The Trump administration’s approach to trade and tariff policy has emerged as the most disruptive factor for the economic outlook, fueling market volatility and uncertainty and heightening near-term downside risks. US economic data are already starting to reflect the strain, with GDP contracting modestly in Q1. Despite near-term risks, the Multi-Asset team left its 10-year US GDP growth forecast roughly unchanged at around 2.1%. Globally, economic activity was mixed, with both the Eurozone and Japan struggling during Q1. Meanwhile, GDP in China remained supported by fiscal and monetary stimulus, even as tariff concerns weighed on growth prospects.

Key Updates in this Quarter's Forecasts

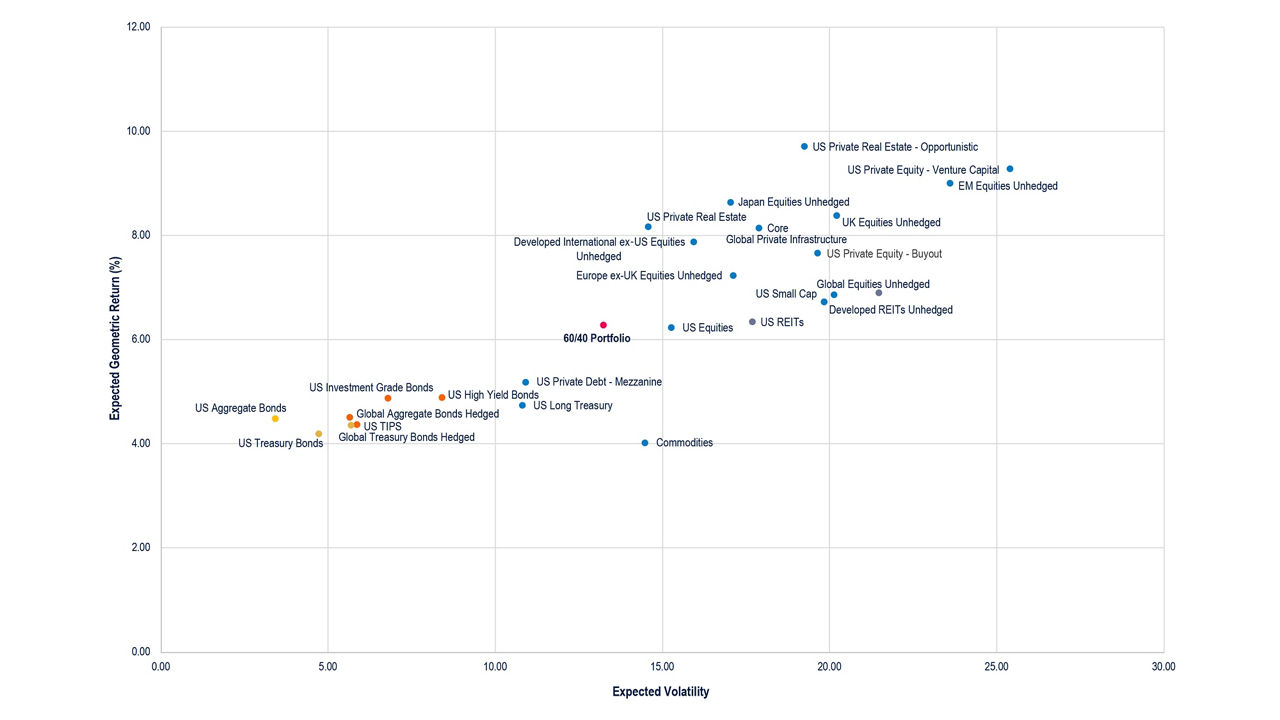

PGIM Quantitative Solutions’ long-term outlook for fixed income assets shifted lower from last quarter, coincident with the decrease in sovereign interest rates in Q1 2025. Adjustments to the 10-year annualised return forecasts include:

- US Aggregate Bonds: Revised to 4.5% from 5.2% last quarter.

- US Long Treasury Bonds: Revised to 4.7% from 5.8% last quarter.

- Global Aggregate Bonds Hedged: Revised to 4.4% from 4.6% last quarter.

Their 10-year forecasts for equity markets outside the US continue to exceed those of large-capitalisation US equities, primarily attributable to more favourable valuations, though that differential modestly declined following a quarter in which US equities underperformed global peers:

- US Large-Cap Equities: Forecasted at 6.2%.

- International Equities ex-US: Forecasted at 7.9%.

- Emerging Markets Equities: Forecasted at 9.0%.

This quarter’s portfolio rebalancing recommendations include:

- Reduction in US Investment Grade Bond allocations.

- Reduction in US Aggregate Bond allocations.

- Increase in US REITs exposure.

Source for all forecasts: PGIM Quantitative Solutions as of 31 Mar, 2025. Forecasts may not be achieved and are not a guarantee or reliable indicator of future results.

Source: PGIM Quantitative Solutions as of 31 Mar, 2025. Forecasts may not be achieved and are not a guarantee or reliable indicator of future results.

References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. The securities referenced may or may not be held in the portfolio at the time of publication and, if such securities are held, no representation is being made that such securities will continue to be held.

The views expressed herein are those of PGIM investment professionals at the time the comments were made, may not be reflective of their current opinions, and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute investment advice or an offer to sell or a solicitation to buy any securities mentioned herein. Neither PFI, its affiliates, nor their licensed sales professionals render tax or legal advice. Clients should consult with their attorney, accountant, and/or tax professional for advice concerning their particular situation. Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

4596149