CHART HIGHLIGHTS

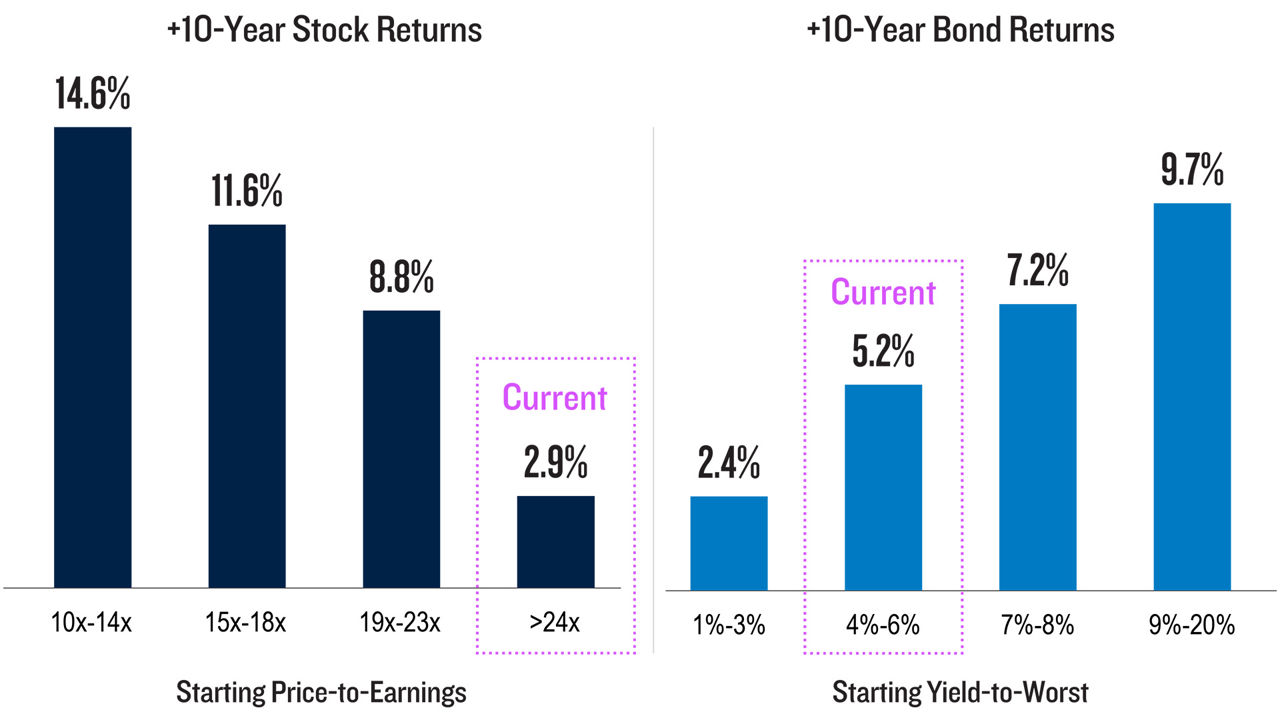

- Stocks are currently trading near historic highs, while bond yields have reached levels not seen since the Global Financial Crisis.

- Bonds outpaced stocks in the 10 years following past periods when equity price-to-earnings ratios topped 23x and bond yield-to-worst measures fell in the 4%-6% range.

Footnotes

Bloomberg U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. It covers the U.S. investment-grade, fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. S&P 500 Index is an unmanaged index of 500 common stocks of large U.S. companies, weighted by market capitalization. An investment cannot be made directly in an index and an index does not have fees. All indexes are unmanaged.

Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost.

The views expressed herein are those of PGIM Investments professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

© 2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI, Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P). GICS classifications and related GICS information are provided “as is” with no express or implied warranties. Bloomberg®, Bloomberg Short U.S. Aggregate Bond Index, Bloomberg U.S. Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by PGIM Investments. Bloomberg is not affiliated with PGIM Investments, and Bloomberg does not approve, endorse, review, or recommend PGIM Investments products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to PGIM Investments products. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in presentations thereof.

Prudential Investment Management Services LLC is a Prudential Financial company and FINRA member firm. PGIM Investments is a registered investment advisor and investment manager to PGIM registered investment companies. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

4504072