Higher interest rates and continued strong equity markets have dramatically improved corporate defined benefit (DB) plan funding ratios. This improvement brings DB plan CIOs new asset management challenges and opportunities. Corporate DB plans are going through a de-risking journey - deciding between managing the risk, e.g., by immunizing the plan, or transferring the risk, e.g., via pension risk transfer (PRT) buyouts, buy-ins or lump sum offerings. Many plans are now in a position to immunize (or hibernate) their portfolios, say with a high 80-90% allocation to LDI, or choose to offload some or all their pension liabilities to a third party, typically an insurer, via a PRT buyout transaction.

In addition to high funding ratios, many plans have meaningful allocations to illiquid alternative assets following a sustained period of increasing investments in these markets. The juxtaposition of improved funding ratios and significant allocations to illiquid alternative assets may pose a problem for DB plan CIOs along their de-risking journey. If the plan decides to execute a de-risking strategy, CIOs may find their portfolio overweighted to illiquid alternative assets with a pressing need to bring them back on their glide path.

In the context of a PRT buyout transaction, we examine how CIOs might "get ready" for these asset allocation challenges by adjusting their private asset commitment pacing.

Most PRT transactions are executed via asset-in-kind (AIK) transfers whereby the DB plan transfers assets, usually public fixed income, to the insurance company to pay part, or all, of the PRT premium (i.e., the payment in exchange for the insurance company to assume the pension liabilities). Since most AIK transfers exclude illiquid alternative assets, the remaining DB portfolio immediately following a PRT transaction is suddenly over-weighted in private assets, sometimes significantly so.

As a simplified example, consider a PRT buyout transaction transferring $2b AIK out of a $10b AUM DB portfolio with an initial 30% allocation ($3b) to private equity (PE) and a 70% allocation to public equity (20%) and bonds (50% - LDI). If the plan's CIO - at least conceptually - lumps PE and public equity together into a "growth asset" category opposite to the portfolio's "hedging asset" category (LDI) and wishes to keep the plan's hedging-growth asset mix constant, the CIO will reduce both LDI and public equity (i.e., sell equities and deliver cash to the insurer). The pre- and post-PRT portfolio asset mix will be:

| Before PRT Transaction | After PRT Transaction | |

|---|---|---|

| LDI | $5b (50%) | $4b (50% →) |

| Public Equity | $2b (20%) | $1b (12.5% ↓) |

| PE | $3b (30%) | $3b (37.5% ↑) |

Following PRT execution, the portfolio experiences some significant allocation changes - noticeably, an immediate 7.5 percentage point increase in PE allocation from 30% to 37.5%. This increase in alternative asset allocation may violate portfolio guidelines - which the CIO may be expected to remedy over time - and may cause other perceived or real challenges for the CIO:

• Increased allocation to private assets may increase liquidity concerns

• Future rebalancing may become more difficult

• The plan may become more exposed to the "denominator effect"

If a PRT transaction produces an undesirable increase in portfolio allocations to illiquid assets, what can the CIO do? They may consider:

• Selling PE shares and prior commitments in the secondary market

• Allocating any additional corporate contributions to public equity

• Adjusting their PE commitment pacing strategy

We use PMA Portfolio Research's OASISTM asset allocation framework to examine several "What-if" scenarios in the context of a PRT transaction which may vary in size, transaction execution lead-time, and may coincide with other market events, to help CIOs better understand the asset allocation consequences of a PRT transaction and help them evaluate alternative commitment pacing strategies.

