A recent Bloomberg article, (Misfiring Models Leave Wall Street Currency Traders Flying Blind) raised some important questions about the challenges facing currency markets today. Here, we pick up where the article left off, examining the forces behind the dollar’s recent moves and addressing the gaps in conventional theories.

It’s not about carry. US interest rates are down year to date, but so are the rates of most other major global currencies (except for the yen). In fact, US rates have declined by only a little less than the average interest rate drop among the G10.

Could it be purchasing power parity (PPP) making a comeback? The dollar has long been overpriced based on most models. But overvaluation alone doesn’t typically explain such a sharp dollar downturn. It’s also strange that the yen, which is the most undervalued against its PPP level (-36%), has appreciated the least. And what about the Swiss franc? It’s now 20% overvalued on a PPP basis yet has climbed roughly 13% against the dollar this year, making it the second-best performer.

Does the answer lie in tariff turmoil? Before April’s “Liberation Day,” tariffs were broadly expected to strengthen the dollar. The logic was simple: US trading partners would depreciate their currencies to offset the higher costs of exporting to the US. Yet the dollar remains below its pre-Liberation Day levels, unlike the rebound seen across most other US assets.

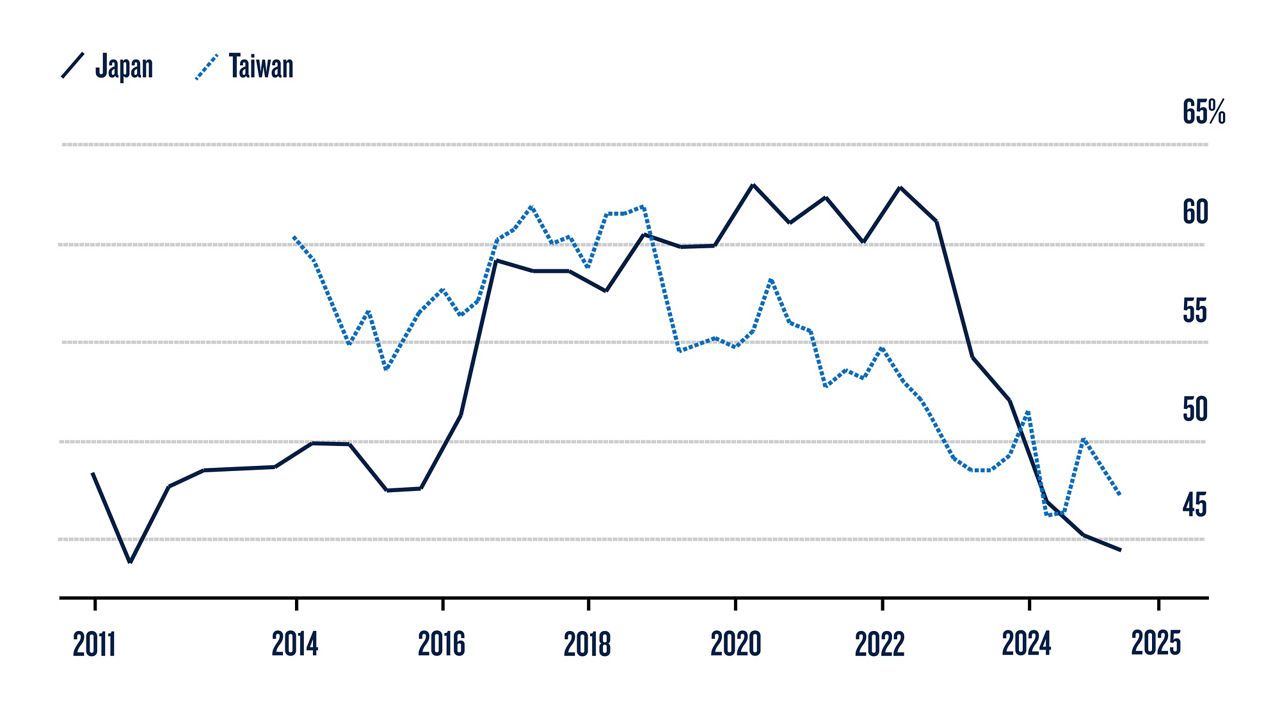

One intriguing possibility gaining attention is hedging. The theory here is that non-US investors have to remain invested in US assets, but are reducing exposure to US currency risk by selling dollars. And while this might contribute in part to the dollar’s decline, it doesn’t seem sufficient to explain its scale or breadth. For instance, Japanese life insurers, which are among the largest private holders of US assets, have reduced their hedge ratios to multi-year lows1. Meanwhile, Taiwan life insurers have seen a slight uptick in hedging activity, though their levels remain low2. For both, hedging is quite costly, because it is expensive to sell dollars when US short-term interest rates outpace local rates.

Source: Bloomberg - Taiwan Life Insurers Caught in Dilemma With Costly FX Hedges

And so it goes. While every theory has its gaps, there are some things that have worked:

First, some core “macro” inputs like growth forecasts and economic data surprises. These have had a good record so far this year for gauging the dollar’s moves. A currency, in some sense, is the sum total of the value of its economy, so macro data should be a primary driver of currencies.

Second, measures that quickly capture shifts in the risk environment. Risk sentiment has fluctuated sharply, particularly after the April 9 “pause” in reciprocal tariffs. Since then, positive trade news has repeatedly eased risk aversion, pulling the dollar lower.

This trend has become more pronounced in recent years. “Risk-off” events in currency markets have tended to be quite short, quickly swinging back to “risk-on” conditions. The days when investors could rely on holding the dollar, Swiss franc, and Japanese yen for months during bouts of risk aversion seem to be over. Or more precisely, the specific risk scenarios that favor these currencies have become increasingly rare. Instead, risk-off events are driven more by liquidity concerns and are often mitigated by policy intervention.

