Germany’s recent fiscal announcements prompted two near-immediate effects. The first, more observable impact was the broad increase in European sovereign yields initiated by the sharp selloff in bunds. The second consequent effect was renewed concerns about debt sustainability across the EU periphery.1 This piece explores 10 fundamental factors at play in support of European peripheral sovereign bonds. The key takeaway is that investors should not let the prospect of increased EU defence spending prevent them from considering the value in peripheral sovereign debt.

As in the U.S., European economies emerged from the pandemic with significantly higher government deficits and debt-to-GDP ratios. In Europe, this was worsened by the energy price shock amidst the war in Ukraine. The associated increase in European government debt issuance has been absorbed by markets, even as the ECB has stepped back as a buyer. Yet, Europe’s lingering debt-sustainability concerns bring us to the current situation.

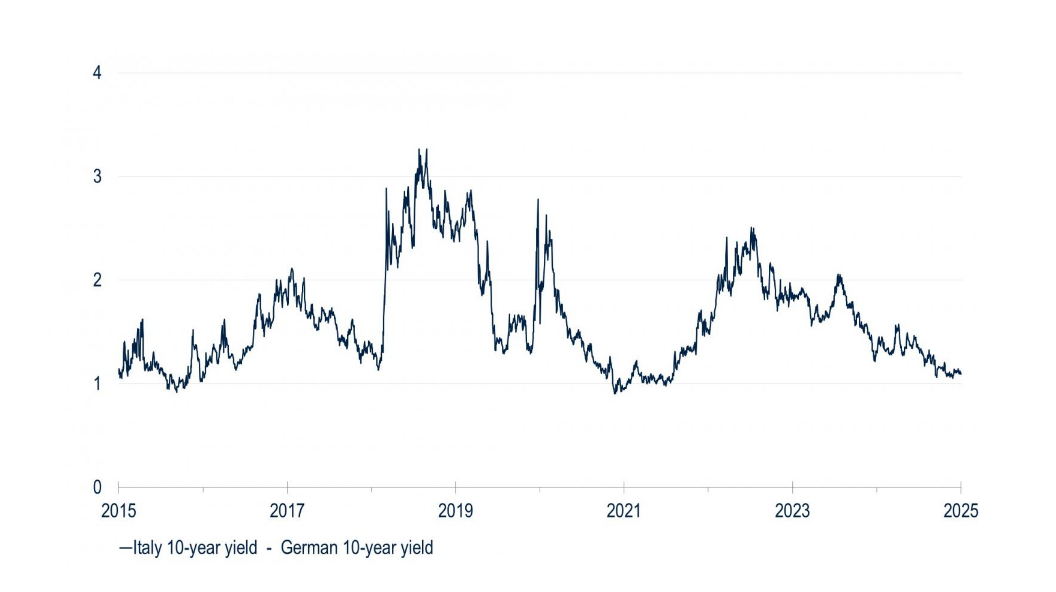

Europe’s increased security risks have raised the prospect of even larger deficits and mounting debt issuance as the region boosts its defence capabilities. Germany’s recent steps to significantly increase defence and infrastructure spending triggered a sharp, but “orderly,” rise in German bund yields that also lifted other European sovereign bond yields. Importantly, this repricing was not accompanied by renewed fragmentation risks as the spread on peripheral yields to German bunds remained near their tightest levels in over a decade. For example, Figure 1 shows that the spread of Italian yields to 10-year Bunds is slightly more than 100 bps, which also marks the tightest levels going back to 2015.

Figure 1

“Orderly” repricing across European peripheral debt maintained the spread of Italian yields to German bunds near the tightest levels over the last decade (percentage points).

Source: Bloomberg. Data from 1/1/15 to 31/12/24

However, the rise in yields is again raising debt sustainability concerns – particularly in those countries most affected during the European sovereign debt crisis. Italy is frequently cited as the most vulnerable of the peripheral countries.

Although near-term technical factors associated with increased debt issuance could again test market absorption and prompt periods of volatility for European sovereigns, below we set out 10 factors that should help support European peripheral sovereign bonds. These reasons may also serve as points to monitor as Europe ventures into what may become a new fiscal paradigm.

