Financial markets are buzzing with anticipation as the US prepares for President-elect Donald Trump’s second term. But this isn't the first time markets have reacted in such fashion to a Trump presidency. In fact, much of what we're seeing is reminiscent of the market movements following his 2016 victory. In this piece, we aim to dissect market reactions and trends, analyze how Trump's policies may shape financial landscapes again, and offer investors insights and strategies to help prepare for his return to the White House.

Initial Market Reactions

In the immediate aftermath of Trump’s decisive victory over Vice President Harris, the S&P 500 gained 5.1% within five trading days. This was accompanied by an even more impressive 9.8% rise in small-cap stocks (Russell 2000) and a 7.8% surge by financials (SPDR Financial Sector Fund)1. The equity rally, reflecting investor optimism about potential deregulation and tax cuts during Trump's second term, stood in stark contrast to the flat performance of Treasury Bonds (Bloomberg US Treasury Bond Index: 0.0%) amid concerns about rising inflation and budget deficits that may temper longer-term bond yields.

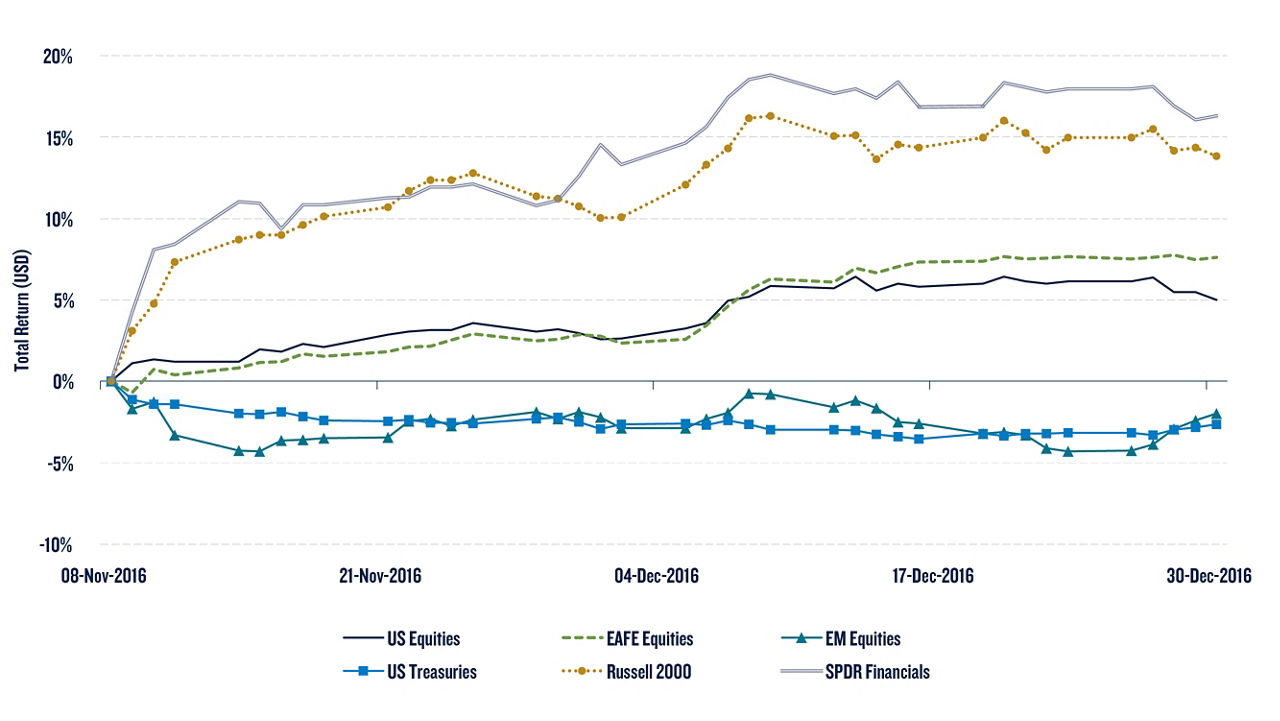

This market reaction wasn’t unexpected; we saw a version of this play out in the aftermath of Trump’s 2016 election victory (Figure 1, below). Developed market equities rallied, US small caps and financials outperformed, and US Treasuries slumped. And while the 2016 election results were far more unexpected, investors seem to be following a similar playbook now, channeling funds into asset classes positioned for growth under Trump’s expected policies.

