Macroeconomic challenges emerging in the early months of 2025 continue to influence the global real estate landscape. Unpredictable U.S. policy and increasing odds of recession contribute to a complex environment for investors. A mix of tariff-driven pricing pressure and softening economic signals further complicates matters by fueling interest rate uncertainty.

While the chances are higher, a full-blown recession remains a lower-probability scenario. Amid insufficient supply, tempered demand moves conditions toward better balance, helping arrest ongoing rises in rents and property values. Different sectors present unique opportunities, with some offering more defensive qualities that can provide stability during an economic slowdown. Moreover, recent public market volatility highlights the importance of diversification.

RESILIENCE AMID PUBLIC MARKET VOLATILITY

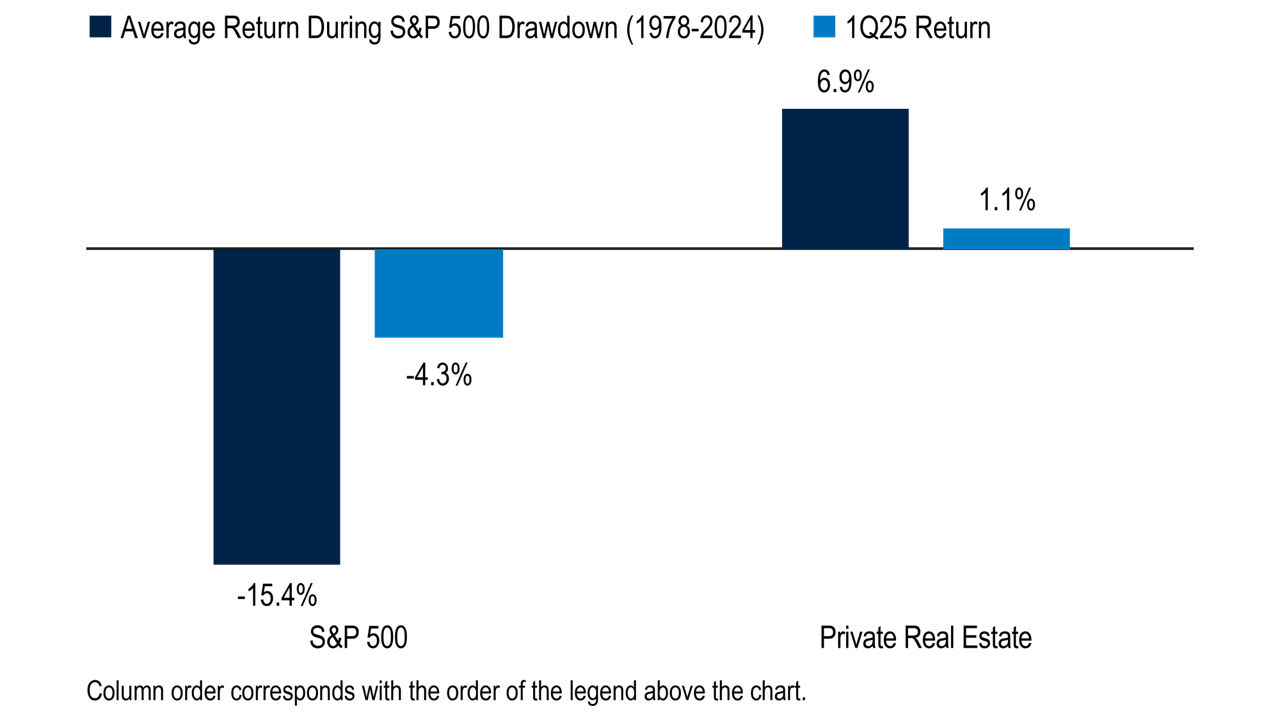

Historically, private real estate has provided a reliable buffer during public market downturns. For instance, private real estate delivered positive returns during seven of the last eight annual S&P 500 declines since 1978, averaging 6.9% gains as the S&P 500 declined 15.4%. In the most recent example of its relative resilience, private real estate climbed 1.1% while the S&P 500 fell 4.3% in this year’s first quarter.

PRIVATE REAL ESTATE RESILIENCE DURING EQUITY MARKET DECLINES

Source: Morningstar as of 31/3/2025. Private real estate represented by NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE). Past performance does not guarantee future results.

A DELAYED, NOT DISCONTINUED, RECOVERY

Real estate markets have largely priced in recent challenges following significant corrections. Despite heightened uncertainty limiting short-term upside, the broader recovery and growth trajectory remains intact. Slower supply growth is helping balance softer demand, easing pressure on rents and property values. Investors remain cautious, delaying capital deployment and reducing liquidity, but the recovery continues at a measured pace. Our cautiously optimistic outlook projects modest rental and capital growth as markets stabilise.

SUPPORTIVE FUNDAMENTALS

Fair valuations: Property values are rising in most sectors, supported by valuation cap rates that appropriately reflect long- term interest rate expectations. With values nearly 20% below their late-2022 peak, real estate is better positioned to weather economic headwinds.

Limited supply growth: Slower development activity is sustaining rents and property values, even amid weaker demand.

Active credit markets: Lenders continue to support the sector by maintaining credit availability, providing critical stability for property values.

FOCUS ON DEFENSE AND DIVERSIFICATION

In a shifting economic environment, global real estate markets remain resilient, offering strategic opportunities for investors. Residential assets are particularly attractive due to persistent housing shortages and limited supply, delivering strong income potential and favourable risk- return profiles.

Core real estate assets, following valuation corrections, now present compelling entry points for long-term, low-leverage investors focused on stability and income growth. While appetite for value-add strategies has tapered due to uncertainty, long-term opportunities remain viable.

As markets pivot toward income-driven returns, identifying areas with effective capital deployment opportunities will be essential.

Darin Bright

Managing Director, Head of U.S. Core Plus

The views expressed herein are those of PGIM Custom Harvest investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

PGIM Investments, PGIM Custom Harvest, and PGIM, Inc. (PGIM) are registered investment advisors. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, PGIM Real Estate, PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

4580138

)