Municipal bonds have experienced notable underperformance relative to U.S. Treasuries this year, especially long-dated muni bonds. While rate moves can explain a portion of this underperformance, supply and demand dynamics within the muni market have also played a significant role. Not only is muni market supply running well ahead of last year’s pace but the type of issuers and investors participating in the market has skewed the technical picture in favor of short-dated munis. The result is a far steeper muni yield curve and relative values that far exceed long-term averages.

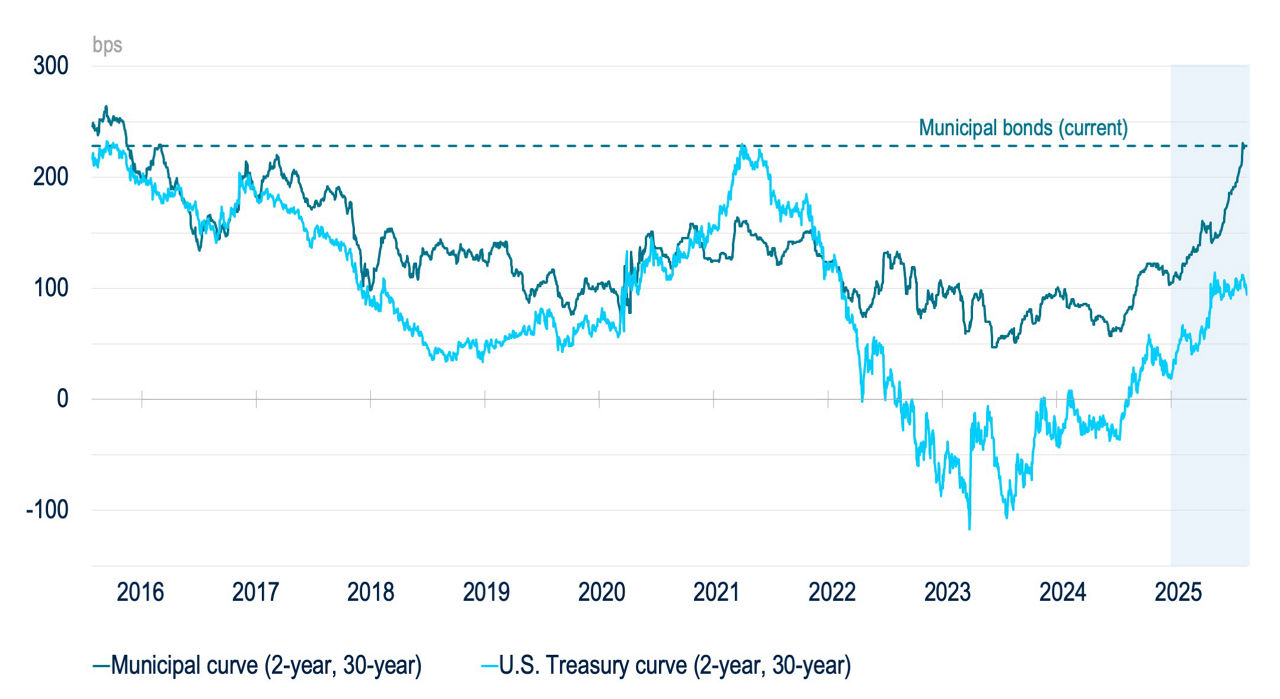

Municipal bonds are generally thought of as a rates product and highly correlated with the broader Treasury market. However, municipal bonds—especially long-dated ones—have underperformed Treasuries since the beginning of 2025. For context, long-dated municipal bonds have sold off 77 bps while short-dated muni bonds have rallied 43 bps. Over the same period, 30-year Treasuries have risen 12 bps and two-year Treasuries fell 28 bps. Put more simply, the municipal curve steepened by 120 bps and the Treasury curve steepened by 40 bps. (Fig 1). This raises questions about why munis have underperformed by so much.

Figure 1

The muni curve has steepened sharply in 2025

Source: Bloomber as of August 2025.