ONE

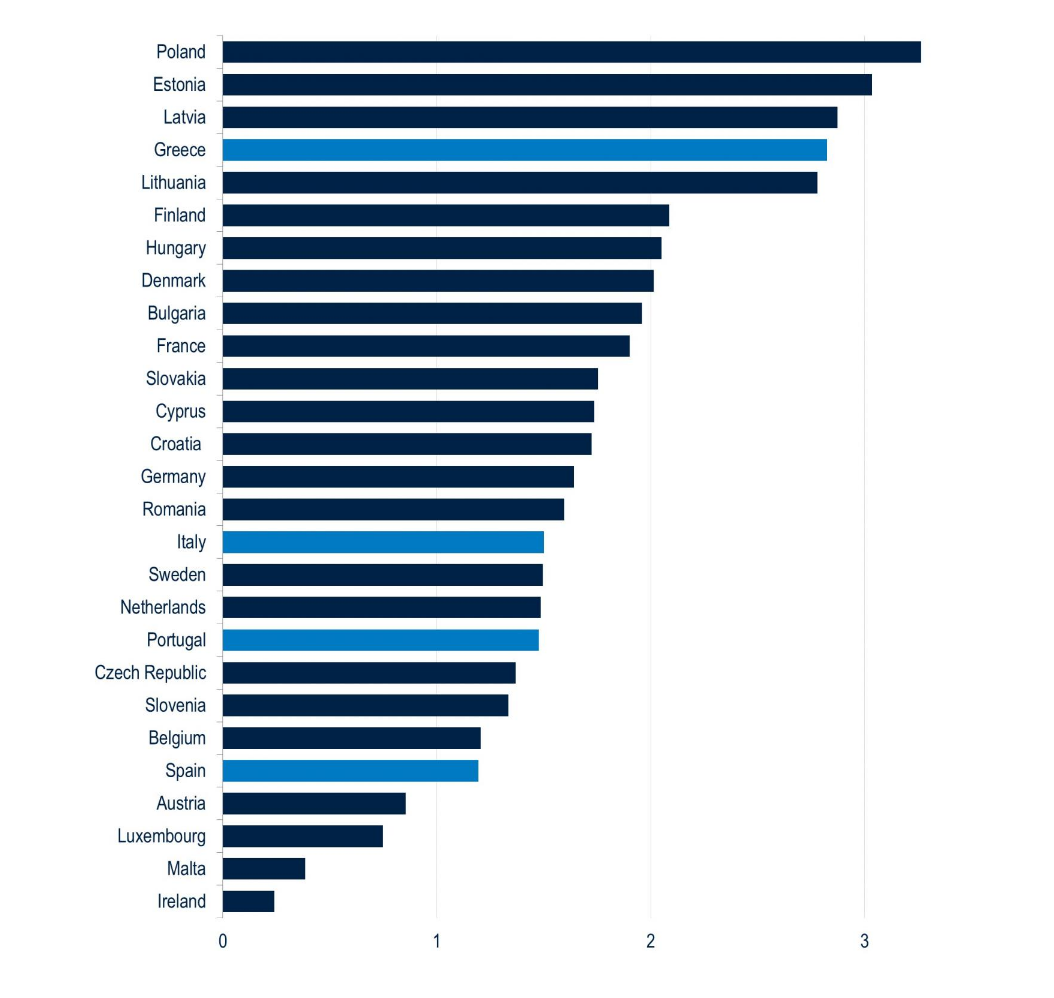

It seems unlikely that the loosening in EU fiscal rules will lead to a significant rise in defence spending by the periphery. They generally spend less on defence as a percentage of GDP by political choice, rather than fiscal constraints (Figure 2). Distance to Russia also appears to be a factor in European expenditures. Seeking waivers at the national level to increase defence spending likely carries a political stigma that may limit these requests in the periphery.

Figure 2

Peripheral countries’ defence spending generally lags the rest of the EU (total defence expenditure as % of GDP).

Source: European Defence Agency. Data are the latest available and are as of 2023.

