Markets spent another week on trade watch, as investors parsed the latest clues on President Donald Trump's plans to roll out a series of new tariffs. Trump, who is expected to detail his reciprocal tariffs on April 2, suggested that he could refrain from enacting levies that fully match those imposed by US trade partners, saying he "may give a lot of countries breaks." While separate tariffs on select sectors like autos and semiconductors are also in the pipeline, the possibility that Trump's reciprocal tariffs may not be as sweeping as feared rallied stocks to begin the week, helping major indexes recoup some of their losses since the start of the year.

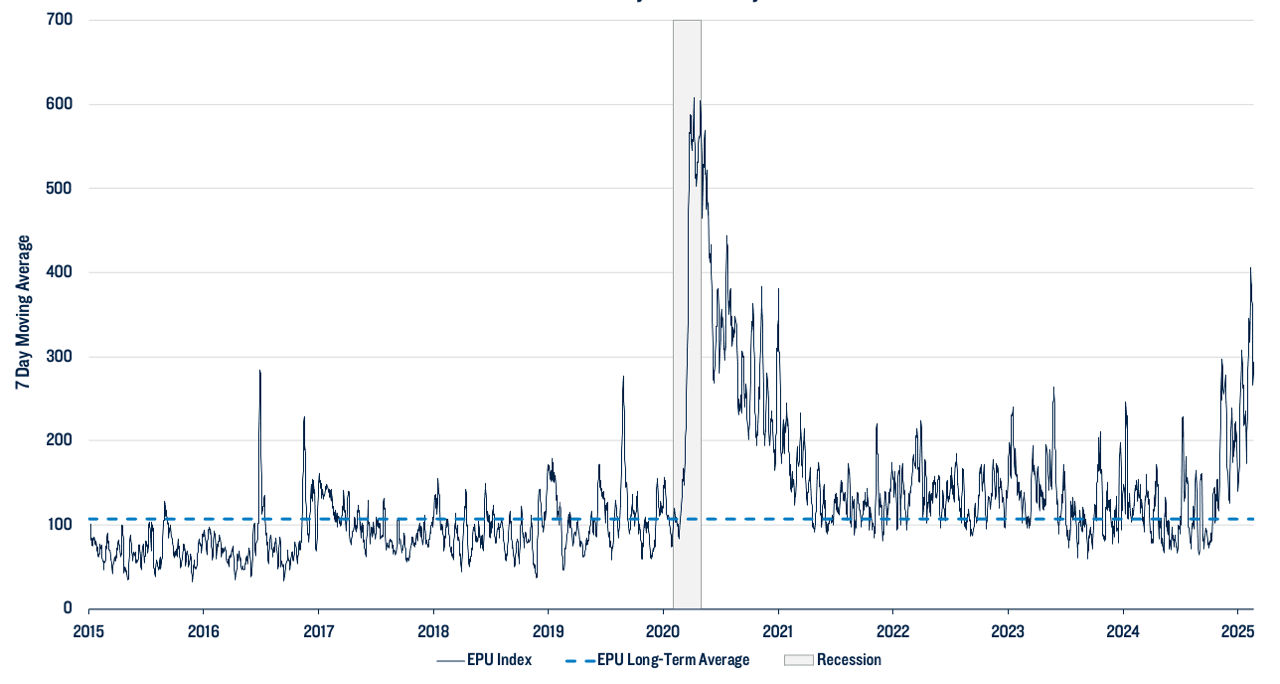

The US Economic Policy Uncertainty (EPU) Index, which tracks media coverage, the expiration of federal tax provisions, and the gap between economic forecasters' predictions, has climbed beyond its pre-pandemic levels with the outcome of the trade spat still to be determined. This uncertainty over the investment outlook, including potential impacts to inflation, economic growth and policy rates, has contributed to spikes in market volatility of late. PGIM Quantitative Solutions' Market Matters blog examines how investors can track the dynamics of policy uncertainty to help build portfolios that could withstand shocks while capturing alpha opportunities.

you may also like

-

Fears Shift from Inflation to Lackluster GrowthInvestors are gauging the prospects for monetary policy, the global economy, and US policies following next month's elections.

Read More

-

Fed Officials on Alert for Potential Inflation RisksFederal Reserve officials said this week they continue to weigh potential risks to inflation and the broader US economy.

Read More

-

Fed Stands Pat as Fight Against Inflation Drags OnThe Federal Reserve left interest rates unchanged and signaled that a recent lack of progress on the inflation front calls for borrowing costs to remain high.

Read More