Macroeconomics

ThreefortheECB:ScenariosHighlightingEurope’sPolicyChallenges

5 mins

Although the ECB recently pulled off what amounts to a dovish reduction in the pace of its pandemic related asset purchases, it is entering a critical phase of charting its course in 2022 and beyond.

Three Scenarios

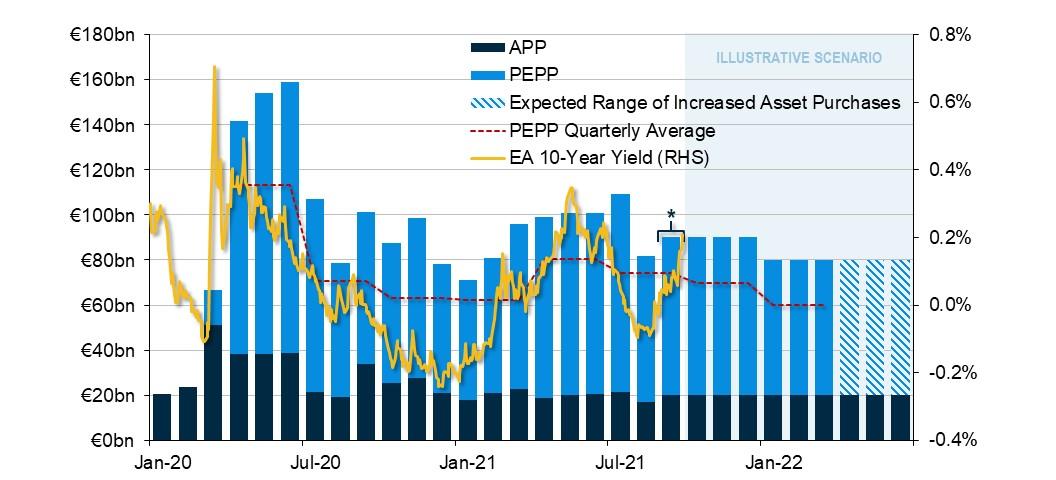

One of the ECB’s key policy tools introduced during the depths of the virus-related downturn—the Pandemic Emergency Purchase Programme—is scheduled to conclude at the end of March 2022. The looming cliff-edge in purchases from around €80 billion per month to €20 billion per month in Q2 next year (if policy is left unchanged) places the ECB on the precipice of three potential scenarios as we look ahead (Figure 1).

Figure 1

Illustrative ECB Monthly Asset Purchases and Euro Area GDP-Weighted 10-year Yields

PGIM Fixed Income and ECB. *September PEPP purchases assumed to be €70 billion.

Scenario 1: Muddling Through

A scenario where the Governing Council reverts to type and chooses a policy path that delivers “too little, too late” exists as a tangible risk. It’s a potential situation where action is sufficient to avoid excessive market volatility, but insufficient to achieve the ECB’s new 2% symmetric inflation target. Such an outcome could return the economy to the weak growth and below-target inflation that existed in the decade prior to the pandemic. In such a scenario, we would expect long-term rates to rise further from their current level, particularly in Germany, for example, and a stronger EUR/USD exchange rate relative to Scenario 3.

Scenario 2: Communications Misstep

A communications misstep is conceivable considering the nuances involved in Europe’s monetary policy and the precision the ECB will need to accurately convey its policy intent. A miscommunication could lead to a European “Taper Tantrum” in terms of mistakenly signalling policy tightening sooner than intended. The difficult policy choices coupled with the Governing Council’s previous lack of consensus have market participants alert to any hints of insufficient accommodation. Furthermore, the introduction of uncertainty complicates decisions for households and businesses, while signs of hesitation from the ECB could ironically require even greater intervention to achieve its goals. Such a scenario could repeat the events of early March 2020 when the Governing Council initially announced a relatively modest intervention in the early days of the pandemic, which was followed by severe market dislocation and the subsequent launch of the PEPP.

