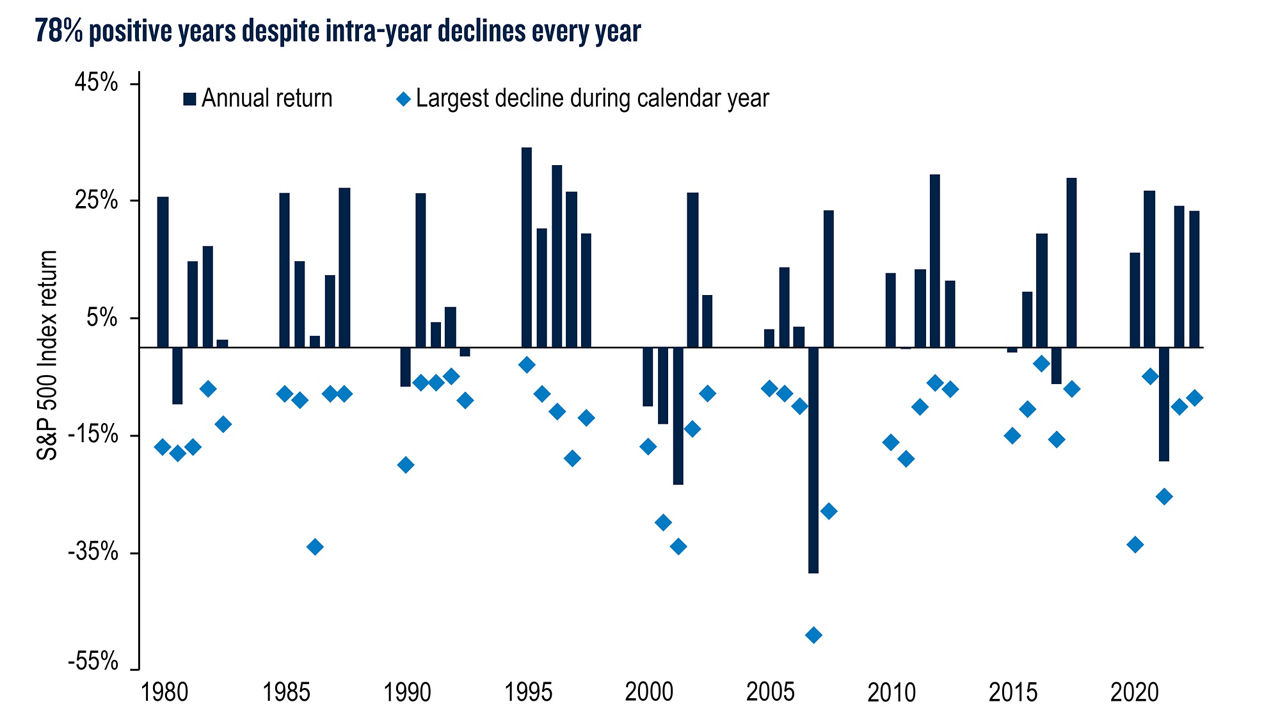

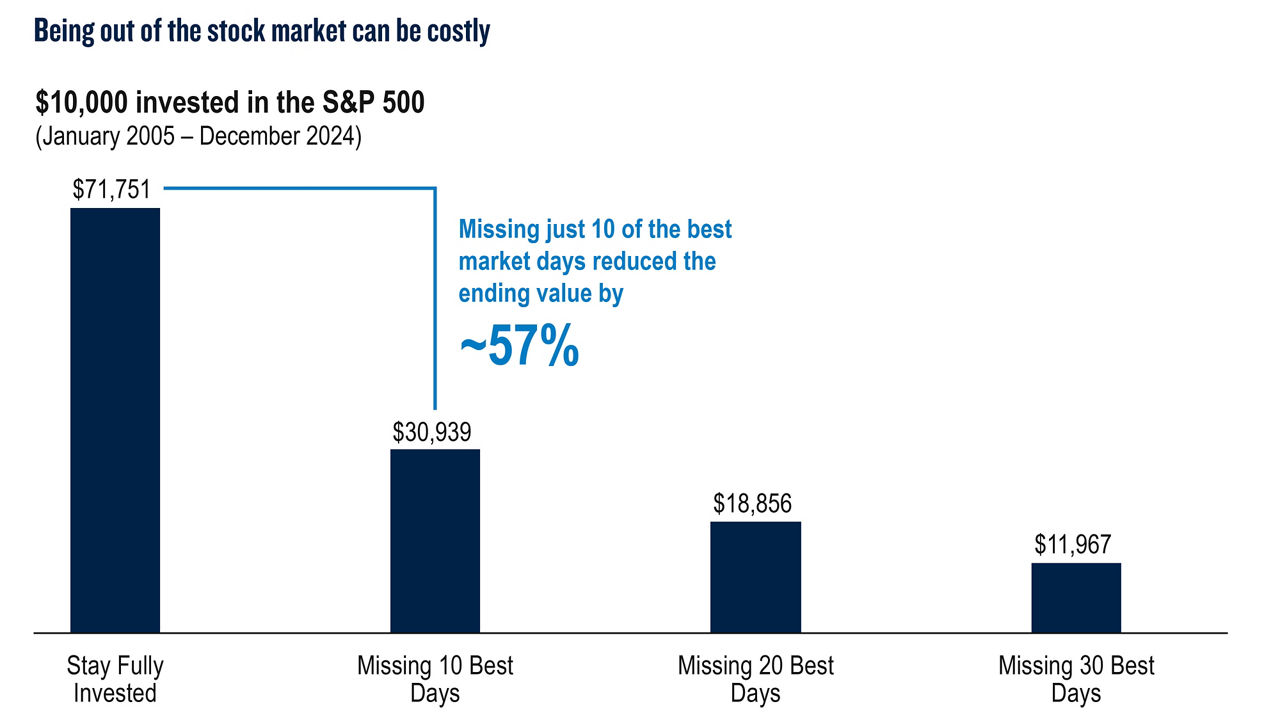

Recent market volatility serves as a clear reminder of how unpredictable markets can be. While the future remains uncertain, adopting smart, long-term investing strategies can help investors stay focused and avoid impulsive decisions during turbulent times. Despite the temptation to sell during downturns, history consistently shows that markets tend to recover and reward patience.

Two Strategies For Navigating Volatile Markets

PGIM BUFFER ETF FUNDS RISKS

The Funds invest in FLEX Options, which subjects the Funds to the risks of losing their premium paid for the option or that the price of the underlying reference asset drops significantly below the exercise prices and the Funds’ loses are substantial. FLEX Options are also subject to the risk that they may be less liquid than other securities, including standardized options. FLEX Options are subject to trading risks and valuation risks because they are market traded and centrally cleared by the OCC. The Funds are designed to deliver returns that approximate the Underlying ETF if Fund shares are bought on the first day of a Target Outcome Period and held until the end of the Target Outcome Period, subject to the buffer and the cap. If an investor purchases Fund shares after the first day of a Target Outcome Period or sells shares prior to the expiration of the Target Outcome Period, the returns realized by the investor will not match those that the Funds seek to provide.

The Funds are subject to buffered loss risk in which there can be no guarantee that the Funds will be successful in their strategy to provide downside protection against Underlying ETF losses; cap change risk in which the cap may rise or fall from one Target Outcome Period to the next and is unlikely to remain the same for consecutive Target Outcome Periods; and capped upside risk where the Funds will not participate in gains in the Underlying ETF beyond the cap. The PGIM S&P 500 Max Buffer ETFs may have a buffer significantly below 100% in certain Target Outcome Periods. The Funds are subject to Underlying ETF risk in which the value of an investment in the Fund will be related to the investment performance of the Underlying ETF. Therefore, the principal risks of investing in the Funds are closely related to the principal risks associated with the Underlying ETF. As ETFs, the Funds are subject to risks involved with: ETF shares trading risk (including the risk of the shares trading at a premium or discount to net asset value or the lack an active trading market); authorized participant concentration risk; and the risk of transacting in cash versus in-kind. The PGIM Nasdaq-100 Buffer ETFs are subject to Technology Sector Risk in that the Underlying ETF's assets may be concentrated in the technology sector and may be more affected by the performance of the technology sector than a fund that is less concentrated.

