Equity markets faced a rocky start to 2025, weighed down by fading AI enthusiasm and new U.S. tariffs. However, recent trade negotiations and strong earnings from AI-related companies hit hardest during the sell-off are helping restore confidence. Despite this rebound, significant uncertainty and the potential for escalating geopolitical tensions suggest markets could see more turbulence ahead.

That said, we remain optimistic about companies driven by durable secular trends. Those with strong pricing power, resilience to tariffs, and competitive advantages are better positioned to navigate volatility. Businesses demonstrating above-average growth in this environment are likely to stand out and maintain their edge.

A SLOWING GROWTH ENVIRONMENT

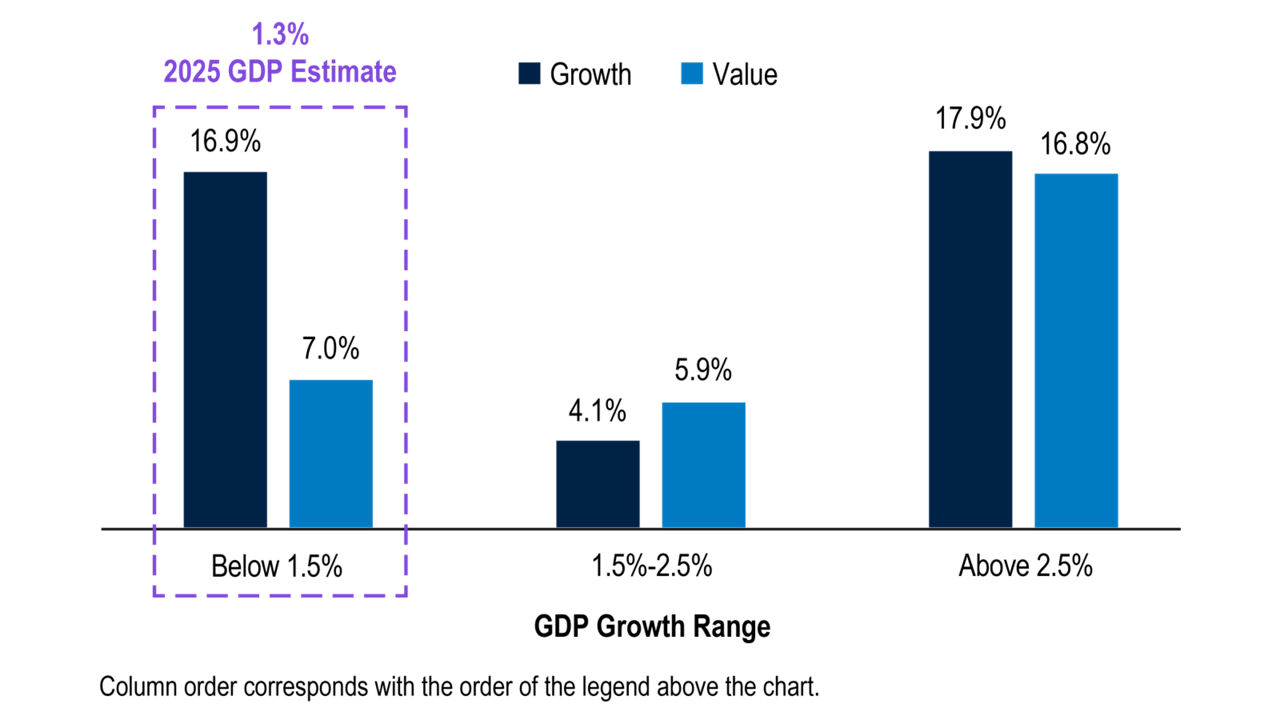

Recent volatility has sparked a shift to quality, but the number of companies capable of withstanding significant macro uncertainty is limited. As the economy slows, growth becomes scarce, making companies with durable earnings growth more appealing. Historically, growth stocks outperform value stocks during periods of below-average GDP growth. With U.S. GDP projected at 1.3% in 2025 and potential Fed rate cuts later in the year, growth stocks could gain strength. Finding standout companies requires looking for opportunities with unique return drivers less affected by macroeconomic trends.

GROWTH BEATS VALUE IN LOW GDP GROWTH ENVIRONMENTS

UNLOCK NEW AI OPPORTUNITIES

AI is advancing at an unprecedented pace, ushering in the fourth era of computing. As we move beyond hardware, the focus shifts to applications driving the next stage of AI monetisation.

Generative AI: AI agents are emerging as a transformative force, likely to shape the next wave of innovation.

Transformational technologies: While early AI investments focused on infrastructure and computing power, the next phase will see applications revolutionising industries. Companies are leveraging AI to accelerate product development, enhance customer service, and unlock deeper insights from data.

DIVERSIFY WITH RESILIENT SECULAR TRENDS

Amid evolving tariff developments and related macroeconomic uncertainty, it’s crucial to focus on sectors less sensitive to these dynamics.

Consumer brands: While softening in price-sensitive consumer segments is pressuring aggregate demand, powerful consumer brands in key luxury segments continue to see strong pricing power and demand growth.

Technology enablers: Advances in technology-enabled manufacturing and automation continue to drive productivity, while electrification trends stand to benefit from new global policies. For instance, Chinese electric vehicles experiencing strong demand are immune to tariff impacts and a slowing U.S. economy.

Fintech platforms: Emerging markets are fueling demand for innovative, affordable, and accessible financial services that are less affected by tariff pressures than tangible goods.

Health care innovation: Advances in drug development, personalised treatments, and data-driven insights are unlocking significant opportunities in the health care sector.

Related Insights

-

Investment ThemesPGIM managers delve into key trends, offering valuable insights on navigating risks and unlocking potential in this challenging environment.

Read More

-

Durable Growth Trends for Uncertain TimesJennison Associates’ Mark Baribeau shares his perspective on growth equity investing in this dynamic environment.

Read More

The views expressed herein are those of PGIM Custom Harvest investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

PGIM Investments, PGIM Custom Harvest, and PGIM, Inc. (PGIM) are registered investment advisors. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments, PGIM Quantitative Solutions and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

4580128

)