What is MPS?

PGIM Quantitative Solutions’ Market Participation Strategy (MPS) is a risk-mitigation strategy (RMS) seeking to deliver consistent returns by providing upside market capture while limiting portfolio losses during market downturns*.

How do investors typically utilize MPS?

Why include MPS in your portfolio?

MPS may help clients achieve their long-term return objectives by capturing approximately 60% of an equity index upside while participating in only 30% of the downside, resulting in performance similar to the index with substantially lower volatility.

MPS can be an important and positive relative contributor to your overall portfolio risk budget due to its natural risk-reward characteristics, typically measured by Sharpe ratio. As a result, it can help free up additional risk within your risk budget to redeploy elsewhere as needed from a portfolio construction perspective. MPS is particularly compelling during periods of market crises when asset classes can become highly correlated and the benefits of diversification are less pronounced.

We have extensive experience creating customized solutions that target investors’ desired equity market upside participation while limiting downside. We do this by investing in both Treasury bonds and long-dated equity call options and varying the allocations to each according to investor specifications. This approach has historically delivered on, or exceeded, client expectation while also having almost zero correlation to bonds and a low beta to equities, and when added to a diversified investment portfolio, can enhance the overall risk-reward profile. With its 30-year track record, MPS has demonstrated its ability to meet both upside participation during bull markets and downside protection targets during bear markets.

How We’re Different

The Numbers Speak for Themselves

- Attractive Track Record: MPS has a 30-year track record of mitigating large losses through its bond-like defensive features in turbulent markets, while also providing growth through upside participation in rising equity markets.

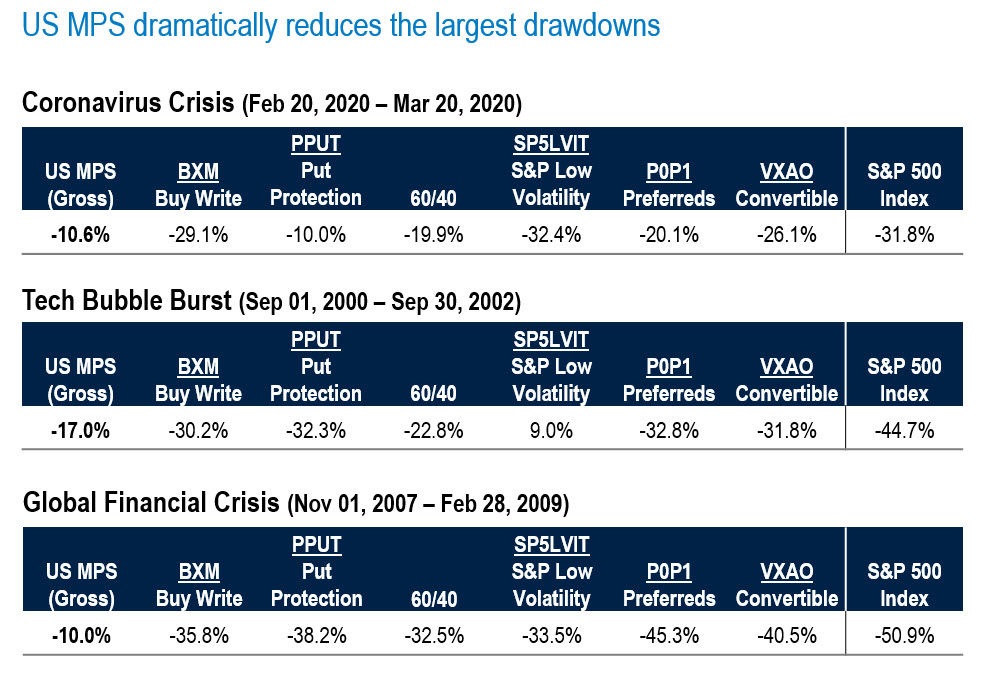

- Protection During Market Crises: MPS particularly shines during significant drawdowns such as the Tech Bubble burst, the Global Financial Crisis, and most recently, during the sharp COVID correction. MPS’ strength as a true downside protection strategy during times of significant crises is compelling, but longer-term performance shows that MPS provides upside participation during rising markets as well.

- MPS dramatically reduces the largest drawdowns: It can take a long time to recover from big drawdowns.

Largest Drawdowns since 2000

How We Can Work with You

- Exposure: MPS typically targets 60% equity exposure at reset but is completely customizable to various market exposures.

- Global Reach: MPS is available on both a US and Global Equity market basis. In the past several years, we have witnessed a significant improvement in the availability and liquidity of global long-dated options. As such, we are able to create versions using US Small Cap, Non US, and Global indices which capitalize on the same competitive advantages as the US MPS strategy.

- Implementation: MPS can be used as a lower volatility equity replacement, a component of risk mitigation, or an alternative investment allocation. Similar to hedge funds, MPS aims to decrease volatility while increasing risk-adjusted returns and reducing drawdowns. It has generally provided superior risk-adjusted returns and lower maximum drawdowns with a far more cost-effective fee structure. While hedge fund (long/short) allocations are typically sought for reasons mentioned above, and may deliver results, they do so in a much more costly fashion.

Meet the team

MPS is managed by an experienced portfolio management team.

Devang Gambhirwala

Portfolio Manager

Joel M. Kallman

Portfolio Manager

Edward J. Tostanoski III

Portfolio Manager

Putting it All Together

MPS can be part of a well-designed strategic asset allocation framework. MPS leverages the skill of our portfolio managers, who work together across investment teams to combine equity/options expertise with asset allocation experience in the application of tactical views to determine portfolio exposures. Portfolio managers consider current market conditions, their overall economic outlook, and the liquidity available in the marketplace, along with the quantitative parameters used as a guide to reset equity exposures. With its proven 30-year track record, MPS has met its objective of decreasing total portfolio standard deviation while increasing Sharpe and Sortino ratios and lowering maximum drawdown. See how MPS can help you achieve your investment portfolio objectives through participation in equity market upside while limiting the downside.

* There is no guarantee this objective will be achieved.