Inflation has reached its highest level in over 30 years.

Which factors have done well during periods of high inflation?

With inflation reaching its highest level in over 30 years (Exhibit 1), PGIM Quantitative Solutions' Quantitative Equity team analyzed how inflation has historically impacted factor performance. The focus was on whether value, which has generally trailed other factors during the equity market run-up over the last decade, can be expected to reverse course in the current period of rising inflation. Typically, value-oriented sectors like Financials, Energy, and Materials have done better during periods of rising inflation and interest rates. However, can the assumptions and expectations of the past be applied to today's market environment?

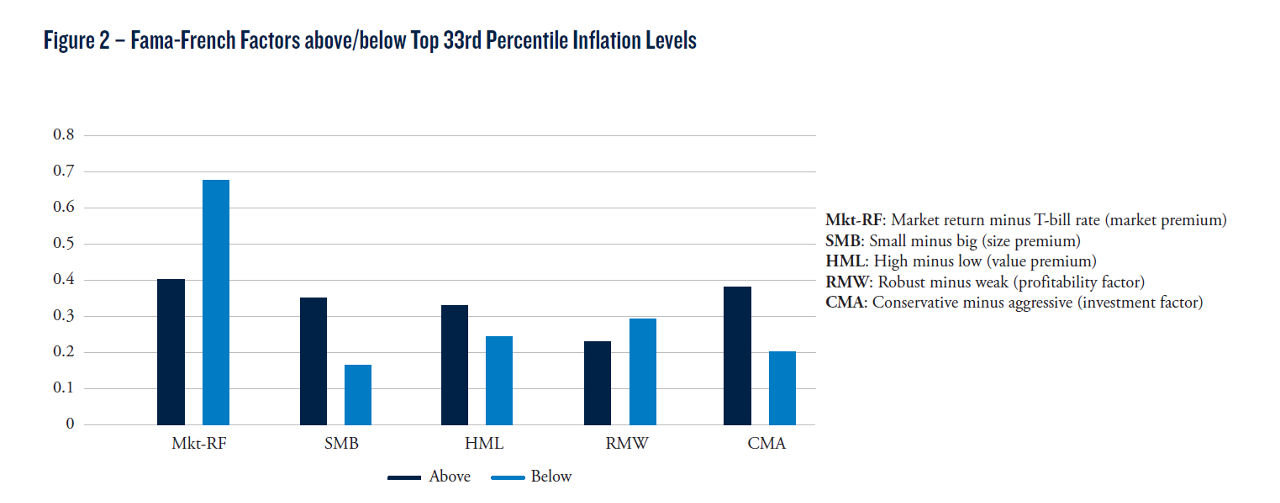

Exhibit 2 illustrates the performance over nearly 60 years (1963-2021) of the five Fama-French factors during periods of high and low inflation. In analyzing historical inflation levels, we assigned the top 33rd percentile as high inflation and the bottom 33rd percentile as low inflation. We calculated the average factor returns for each of the five Fama-French factors for both high inflation and low inflation periods. It is evident that historically, the value factor has performed better during periods of high inflation, but can this expectation be applied in today's landscape?

We believe that predicting the trajectory of value's future returns involves a more nuanced approach than simply looking at past periods of high or rising inflation. Although the Fama-French model suggests that value should perform well amid the current rising inflation landscape, we think that predictions must be qualified by considering the following:

- It is difficult to predict factor performance based on inflation because the historical inflation dataset is bifurcated, with an initial extended period of high inflation followed by a prolonged period of low inflation. Indeed, the analysis would be stronger if high inflation persisted in the more recent past, and if the dataset was not dominated by only two extended regimes. This regime dominance renders statistical analysis less dependable.

- As depicted in Exhibit 1, high inflation was most prominent during the 1970s/1980s. However, the equity market of the 1970s/1980s is far different from that of today, especially given the impact of disruptive tech stocks over the last decade.

- Overarching macro themes could simultaneously drive inflation and factor returns, making it difficult to pinpoint whether an inflationary backdrop was the primary driver behind historical factor returns. It is noteworthy, though, that each of the Fama-French factors have a positive monthly return, on average, dating back to 1963 whether inflation is above or below the top 33rd percentile relative to history.

We utilized Fama-French factors in this analysis because they are widely accepted in the asset management industry and have a long return history. However, the proprietary factors that we employ at PGIM Quantitative Solutions behave differently from those in the Fama-French model. Our factors, which emphasize company fundamentals that we believe are predictive of future stock performance, have been analyzed and backtested through different regimes, including those characterized by both high and low inflation. We believe that our robust, systematic investment strategies are designed to withstand varying macroeconomic environments, including periods of high and low inflation, to deliver consistent alpha.