Growth has defined private credit since the 2008 financial crisis, attracting investors seeking steady returns, attractive spreads, and flexibility. Its resilience during equity market turbulence adds to its appeal, but investors should note a key risk: many newer private credit managers lack experience navigating today’s complex conditions.

While credit markets remain stable, challenges like trade, geopolitics, and inflation could create headwinds. However, these same factors may also present opportunities through higher base rates and wider credit spreads.

SELECTIVITY CRITICAL AS ECONOMY SLOWS

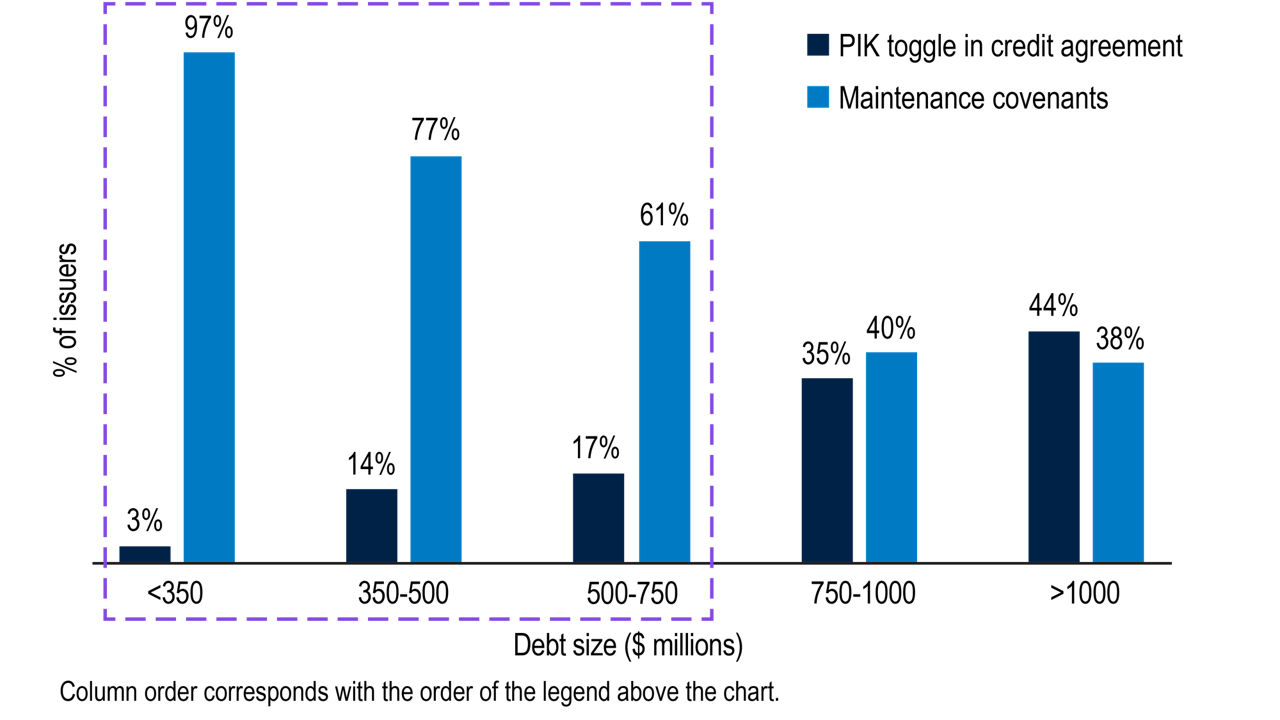

Be picky about PIK loans: Since 2022, rising interest rates have placed significant strain on heavily leveraged companies, with many now facing interest payments that exceed their cash flow. To address short term liquidity issues, payment-in-kind (PIK) loans have become a popular option. These loans let borrowers defer cash interest payments by adding unpaid interest to the loan’s principal, postponing immediate outflows.

The rise of PIK loans is fueled by intense competition in private credit markets, particularly in larger segments. However, these higher-interest loans carry greater credit and default risks, which can be an issue in a slowing economy as borrowers struggle to meet obligations. For interval funds and business development companies, managing PIK loans is challenging since unpaid interest must still be distributed to shareholders, adding pressure in uncertain times.

Seek stronger covenants: At the same time, slowing M&A and IPO activity, along with fears of “zombie” companies unable to restructure, adds to the challenges. Weaker covenants across the industry increase risks if the economy worsens. As growth slows, untested companies and newer private credit managers face mounting obstacles. Underperforming companies with covenant-lite structures prevent lenders from exerting influence before a borrower’s performance significantly deteriorates, which can negatively impact investor recoveries.

Amid intense lender competition, it will be crucial to assess manager risk appetite for PIK loans and covenant-lite structures that can subsequently jeopardise credit performance in distress scenarios.

MIDDLE MARKET RESILIENCY SHINES

While many lenders focus on the larger market segments, we see greater potential in middle-market companies. These businesses offer better risk-adjusted return potential, with higher yields and lower leverage. The middle market stands out as a sweet spot, benefiting from fewer PIK loans and stronger covenant protections.

NON-SPONSORED DEALS FILL THE SPONSORED GAP

Private credit volumes are largely driven by M&A activity backed by private equity sponsors. However, many private credit lenders, traditionally focused on sponsored deals, are facing challenges from elevated interest rates and tariff uncertainties. With a subdued M&A outlook, non-sponsored deals can be a compelling option for lenders to stay competitive and source new transactions as well as offer diversification to the typical leveraged buyout (LBO) cycle.

LOWER PIK AND MORE COVENANTS IN SMALLER MARKETS

Source: S&P Global Ratings as of April 2025.

Matthew Harvey

Executive Managing Director and Head of Direct Lending

PGIM Private Capital

Related Insights

-

Understanding Middle Market Direct LendingPGIM Private Capital explores why middle market direct lending may offer a compelling risk-return profile.

Read More

-

A Roadmap for ResiliencePGIM asset managers reveal key factors shaping their 2026 outlooks, offering insights to help investors capitalize on market stability and uncover growth beneath the surface.

Read More

The views expressed herein are those of PGIM Custom Harvest investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

PGIM Investments, PGIM Custom Harvest, and PGIM, Inc. (PGIM) are registered investment advisors. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, PGIM Real Estate, PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

4580139

)

_Main%20page%20Hero)