With bond yields at a two-decade peak, income-seeking investors can find compelling opportunities in high yield bonds. These bonds may help protect against rising interest rates and potentially deliver returns that are competitive with other yield-oriented investments.

Equity-Like Returns With Less Risk

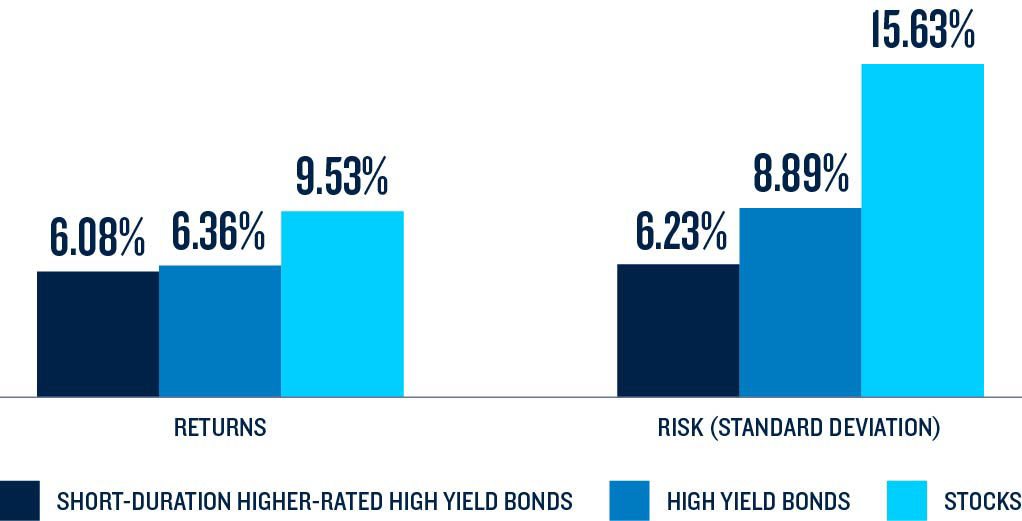

High yield bonds have provided 68% of the U.S. stock market’s return with only 57% of the volatility. For investors who prefer less risk, short-duration higher-rated high yield bonds (i.e., the higher-rated segment of the high yield market) have provided 64% of the return of U.S. stocks with just 40% of the volatility.

Standard deviation is the statistical measurement of dispersion that measures how widely a stock’s or portfolio’s returns varied over a certain period of time. S&P 500 Index is an unmanaged index of 500 stocks of large U.S. companies. It gives a broader look at how U.S. stock prices have performed. Bloomberg U.S. Corporate High Yield Index measures the market of U.S.-dollar-denominated, non-investment-grade, fixed rate, taxable corporate bonds. Please note that the indexes used in these illustrations are unmanaged. Investors cannot invest directly in an index or average.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Bloomberg U.S. Corporate High Yield 1% Issuers Capped Index is an unmanaged, issuer-constrained version of the U.S. Corporate High Yield Index that covers the U.S. dollar dominated, non-investment grade, fixed-rate, taxable corporate bond market. It follows the same construction rules as the uncapped index, but limits issuer exposure to a maximum 1% and redistributes the excess market value index-wide on a pro-rata basis. An investment cannot be made directly into an index.

Higher-rated high yield bonds are below investment grade, are commonly referred to as “junk bonds,” and are considered speculative. Such bonds are rated Ba, B by Moody’s Investors Service, Inc.; BB, B by Standard & Poor’s Ratings Services or Fitch, Inc.; or comparably rated by another nationally recognized statistical rating organization (NRSRO).

Investing involves risk. Some investments are riskier than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. Fixed income investments are subject to interest rate risk, and their value will decline as interest rates rise.

Consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. The prospectus and summary prospectus contain this and other information about the fund. Contact the PGIM Investments Sales Desk at (800) 396-5501 to obtain the prospectus and summary prospectus. Read them carefully before investing.

Investment products are distributed by Prudential Investment Management Services LLC (PIMS), member FINRA and SIPC. PGIM Investments is a registered investment adviser and investment manager to all PGIM US open-end investment companies. PGIM Fixed Income is a unit of PGIM, a registered investment adviser. All are Prudential Financial affiliates.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

Investment products are not insured by the FDIC or any federal government agency, may lose value, and are not a deposit of or guaranteed by any bank or any bank affiliate.

For financial professional use only. Not for use with the public.

© 2026 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments, PGIM Fixed Income and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.