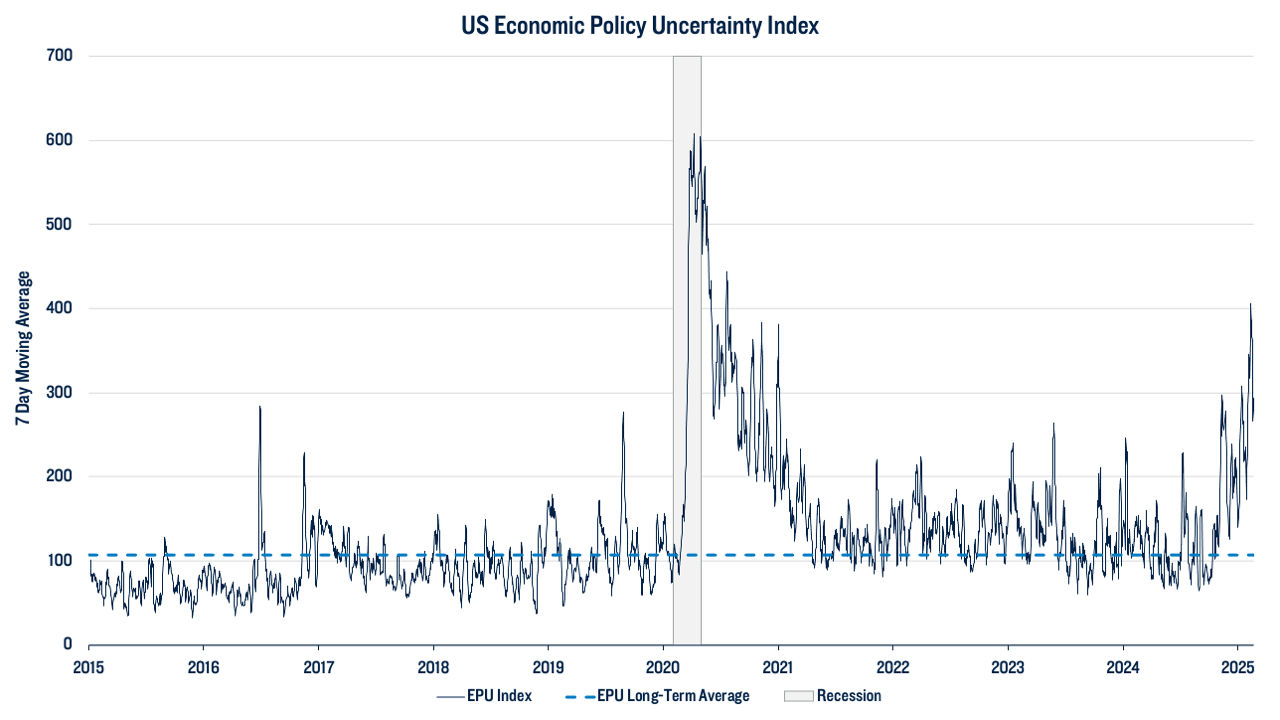

Markets can tolerate risk, but they struggle with uncertainty - and today's environment is brimming with it. From shifting trade policies to unpredictable fiscal decisions, economic policy uncertainty has become a defining trait of the investment landscape. Over recent months, the US Economic Policy Uncertainty (EPU) Index has steadily increased, surpassing pre-pandemic levels and its long-term average (Figure 1A). Unlike cyclical downturns, policy-driven volatility is difficult to quantify and even harder to hedge against.

For asset allocators, understanding the dynamics of economic policy uncertainty is critical. Careful interpretation of policy drivers can help in constructing portfolios that withstand policy-driven shocks while capturing potential alpha opportunities. Navigating today's uncertain climate demands a forward-looking strategy that separates reactive investors from proactive ones who stay ahead of the curve.