As new and relatively small funds with limited operating history, the Funds are subject to the risk that their performance might not represent how they may perform long term and investments may have disproportionate impact on performance. The Funds will be indirectly exposed to equity and equity-related securities, where the value of a particular security could go down resulting in a loss of money; large capitalization companies which may go in and out of favor based on market and economic conditions; and derivative securities, which may carry market, credit, and liquidity risks. Derivatives are subject to counterparty risk, which is the risk that the other party in the transaction will be unable or unwilling to fulfill its contractual obligation, and the related risks of having concentrated exposure to such a counterparty.

The Funds are subject to management risk in which the subadviser will apply investment techniques and risk analyses in making

investment decisions for the Funds, but the subadviser’s judgments about the attractiveness, value or market trends affecting a particular security, industry or sector or about market movements may be incorrect and liquidity risk in which the Funds may invest in instruments that trade in lower volumes and are more illiquid than other investments. Certain transactions in which the Funds may engage may give rise to leverage which could result in increased volatility of investment return.

The Funds intend to qualify as regulated investment companies (“RICs”) under Subchapter M of the U.S. Internal Revenue Code of 1986,

as amended (the “Code”); however, the federal income tax treatment of certain aspects of the proposed operations of the Funds are not clear, including the tax aspects of the Funds’ options strategy (including the distribution of options as part of the Fund’s in-kind redemptions), the possible application of the “straddle” rules, and various loss limitation provisions of the Code.

The Funds are subject to market risks, including economic risks, as well as market disruption and geopolitical risks (the value of investments may decrease, and international conflicts and geopolitical developments may adversely affect the U.S. and foreign financial markets, including increased volatility). The Funds are nondiversified for purposes of the 1940 Act. Investing in a nondiversified fund involves greater risk than investing in a diversified fund because a loss resulting from the decline in value of any one security may represent a greater portion of the total assets of a nondiversified fund. Large shareholders could subject the Funds to large scale redemption risk. These risks may increase the Funds’ share price volatility. The risks associated with the Funds are more fully explained in the Funds’ prospectuses and summary prospectuses. There is no guarantee the Funds’ objective will be achieved.

PGIM LADDERED FUND RISKS

The Funds are “funds of funds” and are subject to ETF risks, SPY risks (for the PGIM Laddered S&P 500 Buffer ETFs) and QQQ risks (for the PGIM Laddered Nasdaq-100 Buffer ETFs), in that the value of investments in the Funds will be related to the investment performance of the Underlying ETFs and, in turn, SPY or QQQ, as applicable. Therefore, the principal risks of investing in the Funds are closely related to the principal risks associated with the Underlying ETFs and their investments. Exposure to the Underlying ETFs will also expose the Funds to a pro rata portion of the Underlying ETFs’ fees and expenses. The fluctuating value of the FLEX Options will affect the Underlying ETFs’ value and, in turn, the Funds’ values. The Funds intends to generally rebalance their portfolio to equal weight (i.e.,81⁄3% per Underlying ETF for the PGIM Laddered S&P 500 Buffer ETFs, and 25% per Underlying ETF for the PGIM Laddered Nasdaq-100 Buffer ETFs) quarterly, in connection with the reset of the cap of each Underlying ETF. In between such rebalances, market movements in the prices of the Underlying ETFs may result in the Funds having temporary larger exposures to certain Underlying ETFs compared to others. Exposure to the Underlying ETFs will also expose the Funds to a pro rata portion of the Underlying ETFs’ fees and expenses.

The Underlying ETFs invest in FLEX Options and to the extent that the Underlying ETF writes or sells an option, if the decline or increase in the underlying assets is significantly below or above the exercise prices of the written options, the Underlying ETFs and, in turn, the Funds could experience a substantial or unlimited loss. FLEX Options are also subject to the risk that they may be less liquid than other securities, including standardized options, as well as trading risks as they are required to be centrally cleared and valuation risks.

