European markets are at somewhat of a crossroads. Equity valuations have remained reasonable and are currently trading in line with the last twenty-year average based on forward earnings multiples. At the same time, there’s a potential opportunity for Eurozone economies to tackle long-standing productivity challenges that could ignite growth. Together, these factors bolster the case for maintaining strategic exposure to the region.

The war in Ukraine has upended industries that were dependent on affordable energy. Supply disruptions—particularly from Russia—have demanded difficult adjustments. Despite mounting optimism for a resolution to the conflict, other forces, like the rise of Chinese brands in the auto sector, are disrupting Europe’s economic landscape. Chinese electric vehicles (EV) now account for 21% of all cars sold in the EU as of 2023, underscoring growing competitive pressures. Meanwhile, EU-China trade negotiations remain unsettled, leaving the future of trade relations mired in uncertainty.

Structural inefficiencies further cloud Europe’s outlook. Rigid labor markets and relatively lower scores on business-friendliness metrics continue to sap productivity gains. As a result, European companies struggle to match the operational agility and momentum seen among peers in other developed markets. While new efforts to spur competitiveness show promise, meaningful impacts will likely take time to materialize.

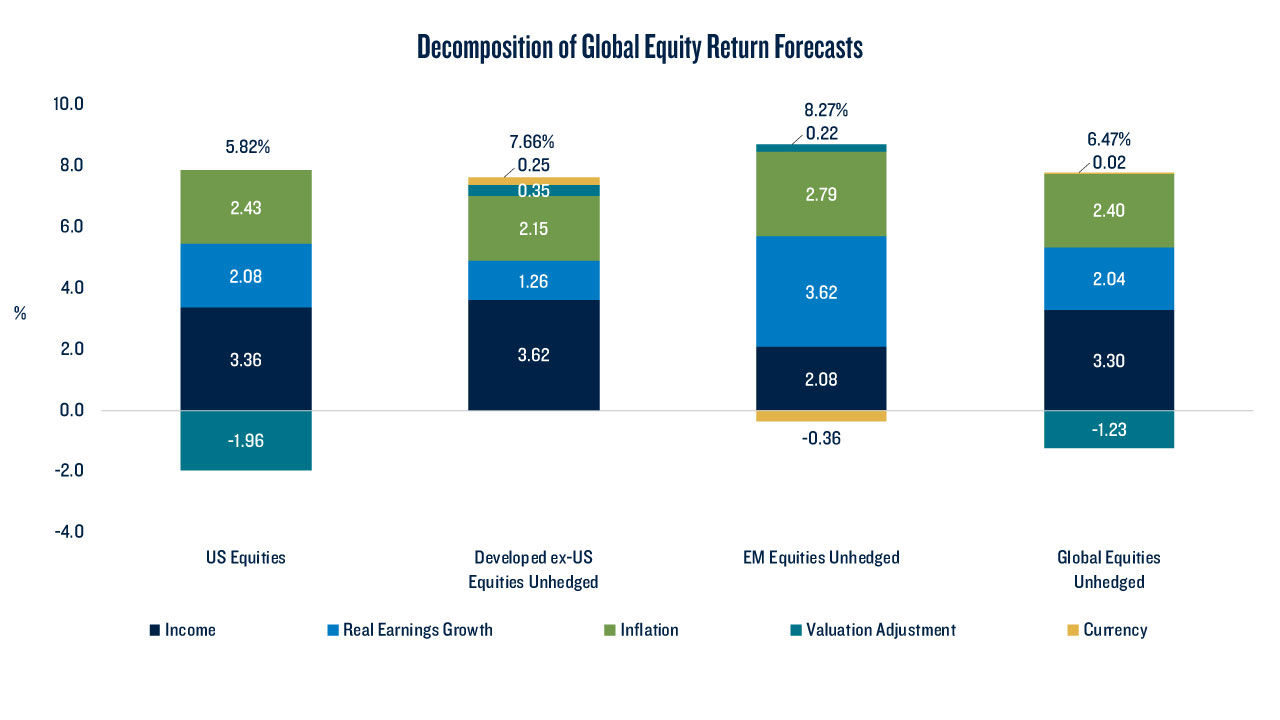

Considering these opportunities and headwinds, our tactical outlook for global multi-asset portfolios remains cautious. In the near term, we continue to favor US and emerging market stocks over European equities. Over the longer-term, however, prospects for European equities remain compelling (Figure 1, below). While earnings growth remains relatively muted compared to other regions, favorable valuations are expected to support returns over a longer horizon. The attractive long-term expected returns1 of European equities, especially relative to US equities, support the case for inclusion in well-diversified portfolios.

Figure 1: Long-term Prospects for European Equities Remain Compelling

Ultimately, Europe faces a challenging but pivotal moment in navigating structural headwinds and shifting global dynamics. For investors, the combination of reasonable valuations and the potential for long-term recovery offers a reason to stay engaged—albeit with tempered expectations. European equities warrant their place as a strategic asset for those focused on long-term portfolio diversification.

12024 Q4 Capital Market Assumptions

https://www.pgimquantitativesolutions.com/outlook/2024-q4-capital-market-assumptions