The Trump Administration and Elevated Uncertainty

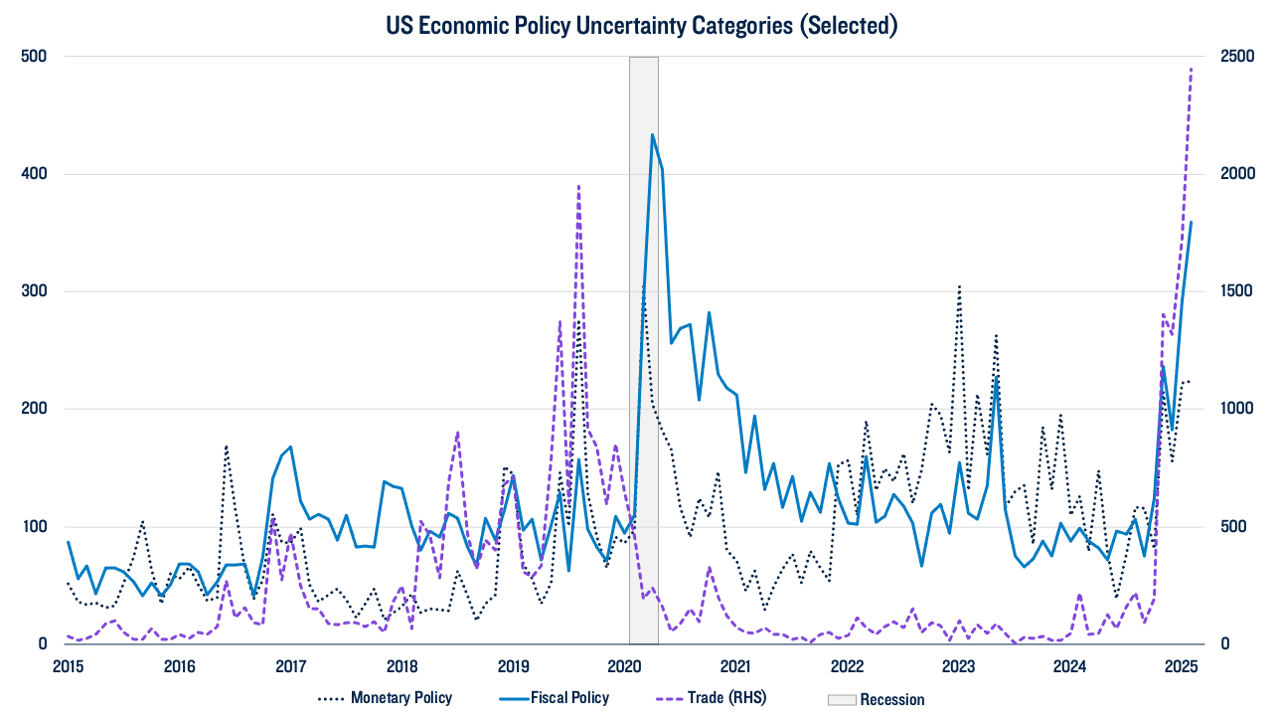

Economic policy uncertainty spiked under both Trump administrations, fueled by abrupt shifts in trade and fiscal policies (Figure 1B). For instance, February 2025 saw trade policy uncertainty reach a staggering 2446 - more than 17 times its long-term average of 136. These policies extend beyond the headlines, reshaping market expectations and influencing key economic factors such as inflation forecasts and subsequently the Federal Reserve's (Fed) interest rate trajectory. The interplay of trade and fiscal policy decisions also contributes to rising uncertainty surrounding monetary policy decisions.

Figure 1A: Economic Policy Uncertainty Surpasses Pre-Pandemic & Long-Term Average

Figure 1B: Economic Policy Uncertainty Spikes across All Metrics

Trade Policy Uncertainty

The Trump administration frequently wielded tariffs as bargaining tools, particularly in trade disputes with China and during negotiations with Canada and Mexico. The resultant policy decisions can be both abrupt and unpredictable. From a game-theory perspective, unpredictability can be a strategic advantage, keeping trade partners off balance and potentially securing more favorable terms. However, the outcomes depend on trade partners' responses, creating persistent uncertainty. The impact extends beyond negotiations, affecting supply chains, pricing, and corporate margins, and muddying long-term economic visibility for investors.

