The U.S. securitised products sector is undergoing transformation, blurring the lines between traditional banking and structured finance. As financial institutions increasingly integrate public and private credit, the sector is also expanding beyond domestic U.S. borders, with a notable rise in cross-border transactions. At the same time, more immediate concerns such as valuations, consumer health, AI-related investments, and tariffs are shaping market participants’ discussions across the sector's various asset classes. Explore these dynamics and what they mean for the future of securitisation.

Key Takeaways

- Valuations were a key theme, with general agreement among participants that spreads are tight across the entire sector.

- A strong desire to source opportunities, particularly in private, asset-based finance (ABF) style of transactions remains.

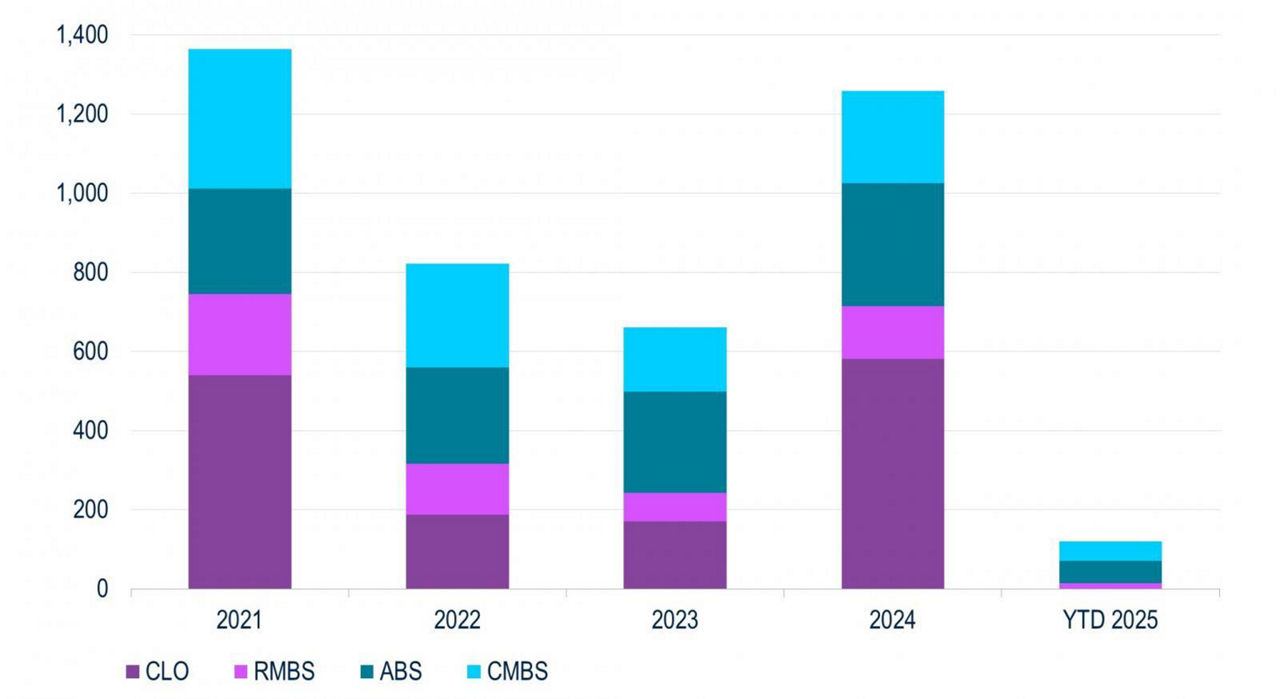

- Issuance is also expected to continue at a strong pace across all sectors (Figure 1).

- In addition to supply and ABF opportunities, some significant credit trends were also discussed as consumer credit performance remains challenged in ABS, while CLO managers described navigating tariffs and other government policy initiatives.

Figure 1

Issuance Expected to Remain Strong Across All Sectors ($bn)

CLOs: Selectivity Is Key With Historic Issuance

The CLO market is contending with historic levels of issuance, and the industry is focused on operational challenges at this level of issuance.

Managers remain focused on asset sourcing, which has proved challenging. Until M&A and LBO activity picks up, leveraged loan supply is expected to come from dividend recapitalizations and refinancings of private credit deals.