The Funds’ risk include, but are not limited to, target outcome period risk, where in the event the Funds acquire shares of Underlying ETFs after the first day of a Target Outcome Period or disposes of shares prior to the expiration of the Target Outcome Periods, the value of the Funds’ investment in Underlying ETF shares may not be buffered against a decline in the value of SPY or QQQ, as applicable, and may not participate in a gain in the value of SPY or QQQ, as applicable, for the Funds’ investment period; buffered loss risk, in which there can be no guarantee that the Underlying ETFs will be successful in their strategy to provide downside protection against losses; cap change risk, in which new caps for the Underlying ETFs are established at the beginning of each Target Outcome Period and are dependent on prevailing market conditions and are unlikely to remain the same for consecutive Target Outcome Periods; and capped upside risk, in that since the Funds will acquire shares of the Underlying ETFs in connection with creations of new shares of the Funds and during each quarterly rebalance, the Funds typically will not acquire Underlying ETF shares on the first day of a Target Outcome Period. In the event that the Funds acquire Underlying ETF shares after the first day of a Target Outcome Periods and the Underlying ETFs have risen in value to a level near or at the cap there may be little or no ability for the Funds to experience an investment gain on those Underlying ETF shares; however, the Funds will remain vulnerable to downside risks. The PGIM Laddered Nasdaq-100 Buffer ETFs are subject to Technology Sector Risk in that the Underlying ETF's assets may be concentrated in the technology sector and may be more affected by the performance of the technology sector than a fund that is less concentrated.

As actively managed exchange traded funds (ETFs), the Funds are subject to risks involved with: ETF shares trading risk (including the risk of the shares trading at a premium or discount to net asset value or the lack an active trading market); authorized participant concentration risk; and the risk of transacting in cash versus in-kind. The Funds are subject to market risks, including economic risks, as well as market disruption and geopolitical risks (the value of investments may decrease, and international conflicts and geopolitical developments may adversely affect the U.S. and foreign financial markets, including increased volatility); and portfolio turnover risk, in that the Funds’ turnover rate may be higher than that of other ETFs which may involve expenses and lead to the realization of capital gains.

As new and relatively small funds, the Funds’ performance may not represent how the Funds are expected to or may perform in the long-term. Large shareholders could subject the Fund to large scale redemption risk. Your actual cost of investing in the Funds may be higher than the expenses shown in the expense table for a variety of reasons. There is no guarantee the Funds’ objective will be achieved. The risks associated with the Funds are more fully explained in the Funds’ prospectus and summary prospectus.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. The Funds are designed to deliver returns that approximate the underlying asset if Fund shares are bought on the first day of a Target Outcome Period and held until the end of the Target Outcome Period, subject to the buffer and the cap. If an investor purchases Fund shares after the first day of a Target Outcome Period or sells shares prior to the expiration of the Target Outcome Period, the returns realized by the investor will not match those that the Fund seeks to provide.

Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their net asset value (NAV), and are not individually redeemed from a Fund. Shares may only be redeemed directly from the Funds by Authorized Participants in creation units only. You may incur brokerage commissions when buying and selling shares on an exchange or through your financial intermediary, which may reduce returns. Market returns are based upon the closing price or the midpoint of the bid/ask spread, as applicable, at the time when the Fund’s NAV is determined (normally 4:00 P.M. Eastern time), and do not represent the returns you would receive if you traded shares at other times. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress. Fixed income investments will change in value based on changes in interest rates, and their value generally will decline as interest rates rise; Diversification does not assure a profit or protect against loss in declining markets. These risks may increase a Fund’s share price volatility. There is no guarantee a Fund’s objective will be achieved. The risks associated with the Funds are more fully explained in each Fund’s prospectus and summary prospectus.

