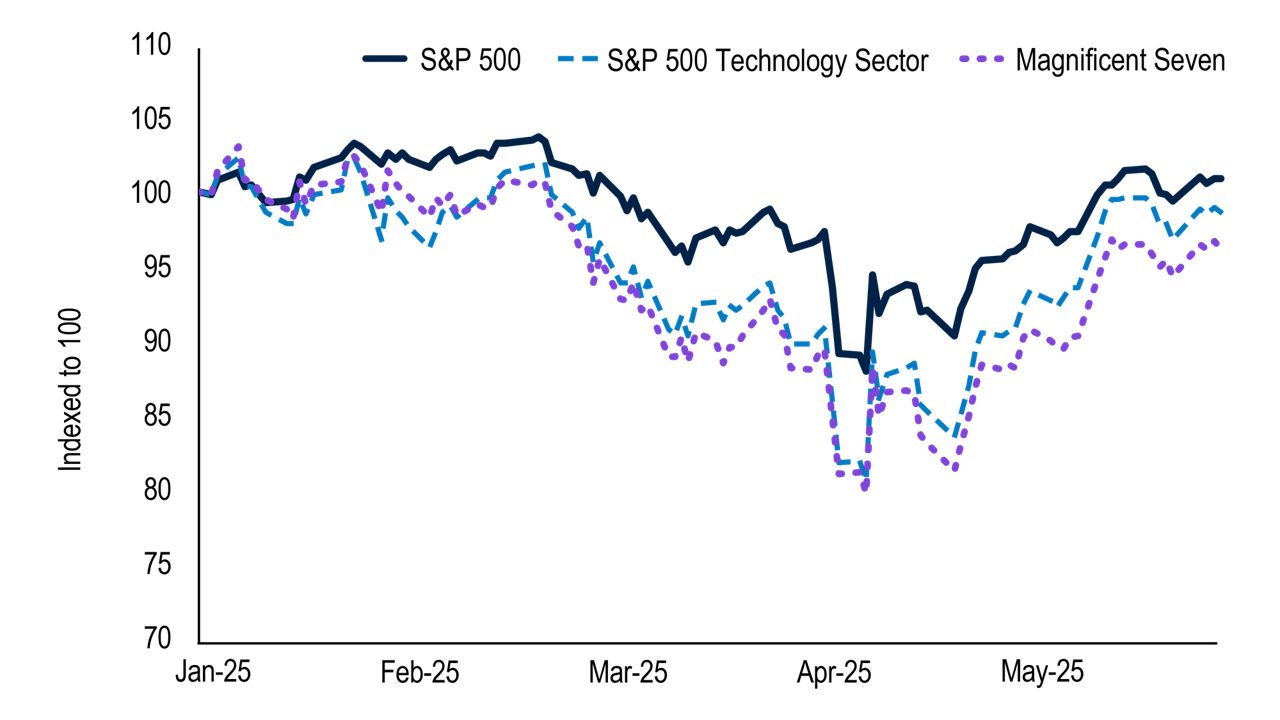

Direct indexing is a specialized strategy that uses tax-loss harvesting to help investors optimize after-tax outcomes. While valuable in any market, current conditions make it especially appealing. Market volatility drives direct indexing, with price changes creating opportunities to offset taxable gains with periodic losses. After a strong start to 2025, the S&P 500 peaked in February before falling into bear-market territory by April. The CBOE Volatility Index (VIX) hit levels not seen since March 2020. Temporary tariff reprieves spurred a May rebound, hinting at more swings as negotiations continue. This turbulence provides unique opportunities for direct indexing to help deliver tax benefits through tax-loss harvesting.

STRONG TAX-LOSS HARVESTING LANDSCAPE

The same shifting macroeconomic conditions weighing on equity returns are also responsible for outsized tax-loss harvesting opportunities. The S&P 500’s tax-loss harvesting potential in 2025 has been more than double its long-term average. Large and volatile sectors, including technology, consumer discretionary and communication services, offered even greater opportunities, exceeding 20%. An investor’s ability to capture losses depends on their cost basis. With market volatility likely to continue, tax-loss harvesting potential appears destined to remain elevated.

OPPORTUNITY TO REDUCE CONCENTRATION RISKS

After years of strong returns, many investors hold highly appreciated, concentrated equity positions, inviting trouble in today’s volatile market. The “Magnificent 7” tech giants that once drove market gains are slowing, and macro uncertainty suggests more volatility in the outlook. Conditions offer a prime opportunity to reduce concentration risk by selling overexposed positions to lock in gains and diversify. Strategic selling can manage tax implications, reduce reliance on past winners, and create a more balanced, resilient portfolio.

POWER OF DIRECT INDEXING’S DUAL MANDATE

Direct indexing seeks to mirror the performance and risk of a market index, like the S&P 500, but with active management. Underperforming assets are sold and reinvested in similar holdings to maintain market exposure. A key feature is tax-loss harvesting—selling at a loss to offset capital gains—offering tax benefits while keeping the portfolio strategy intact. The goal is to achieve index-like returns while lowering the investor’s tax burden. During volatile markets, tax-loss harvesting opportunities increase, letting investors capture losses while staying invested for future gains.

OPTIMIZE TAX-LOSS HARVESTING POTENTIAL

To efficiently manage the tax aspects of a direct indexing mandate, frequent portfolio monitoring for losses is essential. Markets, as we've seen this year, can swiftly reverse and rebound just as quickly. Managers who only assess losses on a quarterly, monthly, weekly, or even daily basis risk missing valuable opportunities. By contrast, monitoring portfolios on an intraday basis can help maximize these opportunities and enhance outcomes.

Robert Holderith

Head of PGIM Custom Harvest

PGIM Investments

-

Pgim Custom Harvest Manager PerspectivesPGIM Custom Harvest’s Robert Holderith & Brian Ahrens offer their perspective on the potential benefits of direct indexing.

Read More

-

A Roadmap for ResiliencePGIM managers delve into key trends, offering valuable insights on navigating risks and unlocking potential in this challenging environment.

Read More

The views expressed herein are those of PGIM Custom Harvest investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

PGIM Investments, PGIM Custom Harvest, and PGIM, Inc. (PGIM) are registered investment advisors. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments, PGIM Custom Harvest and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide

4580140