially better than stocks and nominal bonds in higher-inflation regimes, both on a historical and forward-looking basis. While a 100% allocation to real assets may not be palatable or possible for many asset owners, adjusting portfolio rules to allow greater allocations to real assets can potentially and meaningfully improve expected portfolio outcomes in an elevated inflation regime.

1 Defining a high-inflation regime as one where the annual price level is growing at greater than 4%. Neville, Henry, Teun Draaisma, Ben Funnell, Campbell Harvey, and Otto van Hemert. "The Best Strategies for Inflationary Times." (2021). Available at: https://ssrn.com/abstract=3813202

Sameer Ahmed, Edward Campbell, Rory Cummings, Manoj Rengarajan. Is Inflation About to Revive? Real Assets can Help Insulate your Portfolio (2021)