NAV prices are used to calculate market price performance prior to the date when the fund first traded on its listing exchange. Market price performance is determined using the close at 4:00 P.M. Eastern time, when the NAV is typically calculated. Since shares of each Fund did not trade in the secondary market until after the Fund inception, for the period from inception to the first day of secondary trading, the NAV of the Fund is used as a proxy for the market price to calculate market returns. Closing Market Price is determined using the midpoint between the highest bid and the lowest offer reported to the consolidated tape, as of the time that the Fund NAV is calculated. In the event this is not available, the midpoint between the highest bid and the lowest offer on the listing exchange is used. NAV Price (Net Asset Value) is total assets less total liabilities divided by the number of shares outstanding. Bid/Ask Spread is the amount by which the ask price exceeds the bid price for an asset in the market. The Bid/Ask Spread is essentially the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept to sell it. Premium/Discount is the percent difference between the Market price and the NAV price. There is no guarantee you will receive the stated Premium/Discount and additional fees may result from individual broker fees and transaction costs in the secondary market. Each Fund is subject to management fees and other expenses. The trading prices of a Fund’s shares in the secondary market generally differ from the Fund’s daily NAV and are affected by market forces such as supply and demand, economic conditions and other factors. Information regarding the indicative intraday value of shares of the Fund, also known as “iNAV,” is disseminated every 15 seconds throughout the trading day by the national securities exchange on NYSE Arca or by market data vendors or other information providers. The iNAV is based on the sum of the current value of the Fund’s portfolio holdings that were publicly disclosed prior to the commencement of trading that day and may not reflect Fund expenses or other components used to determine the Fund’s current NAV. Therefore, the iNAV should not be viewed as a “real-time” update of the Fund’s NAV, which is computed only once a day. The Fund is not responsible for the calculation or dissemination of the iNAV and makes no representation or warranty as to the accuracy of the iNAV.

Source: NYSE, Bank of New York Mellon, Lipper, Inc., and PGIM, Inc (PGIM). PGIM is a Prudential Financial company. All returns assume share price changes as well as the compounding effect of reinvested dividends and capital gains. Returns may reflect fee waivers and/or expense reimbursements. Without such, returns would be lower. All returns 1-year or less are cumulative.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

Consider a fund's investment objectives, risks, charges, and expenses carefully before investing. The prospectus and summary prospectus contain this and other information about the fund. Contact your financial professional for a prospectus and summary prospectus. Read them carefully before investing.

Investment products are distributed by Prudential Investment Management Services LLC, member FINRA and SIPC. PGIM Investments is a registered investment adviser and investment manager to all PGIM U.S. open-end investment companies. PGIM Quantitative Solutions is a registered investment advisor. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. PGIM Quantitative Solutions, PGIM, PGIM Investments, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

Investment Products: Are not insured by the FDIC or any other federal government agency, may lose value, and are not a deposit of or guaranteed by any bank or any bank affiliate.

PGIM CUSTOM HARVEST DISCLOSURE

*PGIM Investments acquired Green Harvest Asset Management (now known as PGIM Custom Harvest) in December 2021.

PGIM Custom Harvest does not provide tax, legal, or accounting advice. This material is for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Although PGIM Custom Harvest does not provide tax, legal, or accounting advice, we stand ready to assist clients and their advisors in reviewing the relevant tax rules.

SMAs differ from pooled vehicles like mutual funds in that each portfolio is unique to a single account therefore the investment decisions may vary from those made for other accounts. SMAs do not issue registered prospectuses, and the fee structures differ from those normally seen in mutual funds and generally carry higher account investment minimums. Please remember that there are inherent risks involved with investing in the markets, and investments may be worth more or less than initial investment upon redemption. There is no guarantee that the investment managers' objectives will be achieved. Professional money management is not suitable for all investors.

Investment objectives, risk tolerance, and liquidity needs must be reviewed before suitable programs can be recommended. Asset allocation and diversification strategies do not assure a profit or protect against loss in declining markets. Investors should consult with their attorney, accountant, and/or tax professional for advice concerning their particular situation.

PGIM Custom Harvest is a registered investment adviser and a Prudential Financial company. © 2025 Prudential Financial, Inc. and its related entities. PGIM Custom Harvest, PGIM Investments, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

MANAGED ACCOUNTS: Are not insured by the FDIC or any other federal government agency, may lose value, and are not a deposit of or guaranteed by any bank or any bank affiliate.

© 2026 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.