Credit spreads remain tight despite ongoing economic uncertainty, making it harder to improve a portfolio’s risk-reward profile via traditional fixed income sectors. Edwin Wilches, Co-Head of Securitized Products at PGIM, offers a compelling case for seeking solutions within the market for collateralized loan obligations (CLOs).

Access to CLOs is expanding beyond the market’s institutional origins as innovative new products introduce investors to an asset class known for stable income, credit resilience and diversification. With extensive experience managing CLO investments through market cycles, Wilches answers five key questions about CLOs for investors as they investigate the opportunity.

- Structure

- Risk-adjusted Return

- Portfolio Benefits

- During Market Stress

- CLOs vs CDOs

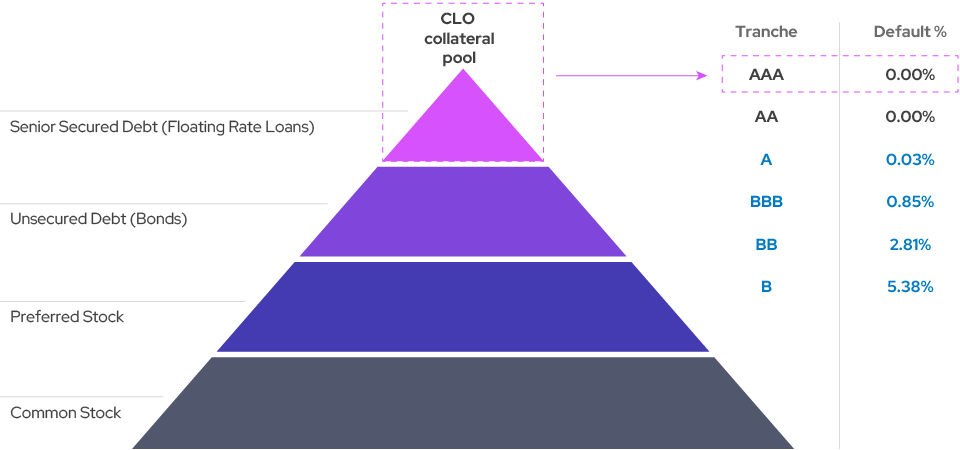

1. Where does the AAA tranche sit within the capital structure, and why is it considered risk-remote?

CLOs consist of senior secured corporate loans that are pooled into a special purpose vehicle, which issues securities in tranches offering various levels of risk and return potential. Payments from the underlying loan pool are made to the highest quality tranches first as part of a top-down “waterfall” hierarchy.

High-quality Assets with Low Credit Risk

That means the AAA tranche is the first in line to receive principal repayment and interest income, and the last in line in terms of absorbing losses. In roughly three decades of CLO market history, there have been no reported defaults in the AAA and AA tranches. Per Wilches, these are highly resilient and loss-remote instruments that have been successfully tested through multiple economic cycles and market swings, including the Global Financial Crisis (GFC).

2. How do AAA CLOs compare with other fixed income assets in terms of risk-adjusted returns?

At a time when widespread uncertainty is boosting demand for income-driven returns, CLOs stand out for their ability to generate relatively attractive income. Underscoring their appeal, CLOs typically offer higher yields than comparably rated corporate bonds.

Stronger Returns with Lower Volatility and Less Rate Sensitivity

“CLOs’ higher Sharpe ratio indicates efficient compensation for the level of risk, making them an attractive choice for investors,” Wilches explains. Currently higher than investment grade corporate bonds, AAA CLO yields serve as a foundation for compelling risk-adjusted return potential versus traditional fixed income.