If “macro” and “risk” factors are performing well, that’s a pretty good sign. Currencies are never driven by just one factor, like carry. Relying on such models alone invites what the Bloomberg article aptly calls “misfires.” Successful strategies incorporate multiple factors to compensate when the usual triggers, like carry, falter.

This material is intended for Professional Investors only. All investments involve risk, including the possible loss of capital. Past performance is not a guarantee or a reliable indicator of future results.

PGIM Quantitative Solutions LLC (PGIM Quantitative Solutions or PGIM Quant) is an SEC-registered investment adviser and a wholly-owned subsidiary of PGIM, Inc. (PGIM) the principal asset management business of Prudential Financial, Inc. (PFI) of the United States of America. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc, which is headquartered in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom.

The comments, opinions and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Quantitative Solutions believes to be reliable. We do not guarantee the accuracy of such sources of information and have no obligation to provide updates or changes to these materials. This material is for informational purposes and sets forth our views as of the date of this presentation. The underlying assumptions and our views are subject to change.

These materials are neither intended as investment advice nor an offer or solicitation with respect to the purchase or sale of any security or financial instrument. These materials are not intended to be an offer with respect to the provision of investment management services. The opinions expressed herein do not take into account individual client circumstances, objectives, or needs and are therefore not intended to serve as investment recommendations. No determination has been made regarding the suitability of particular strategies to particular clients or prospects. The financial indices referenced herein is provided for informational purposes only. You cannot invest directly in an index. The statistical data regarding such indices has been obtained from sources believed to be reliable but has not been independently verified.

Certain information contained herein may constitute “forward-looking statements,” (including observations about markets and industry and regulatory trends as of the original date of this document). Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making any decisions. No representation or warranty is made as to future performance or such forward-looking statements.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V. with registered office: Eduard van Beinumstraat 6 1077CZ, Amsterdam, The Netherlands. PGIM Netherlands B.V. is authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands (Registration number 15003620) and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). PGIM Quantitative Solutions LLC, PGIM Limited and/or PGIM Netherlands B.V. are indirect, wholly-owned subsidiaries of PGIM, Inc. (“PGIM”).

In Australia, these materials are distributed by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the Financial Conduct Authority (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. PGIM Limited’s registered office is Grand Buildings, 1-3 The Strand, Trafalgar Square, London, WC2N 5HR.

In Switzerland, information issued by PGIM Limited, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland.