Part of this underperformance can be tied to the supply picture. Issuance is running 15-20% ahead of last year’s record level and is largely a function of elevated supply from issuers in the healthcare, university, and transportation sectors (Fig 2).

Figure 2

Hospitals, airports, universities lead elevated supply

Source: Bloomberg as of July 2025.

While healthcare and universities have been issuing bonds to build balance sheets in preparation for Washington-induced financial strains, airports have returned to the market to increase capacity for a post-COVID resurgence in travel. This elevated supply, which has disproportionately increased the amount of long municipal bonds, has pushed long rates higher (Fig 3). Meanwhile, Treasury issuance has been concentrated at the front end with recent long-bond supply running at less than half of front-end issuance. The Treasury is also increasing the frequency of its buybacks of nominal long-end bonds.

Figure 3

Supply has disproportionately been focused on the long end

Source: Bloomberg, JP Morgan as of August 2025.

Short-term funds see inflows

Municipal bond supply is not the sole reason for underperformance: municipal demand has also played a role. Municipal holders are predominantly retail buyers that benefit from the federally tax-exempt interest and overwhelmingly favor 15-year maturities and in. Retail buyers include Separately Managed Accounts and intermediate/short funds, which make up ~77% of the market and their preference has led to a sharp divergence in fund flows. While shorter-dated open end funds have seen $5.5 billion in inflows so far this year, longer-dated ones have experienced $2.5 billion in outflows.

This leaves a small number of institutional buyers to support longer maturities. However, banks (the largest institutional buyers of municipal bonds) have been reducing their muni bond holdings since the 2017 Tax Cuts and Jobs Act reduced the benefit of the tax exemption by lowering their tax rate from 35% to 21%.

Rolling down the curve

The supply and demand dynamics described above have left long municipal rates and relative values at levels well above their long-term averages. Thirty-year AAA muni yields as a percentage of U.S. 30-year Treasury rates is now 95%, or well above the five-year average of 88% (Fig 4). The absolute level of rates of 30-year muni bonds have not been this high since 2011 and appear increasingly attractive compared to corporate bonds as credit spreads there have compressed.

Figure 4

AAA Muni/Treasury Ratio

Source: Barclays as of July 2025.

This value proposition, extends beyond just the realm of “carry,” or the amount earning from interest alone. As total return buyers, we look for additional sources of return from spread tightening and “rolling down” the yield curve. In an upward sloping yield curve environment, investors can benefit from the price appreciation that occurs as time elapses and the bond “rolls down” to an earlier, lower portion of the yield curve. Price appreciation from rolling down the yield curve is more pronounced when the yield curve steepens—as has been the case this year.

While the broader rate market appears poised to move steeper (with a dovish Fed and potentially higher inflation from tariffs), the relative attractiveness of the long rates and yield curve slopes observed in the municipal market appear attractive. Despite the challenges posed by elevated supply and investor preferences, current market conditions present an attractive opportunity for total return buyers. The steep yield curve and the potential for price appreciation from rolling down the curve make long-dated municipal bonds a compelling investment option.

We’ve already observed some cross-over buyers (who weigh the economics of investing in the municipal market against other markets) come to the market to buy longer bonds. While this has provided some nascent support to the long end and exerted some downward pressure on the yield curve, long-dated muni bonds remain quite cheap versus their long-term average.

The comments, opinions, and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Fixed Income believes to be reliable. We do not guarantee the accuracy of such sources or information. This outlook, which is for informational purposes only, sets forth our views as of this date. The underlying assumptions and our views are subject to change. Past performance is not a guarantee or a reliable indicator of future results.

Source(s) of data (unless otherwise noted): PGIM Fixed Income, as of August 2025.

For Professional Investors only. Past performance is not a guarantee or a reliable indicator of future results and an investment could lose value. All investments involve risk, including the possible loss of capital.