Fiscal Policy Uncertainty

The Trump administration inherited a national debt exceeding $36 trillion, raising concerns about long-term fiscal sustainability. Investors fear that rising debt levels could undermine confidence in US sovereign debt and the dollar's status as the world's reserve currency. Fiscal policy uncertainty stems from a mix of proposed tax cuts, government spending reductions, and tariff revenues. If tax breaks are enacted without corresponding spending cuts, deficits could rise, pressuring bond markets and potentially inflating risk premiums on US debt.

Monetary Policy Uncertainty

Trade and fiscal policy uncertainty also complicate the Fed's decision-making. If tariffs push inflation higher, the Fed may be forced to raise interest rates. But abrupt policy shifts could lead to overcorrections or delayed responses. Add fiscal deficits into the mix, and the Fed's monetary outlook becomes even harder to predict, piling on uncertainty for investors trying to anticipate market movements.

Business Confidence Under Pressure

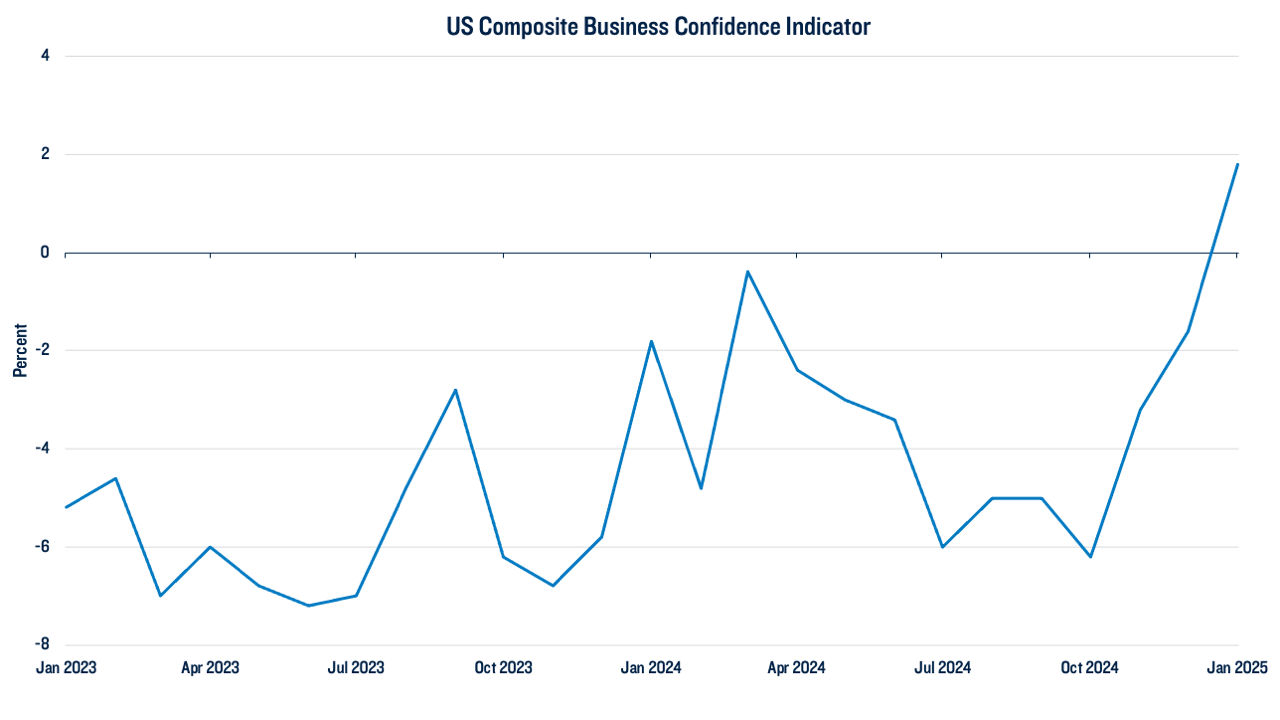

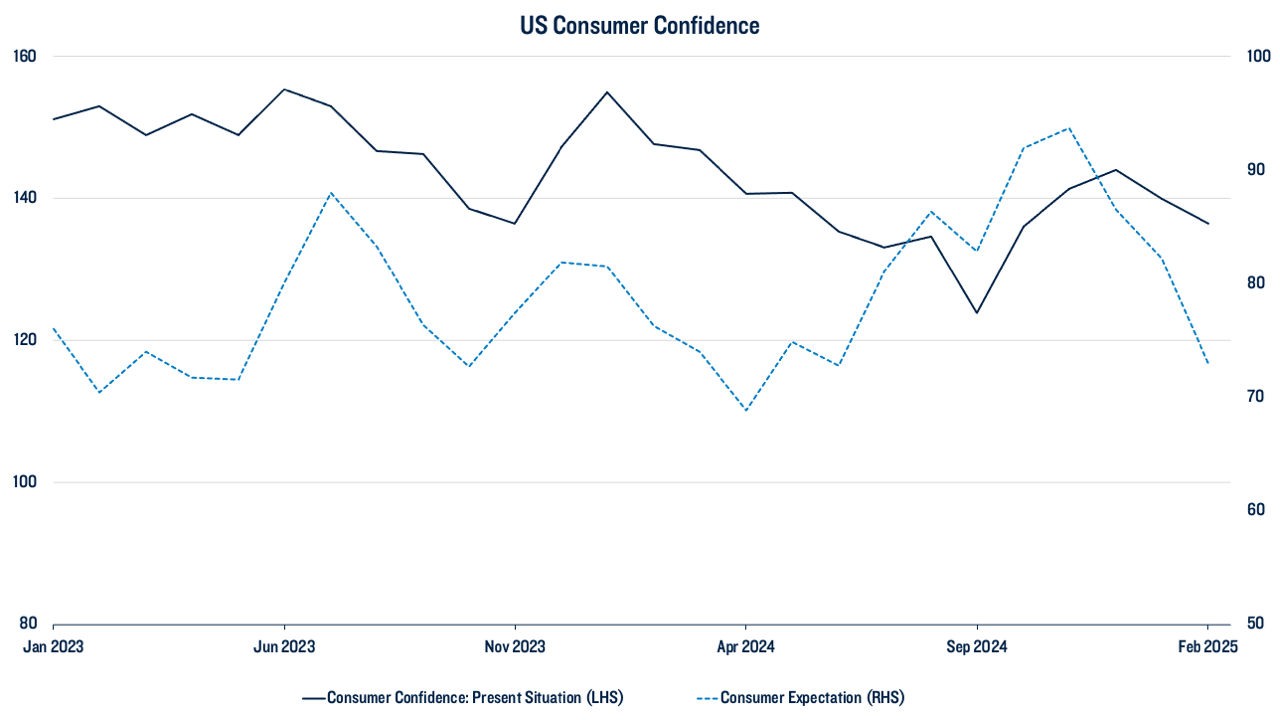

Despite elevated uncertainty, business confidence has remained resilient - even elevated - in recent months (Figure 2A). The key question now is whether this optimism can be sustained as policy uncertainty intensifies, or if rising uncertainty will eventually weigh on corporate sentiment and investment decisions. However, rising uncertainty has begun to weigh on consumer confidence (Figure 2B)2, posing the question of how long this business optimism can last. Extensive research, such as studies by economist Nicolas Bloom of Stanford University, consistently link heightened uncertainty to economic slowdowns. Bloom's research shows that heightened uncertainty leads firms to delay investment and hiring decisions as they wait for clearer policy signals before committing capital3.

Figure 2A: Business Confidence Remains Resilient

Figure 2B: While Consumer Confidence Declines

What's more, the economic effects of uncertainty are asymmetrical. Sudden, large spikes in uncertainty tend to create sharper downturns in investment, hiring, and growth than equivalent reductions in uncertainty have on stimulating economic activity4. This cautious reaction to rising uncertainty - with businesses freezing decisions and hoarding cash - tends to linger, prolonging the impact even as policy clarity improves. For investors, this asymmetry can lead to increased risk premiums, flight-to-safety behavior, and greater market volatility during periods of heightened uncertainty, leading to sharper and more volatile market drawdowns. In contrast, market recoveries are often slower and more gradual.

Investment Strategies for Uncertain Times

Periods of economic policy uncertainty can have lasting effects on business confidence and market volatility. History and research show that slowdowns driven by uncertainty can be sticky, making it crucial for investors to remain agile and adopt strategies that address potential risks without compromising opportunities.

