Ghosts of Growth

Winter, with its frosty breath and warm hearths, is the season I cherish most for rekindling old friendships. As I wander the snow-covered streets or sit by the crackling fire, a curious thought often stirs within me: "What fate or fortune has befallen my dear chum in the past year?"

And so, as the days grew shorter, I invited my cherished friend, let’s call him Ebin, to join me at the tavern to catch up on the latest economic and market scuttlebutt and raise a glass to 2025. “The S&P 500 hit new highs, again,” I said. Ever the cantankerous sort, Ebin let out a deep “bah humbug!”1 before admitting that he’d gotten out over the summer. “The economy is in a truly terrible state! Leading indicators have been negative for how many months? The yield curve is still inverted. The Fed’s in no hurry to provide relief, and the Sahm rule triggered a few months ago. Who knows what the new administration will do? A recession is coming, my friend, no doubt about it.”

After parting ways, Ebin hurried home, closed his door and locked himself in; double-locked himself in, which was not his custom. As he got ready for bed, he heard a booming sound coming from the direction of his wine fridge. He scurried to the location, only to find broken bottles and a dark figure.

“There are only three ways a smart person can go broke: liquor, ladies, and leverage,” the figure said.

“How now,” said Ebin, “who are you?”

“In life, they called me Munger.”

“In life? Munger?” Ebin questioned, before it dawned on him that this was the ghost of Charlie Munger. Cowering on the floor, he cried out, “And what do you want from me?”

“Tomorrow isn’t promised but tonight, you will be haunted by three spirits,” the shape ominously croaked before fading into the ether.

Wondering what must have been in his drink, Ebin went straight to bed without undressing and fell asleep upon the instant.

After a short, fitful sleep, Ebin awoke in a cold sweat, Munger’s ominous warning echoing in his mind. As his eyes adjusted to the dim light, he discerned a peculiar figure standing in his room — a tall, bald man chomping a cigar.

“Who, and what, are you?” Ebin demanded.

“I am the Ghost of Inflation Past.”

Ebin was incredulous but bolted to attention. “Inflation spiked in the post-COVID period due to supply chain disruption, fiscal stimulus, and — though I am loath to admit it — accommodation from central banks. But central bank rate hikes have helped bring inflation under control,” the ghost proclaimed.

“Yes, I understand that, but why can’t the Fed cut more aggressively now that inflation is back down?”

“Central banks need to restore their inflation fighting credibility. The Fed’s September Summary of Economic Projections forecast core PCE inflation to be 2.2% in 2025, so inflation is down but not back under control. While the Fed’s inflation objective is expressed in terms of headline PCE, alternative indicators can help provide insight into where inflation will go in the future.”

