So far in 2025, market activity hasn’t convinced many investors to move idle assets into equities. This year’s surge in volatility has likely added to their hesitation. However, equities remain essential for long-term growth, and avoiding them can be costly.

Volatility cuts both ways—avoiding equities to prevent losses also means missing out on gains during market upswings. Still, concerns like high valuations, declining earnings, interest rate uncertainty, and geopolitical tensions weigh on investors’ minds.

Buffer ETFs, a defined outcome solution, help balance growth and risk. They let investors capture market gains up to a limit while reducing losses, offering a smoother equity investing experience with narrower potential outcomes.

BALANCING GROWTH AND PROTECTION

Despite cautious sentiment, equity exposure remains crucial, especially for long-term financial goals. An aging investor demographic faces persistent inflation and longer lifespans, requiring larger nest eggs to sustain retirement. As retirement nears, the focus shifts to capital preservation while remaining invested for growth. Buffer ETFs provide a way to stay engaged in the market with builtin downside protection, making them particularly appealing for investors seeking to prioritize security without sacrificing growth. By combining growth potential with downside protection, they can help accomplish a range of objectives, from re-entering the equity market to enhancing portfolio resilience.

FROM CASH TO CONFIDENCE

Rising cash allocations have been a popular defensive move amid macroeconomic uncertainty and high equity-bond correlations. However, with interest rates stabilizing or expected to decline, cash returns are falling. While maintaining cash reserves is wise, overreliance can hinder long-term growth. Defined outcome strategies offer a powerful bridge, allowing investors to transition excess cash into equities with confidence.

High buffer levels also complement traditional bond allocations, balancing return potential with downside protection.

RESILIENT SOLUTIONS FOR UNCERTAIN MARKETS

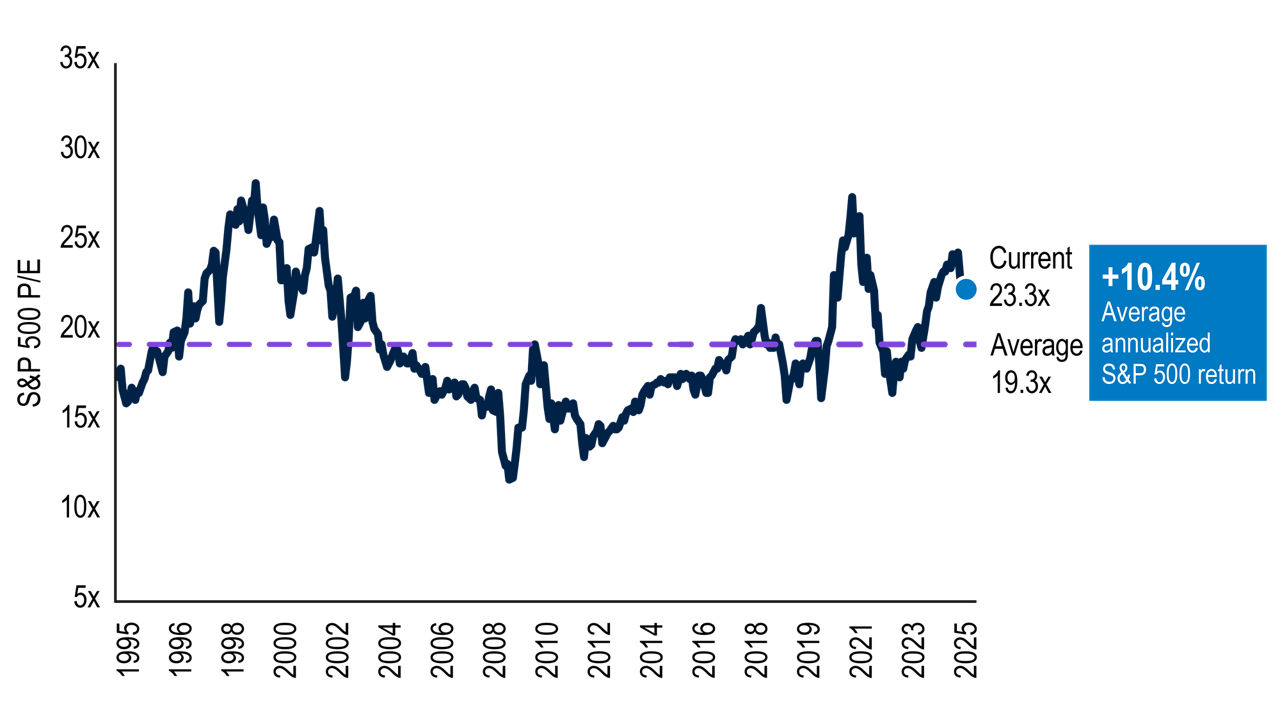

Stocks have delivered an average annual return of 10.4% over the past 30 years, making them a cornerstone of investment portfolios. However, they can be volatile. Earlier this year, the S&P 500 briefly entered a bear market, dropping over 20% before quickly rebounding and erasing losses within days.

These swings, while unsettling, highlight the market’s resilience and the importance of staying invested to benefit from long-term compounding. With markets again at historically high valuations, many investors worry about potential sell-offs. Those who move to cash during downturns risk missing the recovery and growth opportunities.

Devang Gambhirwala

Principal and Portfolio Manager for PGIM Quantitative Solutions within the Quantitative Equity Team

PGIM Quantitative Solutions

-

Buffer ETFs ExplainedBuffer ETFs enable investors to participate in the market’s upside while tempering its downside risks. Watch this video to learn how buffer ETFs work

Read More

-

A Roadmap for ResiliencePGIM managers delve into key trends, offering valuable insights on navigating risks and unlocking potential in this challenging environment.

Read More

The views expressed herein are those of PGIM Custom Harvest investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

PGIM Investments, PGIM Custom Harvest, and PGIM, Inc. (PGIM) are registered investment advisors. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments, PGIM DC Solutions and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

4580133