To navigate today's environment of rising economic policy uncertainty, investors may consider incorporating a portable alpha overlay strategy, which can enhance diversification and generate additive returns without changing underlying portfolio allocations and/or existing active managers. Option-based strategies, such as buffered ETFs, can provide investors protection from downside risks while maintaining upside exposure. Navigating these uncertain times comes down to staying informed, maintaining portfolio flexibility, and preparing for volatility to weather the challenges ahead.

1The categorical data include news-based sub-indexes that require different terms sets. For example, the trade policy category contains terms like import tariffs, government subsidies, and trade treaties. The fiscal policy category contains terms like government spending, federal budget, and fiscal stimulus. The monetary policy category contains terms like federal reserve, money supply, and interest rates. For the complete terms sets and more details on methodology, see https://www.policyuncertainty.com/categorical_epu.html. Each categorical series is normalized to have a mean of 100 from 1985-2010. The long-term averages are calculated using Jan 1985 - Feb 2025 data (EPU 107, Monetary Policy Uncertainty 97, Fiscal Policy Uncertainty 110, Trade Policy Uncertainty 136). The grey bar denotes the recession dated by NBER.

2 Choudhry, T., & Wohar, M. (2024). What drives US consumer confidence? The asymmetric effects of economic uncertainty. International Journal of Finance & Economics, 29(4), 4268-4285.

3 Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77(3), 623-685.

Bloom, N. (2014). Fluctuations in uncertainty. Journal of Economic Perspectives, 28(2), 153-176.

Bloom, N., Floetotto, M., Jaimovich, N., Saporta‐Eksten, I., & Terry, S. J. (2018). Really uncertain business cycles. Econometrica, 86(3), 1031-1065.

4 Foerster, A. (2014). The asymmetric effects of uncertainty. Economic Review, 99, 5-26.

Guenich, H., Hamdi, K., & Chouaibi, N. (2022). Asymmetric response of Investor sentiment to Economic Policy Uncertainty, interest rates and oil price uncertainty: Evidence from OECD countries. Cogent Economics & Finance, 10(1), 2151113

This material is intended for Professional Investors only. All investments involve risk, including the possible loss of capital. Past performance is not a guarantee or a reliable indicator of future results.

PGIM Quantitative Solutions LLC (PGIM Quantitative Solutions or PGIM Quant) is an SEC-registered investment adviser and a wholly-owned subsidiary of PGIM, Inc. (PGIM) the principal asset management business of Prudential Financial, Inc. (PFI) of the United States of America. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc, which is headquartered in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom.

The comments, opinions and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Quantitative Solutions believes to be reliable. We do not guarantee the accuracy of such sources of information and have no obligation to provide updates or changes to these materials. This material is for informational purposes and sets forth our views as of the date of this presentation. The underlying assumptions and our views are subject to change.

These materials are neither intended as investment advice nor an offer or solicitation with respect to the purchase or sale of any security or financial instrument. These materials are not intended to be an offer with respect to the provision of investment management services. The opinions expressed herein do not take into account individual client circumstances, objectives, or needs and are therefore not intended to serve as investment recommendations. No determination has been made regarding the suitability of particular strategies to particular clients or prospects. The financial indices referenced herein is provided for informational purposes only. You cannot invest directly in an index. The statistical data regarding such indices has been obtained from sources believed to be reliable but has not been independently verified.

Certain information contained herein may constitute “forward-looking statements,” (including observations about markets and industry and regulatory trends as of the original date of this document). Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making any decisions. No representation or warranty is made as to future performance or such forward-looking statements.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V. with registered office: Eduard van Beinumstraat 6 1077CZ, Amsterdam, The Netherlands. PGIM Netherlands B.V. is authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands (Registration number 15003620) and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). PGIM Quantitative Solutions LLC, PGIM Limited and/or PGIM Netherlands B.V. are indirect, wholly-owned subsidiaries of PGIM, Inc. (“PGIM”).

In Australia, these materials are distributed by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the Financial Conduct Authority (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. PGIM Limited’s registered office is Grand Buildings, 1-3 The Strand, Trafalgar Square, London, WC2N 5HR.