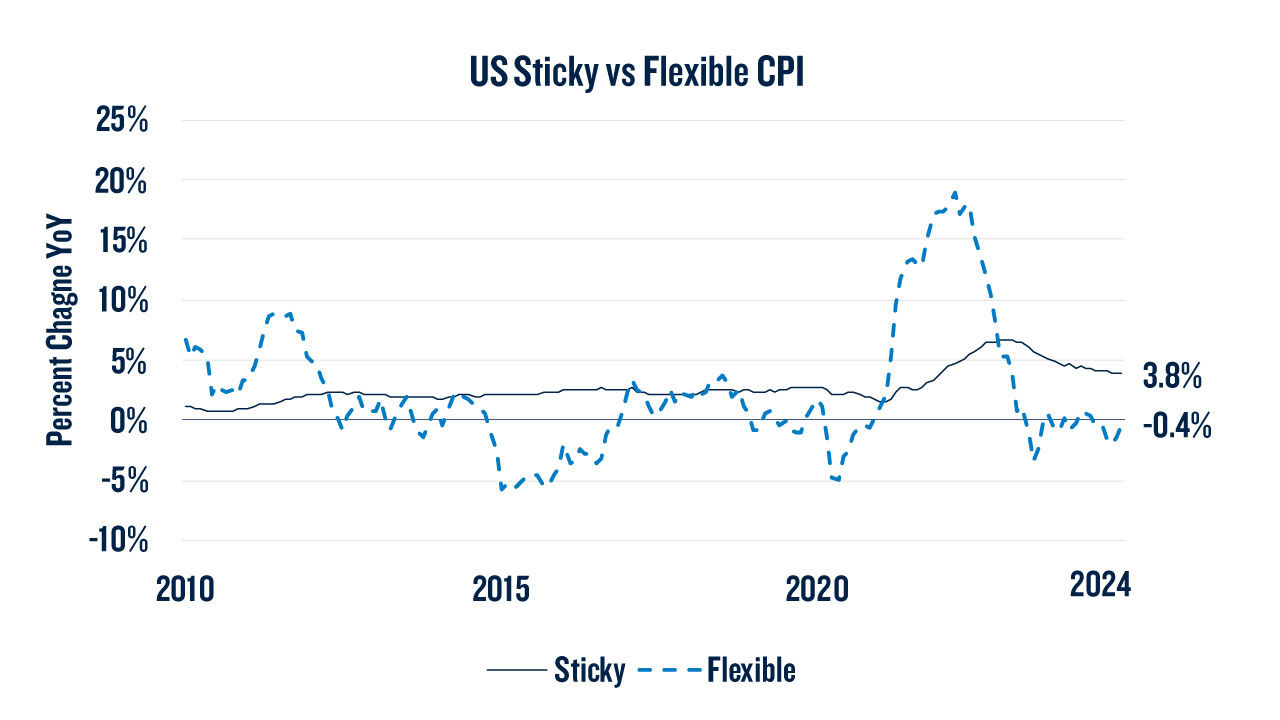

The ghost produced a tattered scroll (Figure 1) showing Ebin the Atlanta Fed’s calculation of Sticky and Flexible inflation. “The sticky components, particularly housing, remain elevated and could keep inflation strong into next year as they take longer to moderate,” the ghost proclaimed.

Figure 1: Flexible Inflation Falls Below 0%, but Sticky Inflation Slow to Return to 2%

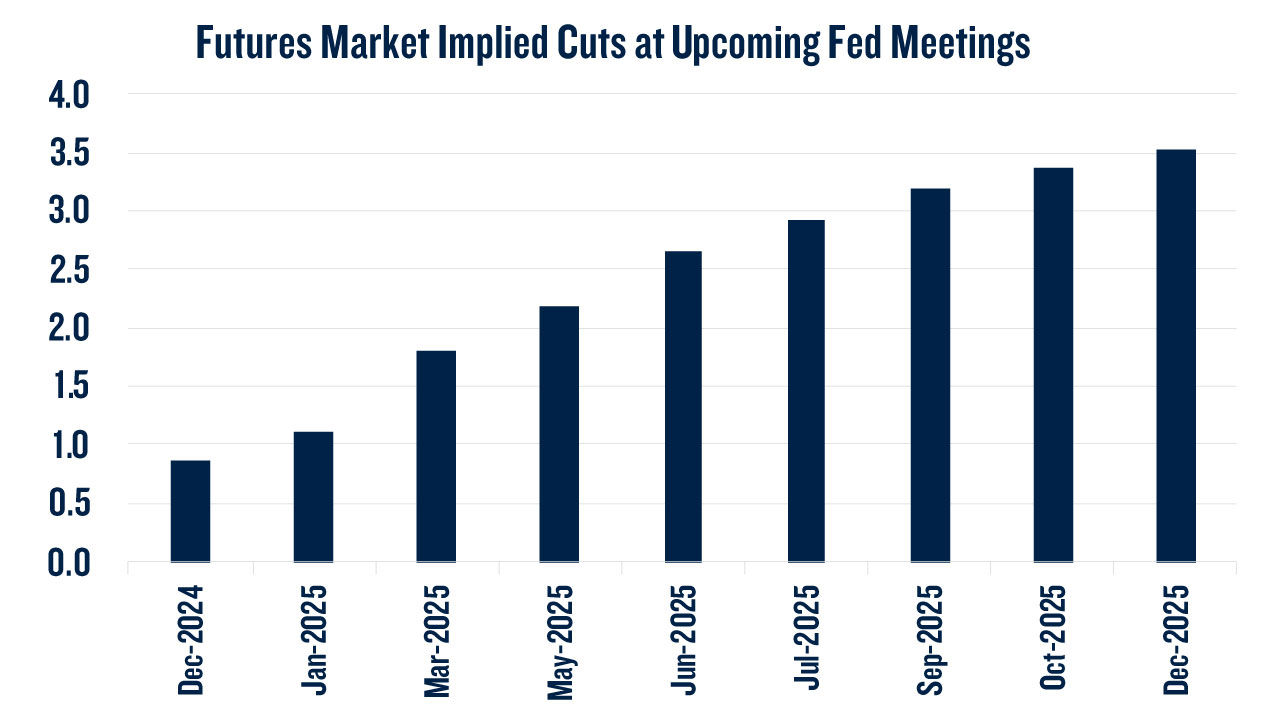

Pulling out another worn parchment (Figure 2), the ghost concluded, “thus, current futures market pricing is for a slow and gradual pace of rate cuts into 2025, consistent with recent comments from Chair Powell.”