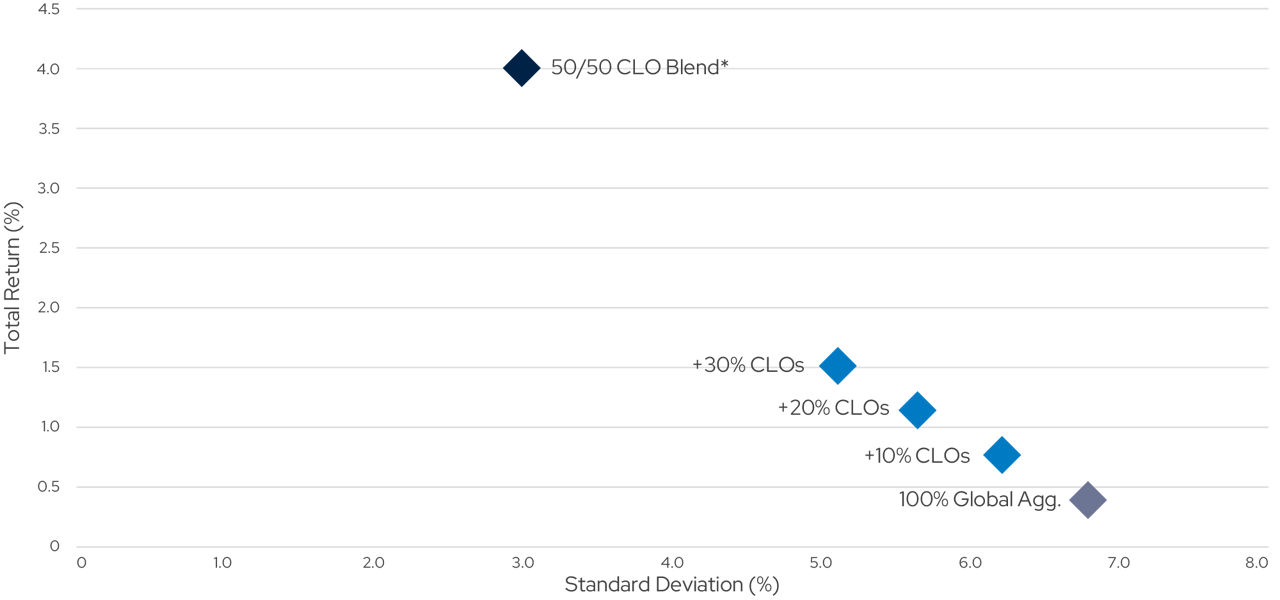

3. What role can high-quality CLOs play in improving a portfolio’s efficiency and diversification attributes?

CLOs are backed by actively managed, diversified pools of senior secured loans across industries, resulting in low correlations with traditional fixed income sectors and equities. For investors seeking resilient income and portfolio balance, AAA CLOs can be a smart complement to core bond allocations.

Adding a 10-30% AAA CLO allocation to Global Agg.

Allocating 10% to 30% of an aggregate bond portfolio to AAA CLOs has historically improved risk-adjusted returns, especially during periods of market stress or rate uncertainty. “CLOs fit in well because they don’t carry generic credit or idiosyncratic industry risk tied to a single underlying asset. They don’t rely on one single company or sector for repayment, which minimizes concentrated exposure,” Wilches says.

4. Do CLOs hold up during periods of market stress?

CLOs have consistently shown resilience during periods of market stress, including the GFC, pandemic-related drawdowns, and recent tariff-driven disruptions. In instances where market volatility increases, trading volume in the secondary AAA CLO market also typically increases as investors turn to the asset class as a source of liquidity.

AAA CLO Spreads Remained Resilient During April’s Stress Test

As tariff concerns rippled through markets in April, credit spreads widened and credit curves steepened to varying degrees; however, this was not the case for AAA CLOs. “During stress events, AAA CLOs behaved similarly to high-quality fixed income instruments, offering predictable performance and minimal spread volatility,” Wilches says. “This creates a very robust cushion for the portfolio amid market volatility.”

5. Did CLOs spark the Great Financial Crisis?

No. CLOs are often mistakenly maligned because many investors confuse them with collateralized debt obligations (CDOs), the securitized debt vehicles that were pivotal in triggering the global credit crisis in 2008.

Residential mortgage-backed CDOs, particularly those consisting of mortgages held by subprime borrowers, were the primary catalysts in the credit crisis. CLOs, on the other hand, are backed by diversified, transparent corporate credit, often from large, audited companies. This robust collateral base offers greater protection versus legacy securitizations such as subprime mortgages.

Emphasize Experience

Despite being a US$1.4 trillion market, CLOs represent new territory for many investors, accentuating the importance of experience, resources and mission-specific expertise when selecting managers.

PGIM ranks among the world’s top 10 CLO managers1 and top 10 CLO issuers2. As an active CLO market participant for over two decades, PGIM leverages resources and relationships that position it to play a notable role as the asset class expands. Wilches says experience gives PGIM an edge in an asset class known for complexity and wide performance dispersion among managers.

Related Insights

-

Clearing Up CLO Confusion: Expert Insights for InvestorsLoren Sageser clears up misconceptions about CLOs and explains why they’re gaining traction among income-focused investors.

Read More

-

Why CLOs Belong in Client PortfoliosEdwin Wilches unpacks AAA CLOs, yields, risks, and how they offer strong income and diversification potential.

Read More

-

The Growing Appeal of CLOsCollateralised Loan Obligations (CLOs) represent a rapidly expanding market, offering distinct opportunities within the fixed income landscape. Their impressive growth has been fuelled by attractive yields, strong performance, diversification benefits, and effective mitigation of interest rate and credit risks.

Read More

1. Source: CLO Premium, #8 based on global CLO AuM as of 31/03/2025.

2. Source: As of 30/06/2025; by CLO manager exposure on US CLOIE AAA Index by market value.

For Professional Investors only. All investments involve risk, including the possible loss of capital.

In Singapore, information is issued by PGIM (Singapore) Pte. Ltd. with registered office: 88 Market Street, #43-06 CapitaSpring, Singapore 048948. PGIM (Singapore) Pte. Ltd. is a regulated entity with the Monetary Authority of Singapore (“MAS”) under a Capital Markets Services License (License No. CMS100017) to conduct fund management and an exempt financial adviser. In Hong Kong, information is issued by PGIM (Hong Kong) Limited with registered office: Units 4202-4203, 42nd Floor Gloucester Tower, The Landmark, 15 Queen’s Road Central, Hong Kong. PGIM (Hong Kong) Limited is a regulated entity with the Securities & Futures Commission in Hong Kong (BVJ981) to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571).

References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. The securities referenced may or may not be held in the portfolio at the time of publication and, if such securities are held, no representation is being made that such securities will continue to be held.

The views expressed herein are those of PGIM investment professionals at the time the comments were made, may not be reflective of their current opinions, and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute investment advice or an offer to sell or a solicitation to buy any securities mentioned herein. Neither PFI, its affiliates, nor their licensed sales professionals render tax or legal advice. Clients should consult with their attorney, accountant, and/or tax professional for advice concerning their particular situation. Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

5014626