In Canada, PGIM Quantitative Solutions LLC relies upon the “International Advisor Exemption” pursuant to National Instrument 31-103 in certain provinces of Canada.

In Singapore, information is issued by PGIM (Singapore) Pte. Ltd. (“PGIM Singapore”), a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. This material is issued by PGIM Singapore for the general information of “institutional investors” pursuant to Section 304 of the Securities and Futures Act 2001 of Singapore (the “SFA”) and “accredited investors” and other relevant persons in accordance with the conditions specified in Section 305 of the SFA.

In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571).

In Japan, the investment management capabilities and services described in the attached materials are offered by PGIM Japan Co., Ltd (PGIMJ), a Japanese registered investment adviser (Director-General of the Kanto Local Finance Bureau (FIBO) No. 392). Retention of PGIMJ for the actual provision of such investment advisory services may only be affected pursuant to the terms of an investment management contract executed directly between PGIMJ and the party desiring such services, it is anticipated that PGIMJ would delegate certain investment management services to its US-registered investment advisory affiliate.

In Korea, PGIM Quantitative Solutions LLC holds cross-border discretionary investment management and investment advisory licenses under the Korea Financial Investment Services and Capital Markets Act (“FSCMA”), and is registered in such capacities with the Financial Services Commission of Korea. These materials are intended solely for Qualified Professional Investors as defined under the FSCMA and should not be given or shown to any other persons.

These materials are not intended for distribution to, or use by, any person in any jurisdiction where such distribution would be contrary to local or international law or regulation. The views and opinions herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients or prospects. No determination has been made regarding the appropriateness of any securities, financial instruments or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions.

Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes and political and economic uncertainties. Emerging and developing market investments may be especially volatile. Investments in securities of growth companies may be especially volatile. Due to the recent global economic crisis that caused financial difficulties for many European Union countries, Eurozone investments may be subject to volatility and liquidity issues. Value investing involves the risk that undervalued securities may not appreciate as anticipated. Small and mid-sized company stock is typically more volatile than that of larger, more established businesses, as these stocks tend to be more sensitive to changes in earnings expectations and tend to have lower trading volumes than large-cap securities, creating potential for more erratic price movements. It may take a substantial period of time to realize a gain on an investment in a small or mid-sized company, if any gain is realized at all. Diversification does not guarantee profit or protect against loss. Emerging markets are countries that are beginning to emerge with increased consumer potential driven by rapid industrial expansion and economic growth. Investing in emerging markets is very risky due to the additional political, economic and currency risks associated with these underdeveloped geographic areas. Fixed-income investments are subject to interest rate risk, and their value will decline as interest rates rise. Unlike other investment vehicles, U.S. government securities and U.S. Treasury bills are backed by the full faith and credit of the U.S. government, are less volatile than equity investments, and provide a guaranteed return of principal at maturity. Treasury Inflation-Protected Securities (TIPS) are inflation-index bonds that may experience greater losses than other fixed income securities with similar durations and are more likely to cause fluctuations in a Portfolio’s income distribution. Investing in real estate poses risks related to an individual property, credit risk and interest rate fluctuations. High yield bonds, commonly known as junk bonds, are subject to a high level of credit and market risks. Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate and when sold may be worth more or less than the original cost.

PGIM Quantitative Solutions affiliates may develop and publish research that is independent of, and different than, the views and opinions contained herein. PGIM Quantitative Solutions personnel other than the author(s), such as sales, marketing and trading personnel, may provide oral or written market commentary or ideas to PGIM Quantitative Solutions’ clients or prospects or proprietary investment ideas that differ from the views expressed herein. Additional information regarding actual and potential conflicts of interest is available in PGIM Quantitative Solutions’ Form ADV Part 2A. Asset allocation is a method of diversification that positions assets among major investment categories. Asset allocation can be used to manage investment risk and potentially enhance returns. However, use of asset allocation does not guarantee a profit or protect against a loss.

© 2025 PGIM Quantitative Solutions. All rights reserved. PGIM, PGIM Quantitative Solutions, the PGIM Quantitative Solutions logo and the Rock design are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

Collapse Section