Figure 2: Fed Likely to Cut at December Meeting, But Only 3 Cuts Priced in 2025

With all this talk of inflation and monetary policy, Ebin found himself overcome by exhaustion and drowsiness2, eventually succumbing to a heavy slumber.

Yet the respite was short-lived, and Ebin soon found himself pacing his apartment in the dead of the night, checking every door and window to make sure he was truly alone. Returning to the bedroom, he beheld a throne fashioned from a lifetime's worth of take-out containers, heaped haphazardly upon the floor. Upon that throne sat a jolly giant.

“Good thing I was wrong about food production increasing linearly!” the giant figure mused to itself.

Ebin took in the scene with a confused expression.

Noticing his befuddled face, the giant spirit offered an introduction: “I am the Ghost of Coincident Indicators,” it proclaimed. “Look upon me.” And Ebin duly complied.

The spirit continued: “US GDP rose at a pace of around 3% (QoQ annualized) over the past two quarters, above the post-Global Financial Crisis (GFC) average. The economy is in good shape. Other coincident indicators that the NBER uses to identify recessions, like personal income excluding transfer payments, job growth, and manufacturing and trade sales are growing at a solid pace.”

“You left out industrial production,” Ebin replied wryly.

The figure responded, “Well, the economy can’t be perfect, can it?”

“And what about leading indicators?” Ebin asked.

The ghost acknowledged, “Yes, leading indicators are quite bad, but they are driven to a large extent by the inverted yield curve. An inverted yield curve, particularly at the short end, is historically a good proxy for when monetary policy is expected to get tighter, and tighter monetary policy tends to occur before a recession. However, we are coming off a period where the economy was running hot, so some amount of Fed tightening was appropriate to prevent overheating and hopefully engineer a soft landing.”

“And the Sahm rule violation, should we just ignore that?” Ebin followed up.