PGIM Fixed Income operates primarily through PGIM, Inc., a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and a Prudential Financial, Inc. (“PFI”) company. Registration as a registered investment adviser does not imply a certain level or skill or training. PGIM Fixed Income is headquartered in Newark, New Jersey and also includes the following businesses globally: (i) the public fixed income unit within PGIM Limited, located in London; (ii) PGIM Netherlands B.V., located in Amsterdam; (iii) PGIM Japan Co., Ltd. (“PGIM Japan”), located in Tokyo; (iv) the public fixed income unit within PGIM (Hong Kong) Ltd. located in Hong Kong; and (v) the public fixed income unit within PGIM (Singapore) Pte. Ltd., located in Singapore (“PGIM Singapore”). PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Prudential, PGIM, their respective logos, and the Rock symbol are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

These materials are for informational or educational purposes only. The information is not intended as investment advice and is not a recommendation about managing or investing assets. In providing these materials, PGIM is not acting as your fiduciary. PGIM Fixed Income as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Investors seeking information regarding their particular investment needs should contact their own financial professional.

These materials represent the views and opinions of the author(s) regarding the economic conditions, asset classes, securities, issuers or financial instruments referenced herein. Distribution of this information to any person other than the person to whom it was originally delivered and to such person’s advisers is unauthorized, and any reproduction of these materials, in whole or in part, or the divulgence of any of the contents hereof, without prior consent of PGIM Fixed Income is prohibited. Certain information contained herein has been obtained from sources that PGIM Fixed Income believes to be reliable as of the date presented; however, PGIM Fixed Income cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. PGIM Fixed Income has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy.

Any forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fee. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any security or other financial instrument or any investment management services and should not be used as the basis for any investment decision. PGIM Fixed Income and its affiliates may make investment decisions that are inconsistent with the recommendations or views expressed herein, including for proprietary accounts of PGIM Fixed Income or its affiliates.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low-interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government agency or private guarantor, there is no assurance that the guarantor will meet its obligations. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be suitable for all investors. Diversification does not ensure against loss.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR.PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V., an entity authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited including those available under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). In Switzerland, information is issued by PGIM Limited, London, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, London, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland. In certain countries in Asia-Pacific, information is presented by PGIM (Singapore) Pte. Ltd., a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. In Japan, information is presented by PGIM Japan Co. Ltd., registered investment adviser with the Japanese Financial Services Agency. In South Korea, information is presented by PGIM, Inc., which is licensed to provide discretionary investment management services directly to South Korean investors. In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571). In Australia, this information is presented by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the FCA (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. In Canada, pursuant to the international adviser registration exemption in National Instrument 31-103, PGIM, Inc. is informing you that: (1) PGIM, Inc. is not registered in Canada and is advising you in reliance upon an exemption from the adviser registration requirement under National Instrument 31-103; (2) PGIM, Inc.’s jurisdiction of residence is New Jersey, U.S.A.; (3) there may be difficulty enforcing legal rights against PGIM, Inc. because it is resident outside of Canada and all or substantially all of its assets may be situated outside of Canada; and (4) the name and address of the agent for service of process of PGIM, Inc. in the applicable Provinces of Canada are as follows: in Québec: Borden Ladner Gervais LLP, 1000 de La Gauchetière Street West, Suite 900 Montréal, QC H3B 5H4; in British Columbia: Borden Ladner Gervais LLP, 1200 Waterfront Centre, 200 Burrard Street, Vancouver, BC V7X 1T2; in Ontario: Borden Ladner Gervais LLP, 22 Adelaide Street West, Suite 3400, Toronto, ON M5H 4E3; in Nova Scotia: Cox & Palmer, Q.C., 1100 Purdy’s Wharf Tower One, 1959 Upper Water Street, P.O. Box 2380 -Stn Central RPO, Halifax, NS B3J 3E5; in Alberta: Borden Ladner Gervais LLP, 530 Third Avenue S.W., Calgary, AB T2P R3.

© 2025 PFI and its related entities.

2025-6826

Collapse Section