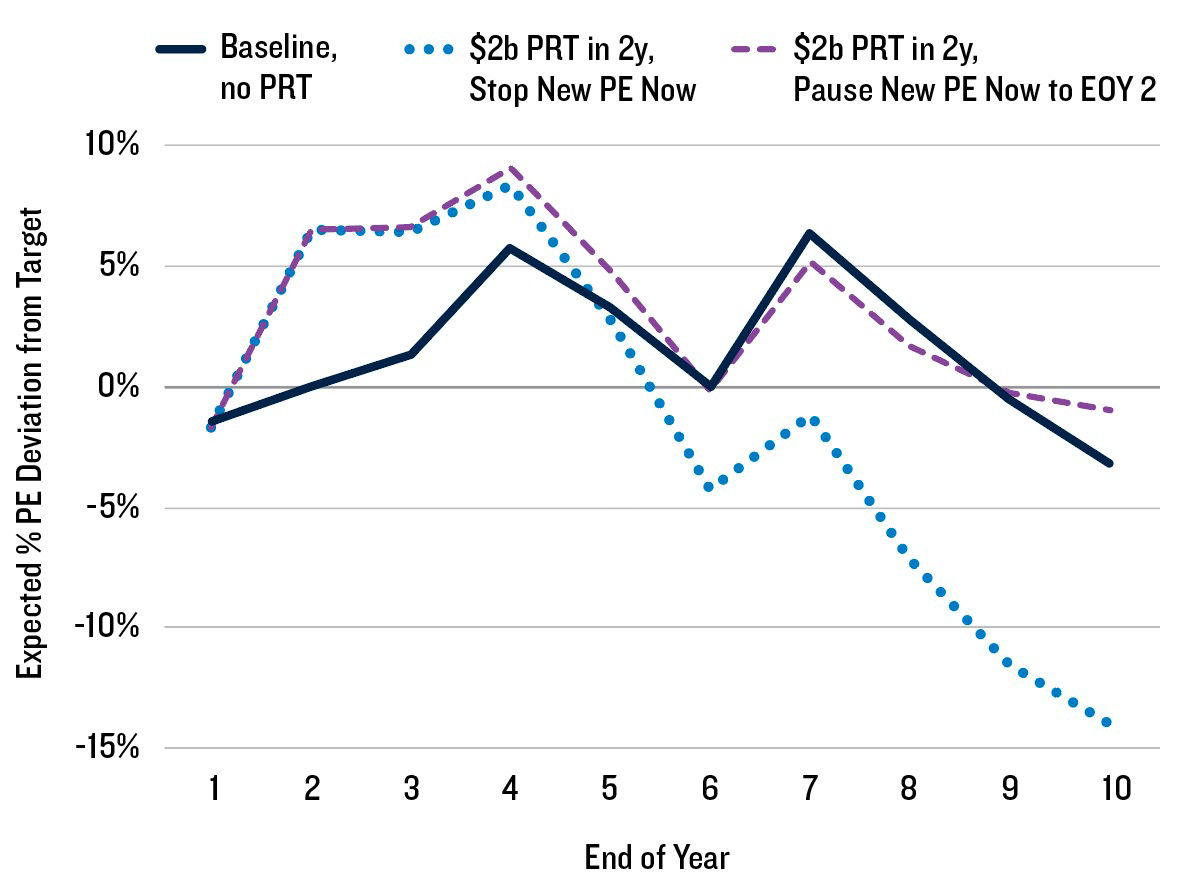

Our analysis shows that a PRT transaction can impact a DB plan's portfolio management significantly, leaving the portfolio with increased allocation to alternatives that may take some time to remedy. For example, if a CIO receives advance notice today for a PRT transaction in 2y, even if they immediately pause future PE commitments for 2y, the portfolio still suddenly becomes significantly overweighted to PE at PRT execution and continues to suffer from PE overweighting (on average, between 5 to 9 percentage points) from end of year 2 to end of year 5.

Therefore, in a world of high funding ratios, PRT planning today is a must for corporate DB plan CIOs to navigate through the asset allocation challenges that may lie ahead.

CIOs need to carefully plan for anticipated - and unexpected - PRT transactions to better stay the course. It is important for CIOs to have an asset allocation framework like OASIS that brings together their SAA target, private asset investing activities, and various liquidity demands to be able to quantify their portfolios' liquidity profile well into the future and make more informed decisions about how to adjust their private asset strategies.

Comparison of $2b PRT in 2y Scenarios vs. Baseline Expected PE NAV% Deviation from Target

(Stop PE Commitments Now vs. Pause PE Commitments Now to EOY 2)