Recessions are a regular feature of the economic and market landscape. But they are only revealed with a lag, which is why CIOs, asset allocators and market participants often rely on recession probability estimates to help gauge current and future recession risk. However, recession probability estimates come from economic models, and different models can, at times, produce conflicting signals.

In a previous (June 2023) research paper based on US data alone we demonstrated that:

- Market inputs and macro inputs both contribute meaningfully to the estimated probability of recession.

- Recession signals that combine market and macro inputs are more dependable than signals that rely on only one set of inputs, even when the inputs themselves are not aligned.

- Elevated recession probability readings are a reliable signal of US recessions.

- But elevated recession probability readings are less informative regarding future stock and bond returns. However, for the US, a better indicator for future stock returns is the change in recession probability. Specifically, excess (1m, 3m, 6m and 12m) forward stock returns are weakest when the probability of a recession is high & rising and are strongest when the probability of a recession is high & falling.

In this paper, we extend our US analysis to four other large developed markets: France, Germany, Italy and the UK. As with our previous work, the goal is not to build a better recession prediction model, but rather to show how CIOs can assess, interpret and utilize recession probability models. We (1) investigate the role of market and macro data in assessing recession risk; (2) evaluate recession signal quality; and (3) explore market reaction to recession risk as captured by the estimated probability of recession.

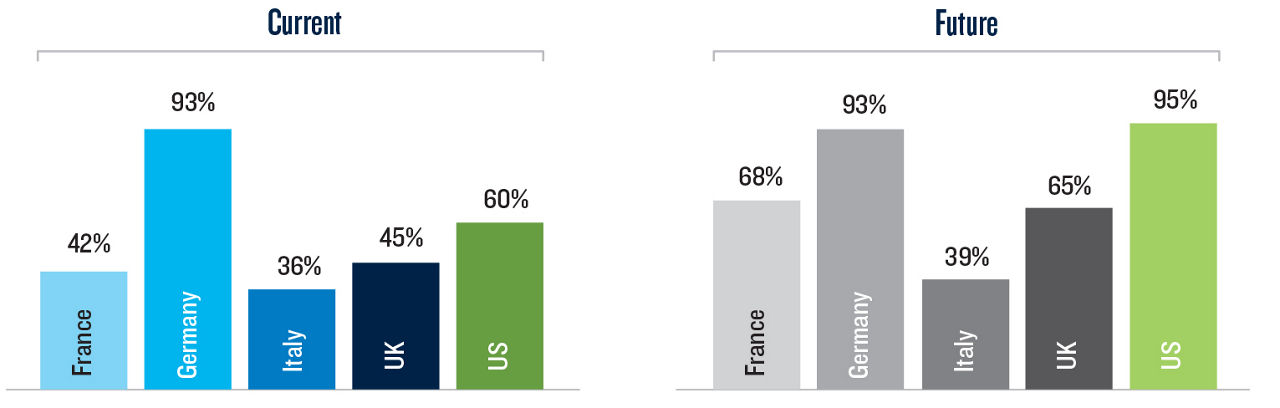

Estimated Probability of Current & Future Recession

(As of February or March 2023)

Looking across the four non-US countries, a flatter yield curve, weaker equity returns, weaker industrial production growth, and deteriorating consumer confidence tend to contribute meaningfully to an increase in the probability of recession. As with the US, combining market and macro variables together leads to the best-fitting recession probability estimates, though this effect is weaker in the UK and Italy than elsewhere.

Across countries, the market implications of recession probability readings are less clear. In the US, the change in recession probability - not its level - is most meaningful for forward excess stock returns, whereas for France and Germany, both the level and the change seem to matter. In contrast, for the UK and Italy, return patterns are less coherent.

Recessions and recession probability models in both the US, Europe and the UK share common attributes with broad implications for portfolio allocation and construction decisions. For CIOs, evaluating the risk of a recession is not just a macroeconomic curiosity; understanding how to interpret the probability of recession and its underlying drivers can shed light on potential market performance and help to better position a multi-asset portfolio.