In Switzerland, information issued by PGIM Limited, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland.

In Canada, PGIM Quantitative Solutions LLC relies upon the “International Advisor Exemption” pursuant to National Instrument 31-103 in certain provinces of Canada.

In Singapore, information is issued by PGIM (Singapore) Pte. Ltd. (“PGIM Singapore”), a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. This material is issued by PGIM Singapore for the general information of “institutional investors” pursuant to Section 304 of the Securities and Futures Act 2001 of Singapore (the “SFA”) and “accredited investors” and other relevant persons in accordance with the conditions specified in Section 305 of the SFA.

In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571).

In Japan, the investment management capabilities and services described in the attached materials are offered by PGIM Japan Co., Ltd (PGIMJ), a Japanese registered investment adviser (Director-General of the Kanto Local Finance Bureau (FIBO) No. 392). Retention of PGIMJ for the actual provision of such investment advisory services may only be affected pursuant to the terms of an investment management contract executed directly between PGIMJ and the party desiring such services, it is anticipated that PGIMJ would delegate certain investment management services to its US-registered investment advisory affiliate.

In Korea, PGIM Quantitative Solutions LLC holds cross-border discretionary investment management and investment advisory licenses under the Korea Financial Investment Services and Capital Markets Act (“FSCMA”), and is registered in such capacities with the Financial Services Commission of Korea. These materials are intended solely for Qualified Professional Investors as defined under the FSCMA and should not be given or shown to any other persons.

These materials are not intended for distribution to, or use by, any person in any jurisdiction where such distribution would be contrary to local or international law or regulation. The views and opinions herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients or prospects. No determination has been made regarding the appropriateness of any securities, financial instruments or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions.

Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes and political and economic uncertainties. Emerging and developing market investments may be especially volatile. Investments in securities of growth companies may be especially volatile. Due to the recent global economic crisis that caused financial difficulties for many European Union countries, Eurozone investments may be subject to volatility and liquidity issues. Value investing involves the risk that undervalued securities may not appreciate as anticipated. Small and mid-sized company stock is typically more volatile than that of larger, more established businesses, as these stocks tend to be more sensitive to changes in earnings expectations and tend to have lower trading volumes than large-cap securities, creating potential for more erratic price movements. It may take a substantial period of time to realize a gain on an investment in a small or mid-sized company, if any gain is realized at all. Diversification does not guarantee profit or protect against loss. Emerging markets are countries that are beginning to emerge with increased consumer potential driven by rapid industrial expansion and economic growth. Investing in emerging markets is very risky due to the additional political, economic and currency risks associated with these underdeveloped geographic areas. Fixed-income investments are subject to interest rate risk, and their value will decline as interest rates rise. Unlike other investment vehicles, U.S. government securities and U.S. Treasury bills are backed by the full faith and credit of the U.S. government, are less volatile than equity investments, and provide a guaranteed return of principal at maturity. Treasury Inflation-Protected Securities (TIPS) are inflation-index bonds that may experience greater losses than other fixed income securities with similar durations and are more likely to cause fluctuations in a Portfolio’s income distribution. Investing in real estate poses risks related to an individual property, credit risk and interest rate fluctuations. High yield bonds, commonly known as junk bonds, are subject to a high level of credit and market risks. Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate and when sold may be worth more or less than the original cost.

PGIM Quantitative Solutions affiliates may develop and publish research that is independent of, and different than, the views and opinions contained herein. PGIM Quantitative Solutions personnel other than the author(s), such as sales, marketing and trading personnel, may provide oral or written market commentary or ideas to PGIM Quantitative Solutions’ clients or prospects or proprietary investment ideas that differ from the views expressed herein. Additional information regarding actual and potential conflicts of interest is available in PGIM Quantitative Solutions’ Form ADV Part 2A. Asset allocation is a method of diversification that positions assets among major investment categories. Asset allocation can be used to manage investment risk and potentially enhance returns. However, use of asset allocation does not guarantee a profit or protect against a loss.

© 2025 PGIM Quantitative Solutions. All rights reserved. PGIM, PGIM Quantitative Solutions, the PGIM Quantitative Solutions logo and the Rock design are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

Collapse Section