Figure 1: Financial Market Returns in the Wake of 2016 Election

The market performance underscores assumptions that the regulatory environment during Trump’s upcoming term will be more favorable to investors than it would have been under Harris. Furthermore, markets expect the temporary tax cuts enacted during Trump’s first administration to now become permanent. Although this could boost the budget deficit and send inflation higher, it would be positive for risky assets.

The Tariff Tango

From a macro-economic standpoint, several policies advocated by the President-elect could profoundly impact economic conditions and the business climate in the US and abroad. During Trump's first term, tariffs on foreign imports, such as aluminum and steel, were pivotal policy moves that led to a series of market reactions, including currency depreciations against the US dollar. Tariffs on foreign imports are again likely to be at the top of Trump’s policy agenda.

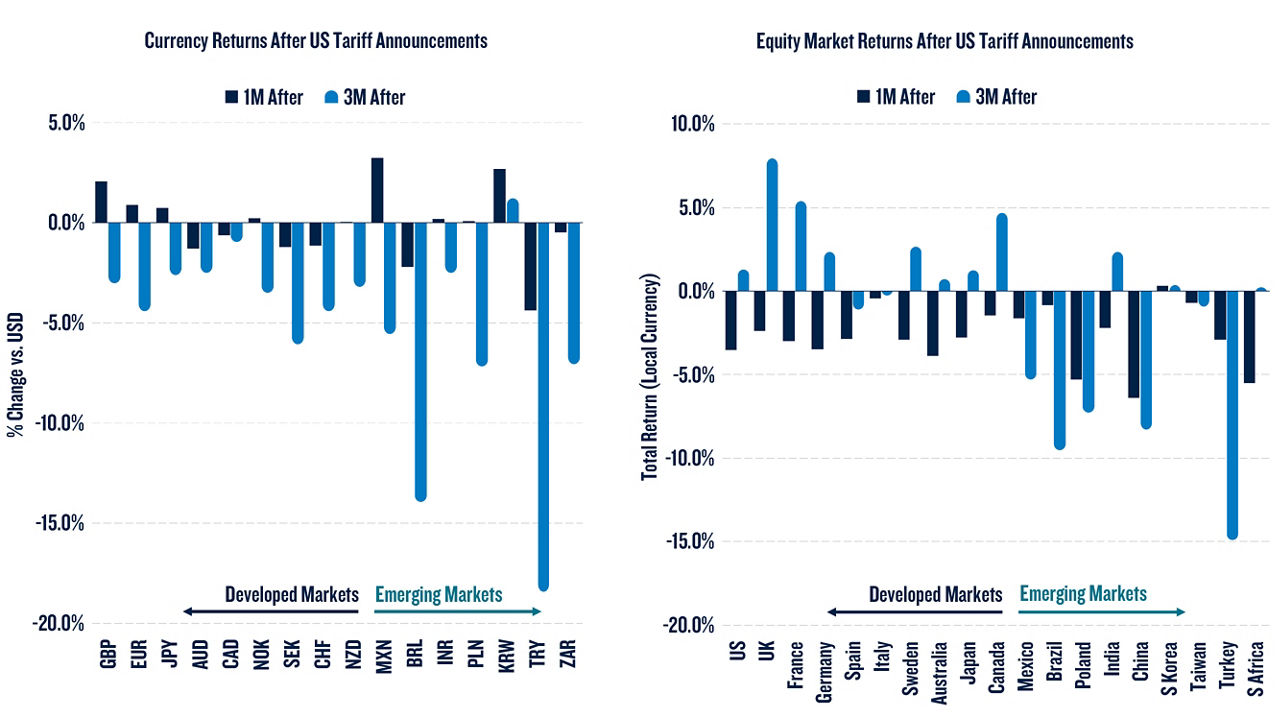

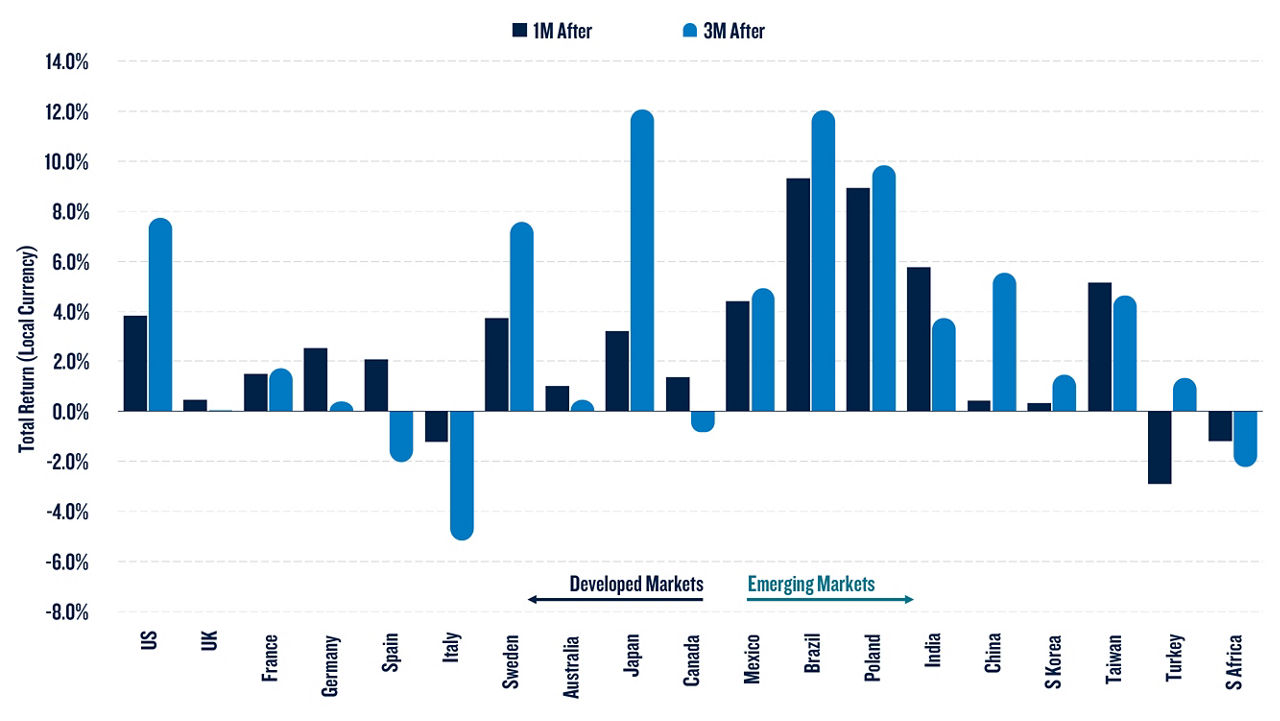

We examined the timing of tariff announcements made during Trump’s last term in office and the subsequent market reactions. Figures 2 and 3 show market returns one and three months after the US imposed tariffs in March 2018, as well as following retaliatory tariffs on US imports announced several months later:

Figure 2: US Announces Aluminum & Steel Import Tariffs

- Most major currencies depreciated significantly against the US dollar three months after the announcement of US tariffs on aluminum and steel imports, particularly in emerging markets.