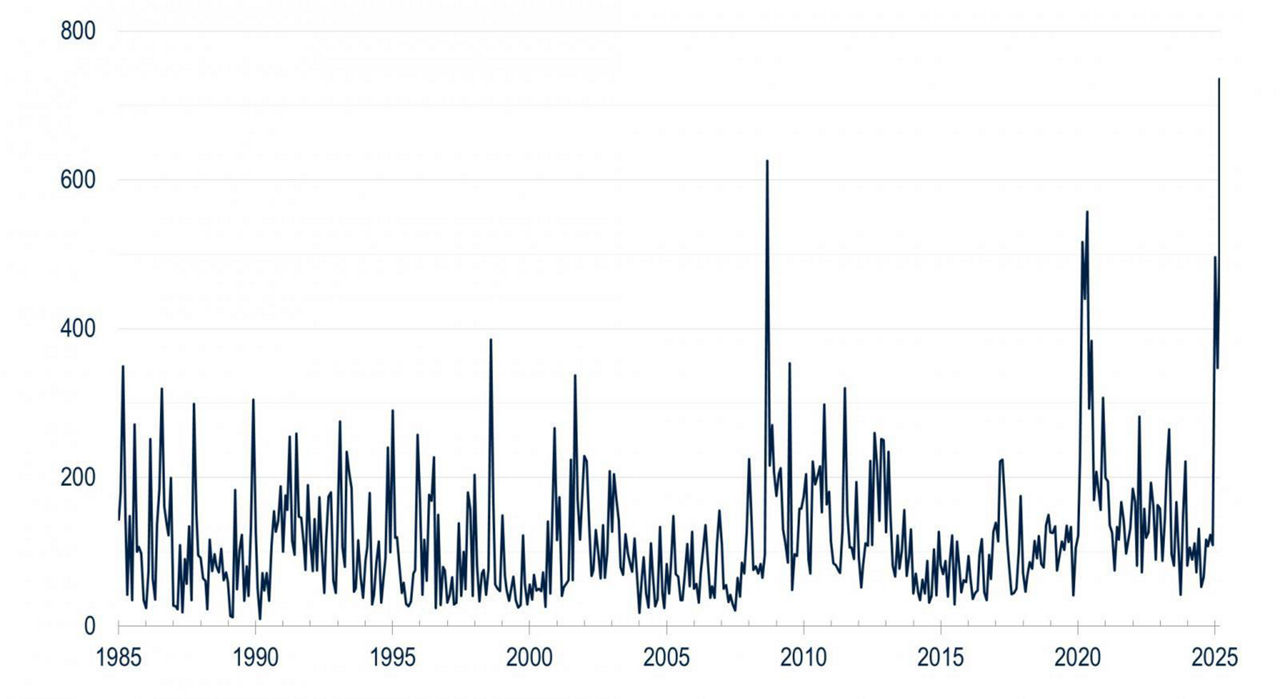

With economic policy uncertainty ratcheting higher (Fig 2), managers are scrutinising portfolios to identify and reduce exposure to issuers exposed to tariff and government efficiency risks. Industries most exposed to tariffs are not typically large allocations in CLOs.