Scenario 3: Do the Right Thing

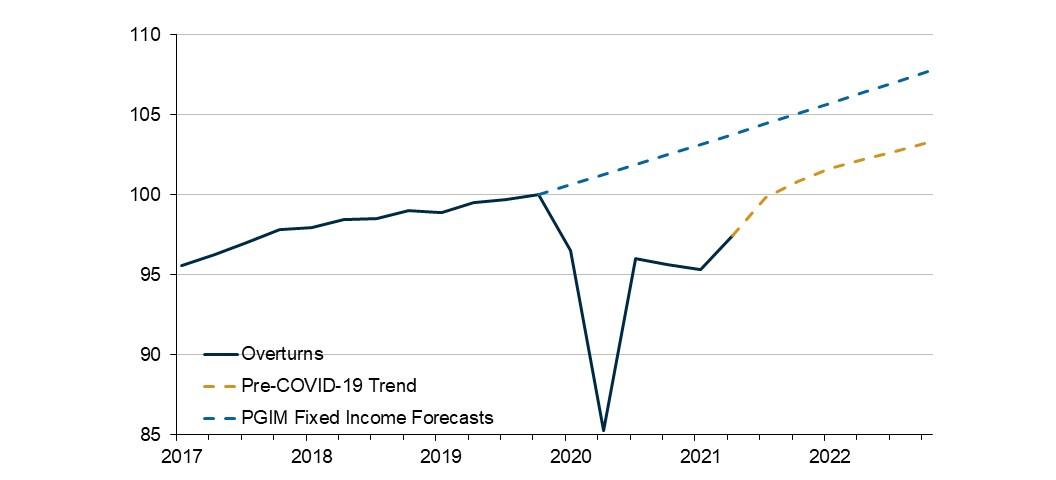

Our base expectation is that the ECB will increase its asset purchases beyond the end of March to the top of the possible outcomes as illustrated by the shaded dark blue bars in Figure 1. It could do this by announcing an envelope of around €500-750 billion to be purchased as needed over successive quarters. This would give the ECB real-time discretion to ensure the continuation of favourable financing conditions. Consensus could be achieved by extending the PEPP for several quarters, considering that medium-term inflation expectations remain well below target and GDP remains well below its pre-pandemic trend (Figure 2). Furthermore, the continuing global impact of the virus on an open economic region such as the Euro area serves as another reminder that the pandemic is not over. A specified extension of the PEPP could appeal to the hawks as it would be time constrained, and it could satisfy the doves by extending the exceptional support that they believe additional, significant QE provides.

Figure 2

EA GDP Set to Linger Below its Pre-Pandemic Trend (Index, 2019Q4=100

PGIM Fixed Income and Haver Analytics.

In such a scenario, we would expect another leg in the reflation trade, rates to remain lower for longer, periphery spreads to tighten towards their pre-2008 levels, and EUR/USD weakness to continue. If the ECB can clearly communicate a willingness to stand by its robust policy stimulus and commit—with a near-unanimous decision—to achieve its new inflation target, medium-term inflation expectations could return to target more quickly than expected, perhaps as soon as 2023. Such an outcome, if achieved, would represent a successful regime change under ECB President Lagarde.