- Most major equity markets experienced negative performance one month after the imposition of tariffs. However, three months after the announcement, most developed markets had rebounded with positive equity performance, while emerging markets continued to struggle.

Figure 3: Retaliatory Tariffs Announced on US Imports

- Most major equity markets saw a significant rally following the retaliatory tariffs on US imports implemented by some nations in June-July 2018.

Investors can take cues from Trump’s first term when trying to anticipate future market moves. By analyzing past trends, we find that, broadly speaking, US tariffs on imports can cause the US dollar to appreciate relative to other currencies, but also potentially expose equity markets to increased volatility, particularly in emerging markets. On the other hand, the implementation of retaliatory tariffs can reduce some market uncertainty, resulting in a relief rally across most regions.

The Final Analysis

As President-elect Trump prepares for his second term, investors face a familiar yet complex landscape. Understanding past market reactions to Trump's policies, tax cuts, and tariffs will be essential for making portfolio positioning decisions. We examined historical trends that can be useful in building a framework for navigating market volatility in two recent publications, the Q4 2024 Outlook and our whitepaper on election cycle volatility. In both pieces, we observe that increased uncertainty leading up to an election often spurs a rally afterward as investors collectively exhale. When markets are unpredictable, strategies such as portable alpha overlays (for institutions) and buffered ETFs can help manage downside protection while maintaining market exposure to potential gains. With the election results in, investors can use insights from Trump's first term to anticipate the impact of potential future policy changes.

1Returns calculated from November 5th (Election Day) to November 11th 2024.

PGIM Quant- 20241119-2930

This material is intended for Professional Investors only. All investments involve risk, including the possible loss of capital. Past performance is not a guarantee or a reliable indicator of future results.

PGIM Quantitative Solutions LLC (PGIM Quantitative Solutions or PGIM Quant) is an SEC-registered investment adviser and a wholly-owned subsidiary of PGIM, Inc. (PGIM) the principal asset management business of Prudential Financial, Inc. (PFI) of the United States of America. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc, which is headquartered in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom.

The comments, opinions and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Quantitative Solutions believes to be reliable. We do not guarantee the accuracy of such sources of information and have no obligation to provide updates or changes to these materials. This material is for informational purposes and sets forth our views as of the date of this presentation. The underlying assumptions and our views are subject to change.

These materials are neither intended as investment advice nor an offer or solicitation with respect to the purchase or sale of any security or financial instrument. These materials are not intended to be an offer with respect to the provision of investment management services. The opinions expressed herein do not take into account individual client circumstances, objectives, or needs and are therefore not intended to serve as investment recommendations. No determination has been made regarding the suitability of particular strategies to particular clients or prospects. The financial indices referenced herein is provided for informational purposes only. You cannot invest directly in an index. The statistical data regarding such indices has been obtained from sources believed to be reliable but has not been independently verified.

Certain information contained herein may constitute “forward-looking statements,” (including observations about markets and industry and regulatory trends as of the original date of this document). Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making any decisions. No representation or warranty is made as to future performance or such forward-looking statements.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V. with registered office: Eduard van Beinumstraat 6 1077CZ, Amsterdam, The Netherlands. PGIM Netherlands B.V. is authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands (Registration number 15003620) and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). PGIM Quantitative Solutions LLC, PGIM Limited and/or PGIM Netherlands B.V. are indirect, wholly-owned subsidiaries of PGIM, Inc. (“PGIM”).

In Australia, these materials are distributed by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the Financial Conduct Authority (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. PGIM Limited’s registered office is Grand Buildings, 1-3 The Strand, Trafalgar Square, London, WC2N 5HR.

In Switzerland, information issued by PGIM Limited, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland.

In Canada, PGIM Quantitative Solutions LLC relies upon the “International Advisor Exemption” pursuant to National Instrument 31-103 in certain provinces of Canada.