Figure 2

U.S. Policy Uncertainty Continues to Rise

CMBS: Data Centres Take Centre Stage

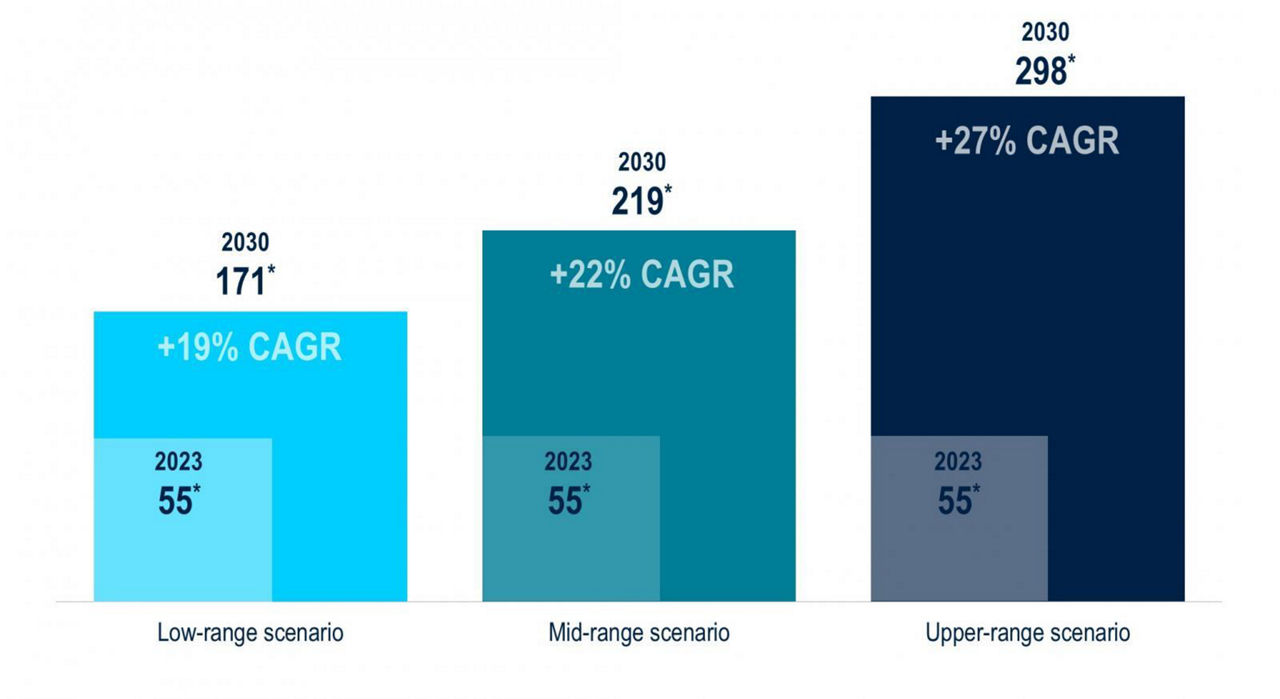

Despite the recent headlines around DeepSeek and Microsoft’s lease cancellations, sentiment around data centre fundamentals remains positive (Fig 3). Regarding DeepSeek’s impact, most market participants expressed the view that the increased cost efficiency will lead to greater demand. Power continues to be the principal constraining factor on new supply, with several operators considering on-site generation as a bridge solution.

Capital and financing needs in the sector continue to grow. Operators have utilised a variety of financing structures including ABS, CMBS, project finance, commercial property assessed clean energy (C-PACE), and private syndications to date. With the recent widening in CMBS data center deals, ABS execution has gotten far more favourable.

ABS: Lending Stays Competitive

Consumer credit performance is still challenged, with no clear driver for improvement. Most originators discussed tightening their “credit box” to cure underperformance from 2022 and 2023 originations.

Issuance is likely to remain strong (Fig 3), with expectations of a steady supply of private opportunities from operators seeking funding diversification. Other operators are looking to expand traditional ABS issuance to complement early-stage private financings and warehouses.

Figure 3

Global demand for data center capacity expected to rise sharply (gigawatts)*

Bank card yields remain relatively high and challengers are looking to chip away at the profitable $1 trillion market. Even a small pullback from banks would create a sizeable opportunity. However, the buy now, pay later (BNPL) lenders will challenge banks for the same customer's business.

Banks are increasingly competing with investors for lending opportunities (e.g., fleet, whole business securitisation, equipment, aircraft), and this could compress spreads and limit available supply.

The commercial/corporate sector is not experiencing any specific weakness by industry type and lenders are avoiding the lowest-quality credits within industries.

Commercial/corporate origination volumes by issuers have generally seen steady growth and performance has not deteriorated except for select captive finance equipment issuers with farm economy exposure.

RMBS: Mortgages Hold Up

Insurance companies’ interest in mortgage credit is especially evident in residential mortgage whole loans.

Mortgage credit investors are monitoring the rise in non-qualified mortgage (QM) delinquencies, which are mostly stemming from the lower FICO and cash-out refi cohorts. However, these are not resulting in material losses due to low loan-to-value ratios and a strong housing market.

-

Weekly View from the DeskPGIM shares their weekly views and outlook for fixed income markets.

Read More

-

Market Swings Reveal Opportunity in Municipal BondsPGIM Fixed Income’s Head of Municipal Bond Research, Sean McCarthy, shares insights on the economy, fiscal policy, and opportunities in municipal bond markets

Read More

For Financial Professional Use Only. Not for use with the public.

All investments involve risk, including the possible loss of capital. Past performance is not a guarantee or reliable indicator of future results. Source: PGIM Fixed Income. The information represents the views and opinions of the author, is for information purposes only, and is subject to change. The information does not constitute investment advice and should not be used as the basis for an investment decision.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

Fixed income instruments are subject to credit, market, and interest rate. Emerging market investments are subject to greater volatility and price declines.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

Prudential Investment Management Services LLC is a Prudential Financial company and member FINRA and SIPC. PGIM is a registered investment advisor and Prudential Financial company. PGIM Fixed Income is a units of PGIM.

© 2025 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.