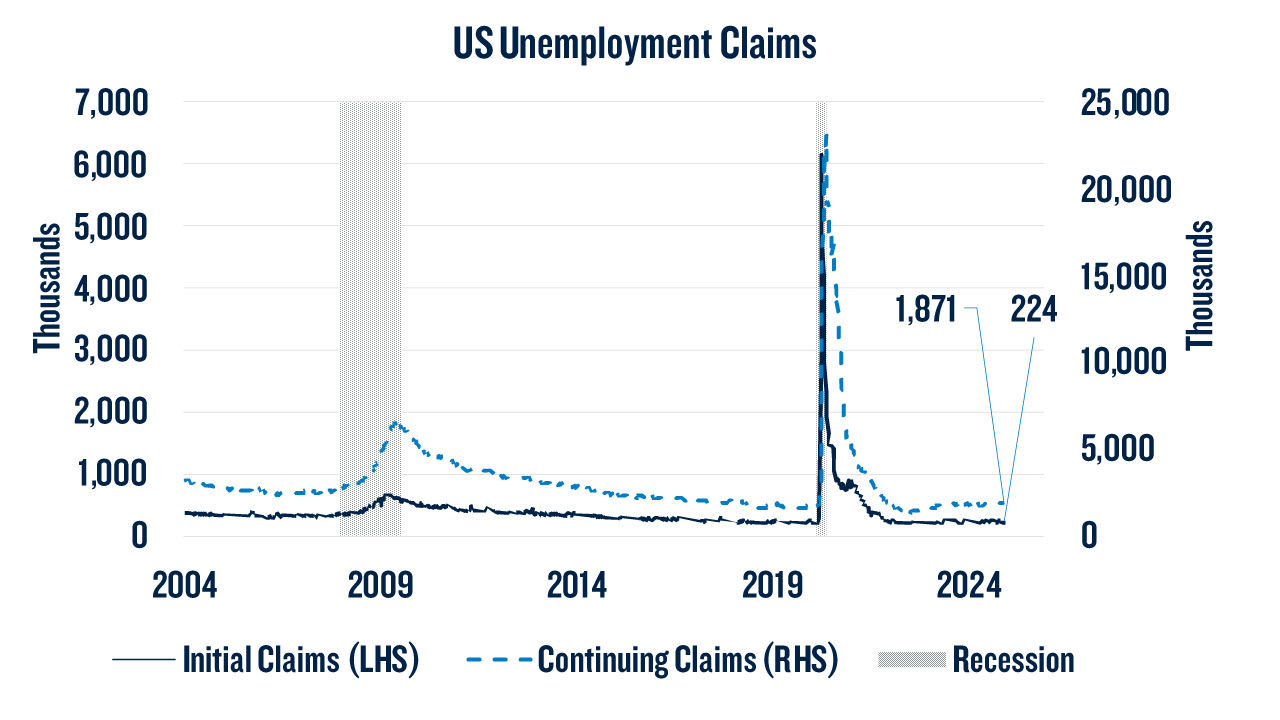

“Well… Claudia Sahm herself has expressed some skepticism about the recent signal. It’s true that unemployment has climbed higher, and it is always wise to keep a close eye on these indicators, especially when they suggest that downside risks are increasing – as is the case now. But as with leading indicators, we are emerging from a period with an overheated labor market. Job openings still exceed the number of unemployed individuals, a contrast to the post-GFC period. Seasonal factors have also disrupted recent labor data. If you isolate the cyclical components of unemployment,3 they remain below the historical average, although admittedly, we have seen a modest upward trend here as well.” The ghost then pointed to Figure 3 and said, “When the US entered recessions past, unemployment claims data spiked higher, and we haven’t seen that yet.”

Figure 3: Initial Unemployment Claims Remain Near Historical Lows

After considering the figure, Ebin turned toward the spirit, prepared to counter that claims are typically a lagging indicator, but the ghost was gone. Lifting up his eyes, Ebin beheld a solemn phantom, draped and hooded, approaching like a mist along the ground.

The phantom was silent, but his countenance suggested it had said, “in the long run we are all dead” one too many times during its life. And Ebin knew that he was in the presence of the Ghost of Policy Yet to Come.

Gathering his wits, Ebin boldly asked, “I know stock markets have rallied in anticipation of favorable economic stewardship during President-elect Trump’s second term, but what about tariffs, what about geopolitical uncertainty, what about fiscal deficits?” The spirit dug through its robe pockets, retrieved a magic eight ball, gave it a shake, and pointed to the answer. Ebin read, “ask again later.” The ghost bestowed upon Ebin a tome, directing him to study the past, and dissipated into a smart phone.

Recognizing the phone as his own, Ebin felt a surge of enthusiasm. “You’re right,” he typed out, reflecting on how the evening began. “The US economy may just be in better shape than I had thought,” and clicked send. But in his sober-minded heart of hearts, he felt he was right to be concerned about downside risks, and followed up with, “But there’s still a bit of humbug!”

1Yes, it’s another retelling of “A Christmas Carol”. And no, there is no Ebin, only Ebenezer (Scrooge, that is).

2As do most of this author’s friends and relatives. Particularly when I break out the charts and graphs!

3Measured by the rate of job losers not on temporary layoff as a percent of the labor force.

This material is intended for Professional Investors only. All investments involve risk, including the possible loss of capital. Past performance is not a guarantee or a reliable indicator of future results.

PGIM Quantitative Solutions LLC (PGIM Quantitative Solutions or PGIM Quant) is an SEC-registered investment adviser and a wholly-owned subsidiary of PGIM, Inc. (PGIM) the principal asset management business of Prudential Financial, Inc. (PFI) of the United States of America. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc, which is headquartered in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom.

The comments, opinions and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Quantitative Solutions believes to be reliable. We do not guarantee the accuracy of such sources of information and have no obligation to provide updates or changes to these materials. This material is for informational purposes and sets forth our views as of the date of this presentation. The underlying assumptions and our views are subject to change.

These materials are neither intended as investment advice nor an offer or solicitation with respect to the purchase or sale of any security or financial instrument. These materials are not intended to be an offer with respect to the provision of investment management services. The opinions expressed herein do not take into account individual client circumstances, objectives, or needs and are therefore not intended to serve as investment recommendations. No determination has been made regarding the suitability of particular strategies to particular clients or prospects. The financial indices referenced herein is provided for informational purposes only. You cannot invest directly in an index. The statistical data regarding such indices has been obtained from sources believed to be reliable but has not been independently verified.

Certain information contained herein may constitute “forward-looking statements,” (including observations about markets and industry and regulatory trends as of the original date of this document). Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making any decisions. No representation or warranty is made as to future performance or such forward-looking statements.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V. with registered office: Eduard van Beinumstraat 6 1077CZ, Amsterdam, The Netherlands. PGIM Netherlands B.V. is authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands (Registration number 15003620) and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). PGIM Quantitative Solutions LLC, PGIM Limited and/or PGIM Netherlands B.V. are indirect, wholly-owned subsidiaries of PGIM, Inc. (“PGIM”).