In Singapore, information is issued by PGIM (Singapore) Pte. Ltd. (“PGIM Singapore”), a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. This material is issued by PGIM Singapore for the general information of “institutional investors” pursuant to Section 304 of the Securities and Futures Act 2001 of Singapore (the “SFA”) and “accredited investors” and other relevant persons in accordance with the conditions specified in Section 305 of the SFA.

In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571).

In Japan, the investment management capabilities and services described in the attached materials are offered by PGIM Japan Co., Ltd (PGIMJ), a Japanese registered investment adviser (Director-General of the Kanto Local Finance Bureau (FIBO) No. 392). Retention of PGIMJ for the actual provision of such investment advisory services may only be affected pursuant to the terms of an investment management contract executed directly between PGIMJ and the party desiring such services, it is anticipated that PGIMJ would delegate certain investment management services to its US-registered investment advisory affiliate.

In Korea, PGIM Quantitative Solutions LLC holds cross-border discretionary investment management and investment advisory licenses under the Korea Financial Investment Services and Capital Markets Act (“FSCMA”), and is registered in such capacities with the Financial Services Commission of Korea. These materials are intended solely for Qualified Professional Investors as defined under the FSCMA and should not be given or shown to any other persons.

These materials are not intended for distribution to, or use by, any person in any jurisdiction where such distribution would be contrary to local or international law or regulation. The views and opinions herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients or prospects. No determination has been made regarding the appropriateness of any securities, financial instruments or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions.

Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes and political and economic uncertainties. Emerging and developing market investments may be especially volatile. Investments in securities of growth companies may be especially volatile. Due to the recent global economic crisis that caused financial difficulties for many European Union countries, Eurozone investments may be subject to volatility and liquidity issues. Value investing involves the risk that undervalued securities may not appreciate as anticipated. Small and mid-sized company stock is typically more volatile than that of larger, more established businesses, as these stocks tend to be more sensitive to changes in earnings expectations and tend to have lower trading volumes than large-cap securities, creating potential for more erratic price movements. It may take a substantial period of time to realize a gain on an investment in a small or mid-sized company, if any gain is realized at all. Diversification does not guarantee profit or protect against loss. Emerging markets are countries that are beginning to emerge with increased consumer potential driven by rapid industrial expansion and economic growth. Investing in emerging markets is very risky due to the additional political, economic and currency risks associated with these underdeveloped geographic areas. Fixed-income investments are subject to interest rate risk, and their value will decline as interest rates rise. Unlike other investment vehicles, U.S. government securities and U.S. Treasury bills are backed by the full faith and credit of the U.S. government, are less volatile than equity investments, and provide a guaranteed return of principal at maturity. Treasury Inflation-Protected Securities (TIPS) are inflation-index bonds that may experience greater losses than other fixed income securities with similar durations and are more likely to cause fluctuations in a Portfolio’s income distribution. Investing in real estate poses risks related to an individual property, credit risk and interest rate fluctuations. High yield bonds, commonly known as junk bonds, are subject to a high level of credit and market risks. Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate and when sold may be worth more or less than the original cost.

PGIM Quantitative Solutions affiliates may develop and publish research that is independent of, and different than, the views and opinions contained herein. PGIM Quantitative Solutions personnel other than the author(s), such as sales, marketing and trading personnel, may provide oral or written market commentary or ideas to PGIM Quantitative Solutions’ clients or prospects or proprietary investment ideas that differ from the views expressed herein. Additional information regarding actual and potential conflicts of interest is available in PGIM Quantitative Solutions’ Form ADV Part 2A. Asset allocation is a method of diversification that positions assets among major investment categories. Asset allocation can be used to manage investment risk and potentially enhance returns. However, use of asset allocation does not guarantee a profit or protect against a loss.

© 2025 PGIM Quantitative Solutions. All rights reserved. PGIM, PGIM Quantitative Solutions, the PGIM Quantitative Solutions logo and the Rock design are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

Collapse Section