Three Reasons for the Base Case

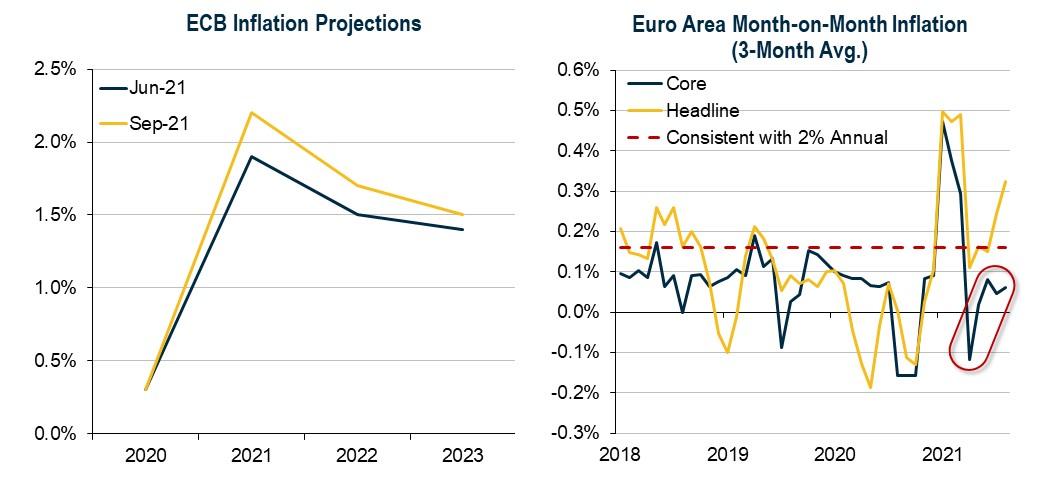

Euro area fundamentals require more accommodation. The ECB’s own macro projections fail to warrant a cliff-edge reduction in QE. It expects growth to ease in 2022 and medium-term inflation to remain well below its new 2% symmetric inflation target. Recent data support that outlook as underlying inflation outturns, such as month-on-month changes in core inflation, also remain subdued and well below levels consistent with the ECB’s new target (Figure 3).

Figure 3

Either Way You Look at It—Inflation Remains Below the ECB’s New Target

PGIM Fixed Income, ECB, and Haver Analytics.

It’s consistent with the new framework. Moreover, such a marked reduction in the pace of asset purchases would be at odds with the ECB’s recently updated framework review, which includes an explicit acknowledgement that monetary policy is constrained when policy rates are close to zero or negative—as is currently the case in the euro area. As such, policy needs to be especially forceful or long lasting. The symmetric 2% target suggests the Governing Council will tolerate—if not target—an inflation overshoot, which it implied in July by stating that inflation would need to reach 2% “well ahead” of the end of its projection horizon and tying the guidance to realised progress in underlying inflation. With neither condition having been met, an imminent tightening in financial conditions so soon after its framework reset would pose a significant risk to the ECB’s credibility. Worse still, it could run counter to the ECB’s surprisingly robust action since the start of the pandemic. Indeed, medium-term inflation expectations have risen for seven consecutive months—the longest such increase in far more than a decade, albeit still well below the ECB’s 2% target (Figure 4).

Figure 4

A Less-than-Expected Surprise Threatens to Unwind Recent Progress

Bloomberg.

Because quantitative easing works. Finally, as discussed in a prior post, the ECB’s staff analysis and the Governing Council’s positive view of the PEPP’s support for the real economy indicates that the ECB views asset purchases as the marginal tool for doing the heavy lifting at this juncture.

Conclusion

The combination of the three preceding factors has undoubtedly underpinned market expectations. As recently as July 2021, the ECB’s Survey of Monetary Analysts indicated no expected increase in asset purchases beyond the end of March 2022. However, the September survey revealed a median expected increase of around €12 billion in monthly purchases through 2022.1 The evolving expectations heighten the importance of the ECB’s decisions—along with their concomitant risks—in December.

We place a 30% probability on our scenario that the ECB reverts to a “muddling through” policy that continues to fall short of its inflation target and further risks its credibility in achieving its new policy regime. We place a non-negligible 10% probability that the ECB’s takes a communications misstep that could potentially result in a European-style Taper Tantrum.

Finally, we place a 60% probability on our base case that the ECB will do the “right thing” by significantly ramping up its asset purchases beyond the end of March 2022. While our base case would further underscore the separation between the policies of G10 central banks, it could also mark a significant step in improving Europe’s economic trajectory relative to its chronic shortfalls prior to the pandemic.

1See The ECB Survey of Monetary Analysts, Sept 2021 https://www.ecb.europa.eu/stats/ecb_surveys/sma/shared/pdf/ecb.smar2109…

Subscribe to the Bond Blog

Sign up to receive our weekly blog email alert notifying you when new blog entries are published.