In Australia, these materials are distributed by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the Financial Conduct Authority (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. PGIM Limited’s registered office is Grand Buildings, 1-3 The Strand, Trafalgar Square, London, WC2N 5HR.

In Switzerland, information issued by PGIM Limited, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland.

In Canada, PGIM Quantitative Solutions LLC relies upon the “International Advisor Exemption” pursuant to National Instrument 31-103 in certain provinces of Canada.

In Singapore, information is issued by PGIM (Singapore) Pte. Ltd. (“PGIM Singapore”), a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. This material is issued by PGIM Singapore for the general information of “institutional investors” pursuant to Section 304 of the Securities and Futures Act 2001 of Singapore (the “SFA”) and “accredited investors” and other relevant persons in accordance with the conditions specified in Section 305 of the SFA.

In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571).

In Japan, the investment management capabilities and services described in the attached materials are offered by PGIM Japan Co., Ltd (PGIMJ), a Japanese registered investment adviser (Director-General of the Kanto Local Finance Bureau (FIBO) No. 392). Retention of PGIMJ for the actual provision of such investment advisory services may only be affected pursuant to the terms of an investment management contract executed directly between PGIMJ and the party desiring such services, it is anticipated that PGIMJ would delegate certain investment management services to its US-registered investment advisory affiliate.

In Korea, PGIM Quantitative Solutions LLC holds cross-border discretionary investment management and investment advisory licenses under the Korea Financial Investment Services and Capital Markets Act (“FSCMA”), and is registered in such capacities with the Financial Services Commission of Korea. These materials are intended solely for Qualified Professional Investors as defined under the FSCMA and should not be given or shown to any other persons.

These materials are not intended for distribution to, or use by, any person in any jurisdiction where such distribution would be contrary to local or international law or regulation. The views and opinions herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients or prospects. No determination has been made regarding the appropriateness of any securities, financial instruments or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions.

Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes and political and economic uncertainties. Emerging and developing market investments may be especially volatile. Investments in securities of growth companies may be especially volatile. Due to the recent global economic crisis that caused financial difficulties for many European Union countries, Eurozone investments may be subject to volatility and liquidity issues. Value investing involves the risk that undervalued securities may not appreciate as anticipated. Small and mid-sized company stock is typically more volatile than that of larger, more established businesses, as these stocks tend to be more sensitive to changes in earnings expectations and tend to have lower trading volumes than large-cap securities, creating potential for more erratic price movements. It may take a substantial period of time to realize a gain on an investment in a small or mid-sized company, if any gain is realized at all. Diversification does not guarantee profit or protect against loss. Emerging markets are countries that are beginning to emerge with increased consumer potential driven by rapid industrial expansion and economic growth. Investing in emerging markets is very risky due to the additional political, economic and currency risks associated with these underdeveloped geographic areas. Fixed-income investments are subject to interest rate risk, and their value will decline as interest rates rise. Unlike other investment vehicles, U.S. government securities and U.S. Treasury bills are backed by the full faith and credit of the U.S. government, are less volatile than equity investments, and provide a guaranteed return of principal at maturity. Treasury Inflation-Protected Securities (TIPS) are inflation-index bonds that may experience greater losses than other fixed income securities with similar durations and are more likely to cause fluctuations in a Portfolio’s income distribution. Investing in real estate poses risks related to an individual property, credit risk and interest rate fluctuations. High yield bonds, commonly known as junk bonds, are subject to a high level of credit and market risks. Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate and when sold may be worth more or less than the original cost.

PGIM Quantitative Solutions affiliates may develop and publish research that is independent of, and different than, the views and opinions contained herein. PGIM Quantitative Solutions personnel other than the author(s), such as sales, marketing and trading personnel, may provide oral or written market commentary or ideas to PGIM Quantitative Solutions’ clients or prospects or proprietary investment ideas that differ from the views expressed herein. Additional information regarding actual and potential conflicts of interest is available in PGIM Quantitative Solutions’ Form ADV Part 2A. Asset allocation is a method of diversification that positions assets among major investment categories. Asset allocation can be used to manage investment risk and potentially enhance returns. However, use of asset allocation does not guarantee a profit or protect against a loss.

© 2025 PGIM Quantitative Solutions. All rights reserved. PGIM, PGIM Quantitative Solutions, the PGIM Quantitative Solutions logo and the Rock design are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

Collapse Section