TWO

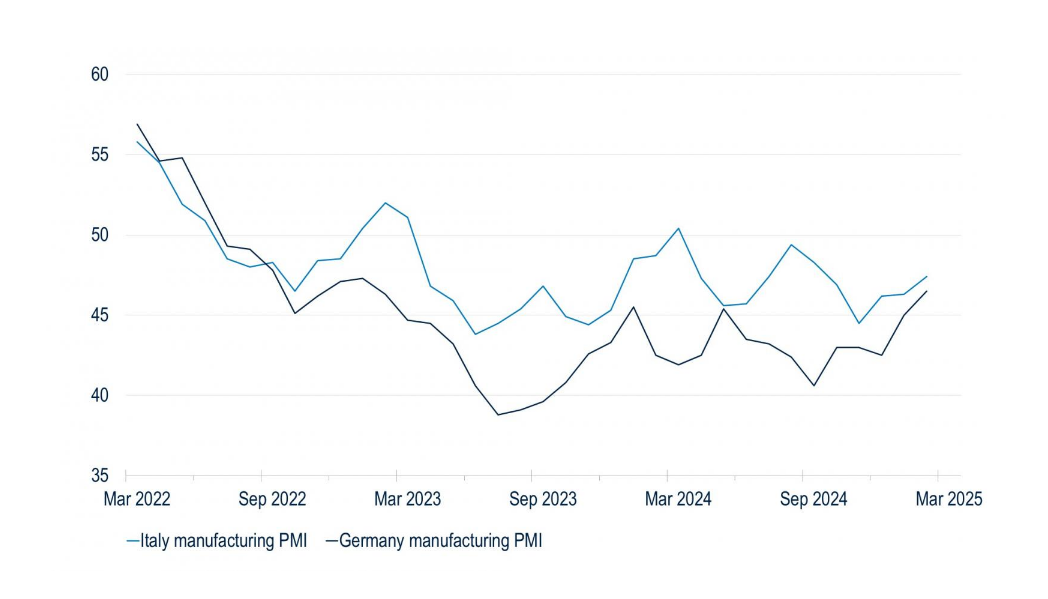

The positive spillovers from Germany’s fiscal loosening will benefit some of the periphery. Italy again comes to mind given as it is the second largest manufacturer in the EU, and its industrial activity historically moves in tandem with Germany’s (Figure 3). So, all else being equal, fiscal easing in Europe could provide a boost to Italian growth, which would be credit positive and support the recent spread compression to German yields.

Figure 3

A fiscal boost to German manufacturing may also bode well for Italy’s closely-aligned manufacturing sector (index level; below 50 = contraction; above 50 = expansion).

Source: Bloomberg. Data from 1/1/22 to 28/2/25

THREE

Italy’s reputation as the periphery’s vulnerable link could be due for an update as its fiscal conditions are far better than expected at this point. This improvement has driven the steady compression in Italian yields to bunds in recent years. Indeed, Italy was the only G7 to post a primary budget surplus in 2024, putting it on track to exit the European Commission’s Excessive Deficit Procedure (EDP) in 2026, which would be two years ahead of schedule.

FOUR

Capital expenditures across the periphery have been solid—even if one were to exclude construction expenditures, which were inflated in Italy due to the Superbonus initiative—likely supporting growth going forward.

FIVE

After a slow start, initial signs of Next Generation EU (NGEU) spending are becoming apparent. Significant spending is set through 2026 and will likely extend beyond next year for a couple of reasons: continuing projects can still access funds, and changes to NGEU rules permit delayed funding disbursements.

SIX

The NGEU effect may be amplified by the recent EU amendment to repurpose cohesion funds. Peripheral countries are meant to be key beneficiaries of these funds, but the absorption has been low thus far. The European Commission’s recent loosening of the criteria to access cohesion funds could essentially serve as a top-up to the periphery’s NGEU funding.

SEVEN

Considering the occasional flare up of fragmentation risks across the EU, Germany’s recent fiscal announcements signal strong support for the Union. This signal potentially solidified Germany’s position as a core-country backstop for the EU, which is an implicit positive for peripheral credit.

EIGHT

In addition to the various EU support mechanisms, the ECB’s Transmission Support Mechanism (TPI) also remains in place. This monetary policy mechanism is designed to support peripheral yields if a development outside a given country pressures its yields higher in an “un-orderly” fashion.

NINE

Debt sustainability in the periphery was recently stress tested when the ECB raised its policy rate to 4%. In Italy’s case, this test brought its 10-year yields to a peak of just under 5% in late 2023. Even a “big fiscal bang” scenario is unlikely to raise Italian long rates by more than 100 bps, which would be needed to take them above 5%, particularly in light of our view that the ECB is expected to cut its policy rate further at forthcoming meetings to 2%.

TEN

Finally, appetite for European sovereign bonds reliant on the domestic retail market, such as those in Italy, Spain and Portugal, remains healthy. This adds an additional buffer to potential peripheral debt volatility.

The points above not only indicate why peripheral debt will likely continue adding value to fixed income portfolios, but they also serve as guideposts to monitor going forward. Given the disorienting backdrop as Europe likely enters a new fiscal paradigm, we’ll continue to provide our analysis in our upcoming Q2 Outlook as well as a geopolitical perspective on Europe’s defence initiatives.

1 Our reference to the EU periphery refers to Italy, Spain, Portugal, and Greece.

References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. The securities referenced may or may not be held in the portfolio at the time of publication and, if such securities are held, no representation is being made that such securities will continue to be held.

The views expressed herein are those of PGIM investment professionals at the time the comments were made, may not be reflective of their current opinions, and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute investment advice or an offer to sell or a solicitation to buy any securities mentioned herein. Neither PFI, its affiliates, nor their licensed sales professionals render tax or legal advice. Clients should consult with their attorney, accountant, and/or tax professional for advice concerning their particular situation. Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

For compliance use only 4410922