Treasury Inflation-Protected Securities (TIPS) often get a bad rap. At first glance, the relative simplicity of nominal Treasury bonds might make them the obvious choice for a fixed income investor.

After all, the decision between a nominal Treasury bond yielding i% and a TIPS bond yielding r% — with inflation expected to be (i - r)% over the bond's life — seems to be straightforward. So what difference does it really make?

For the sake of argument, assume that realized inflation equals expected inflation. Even in this case, the path of coupon payments would look very different. Nominal Treasuries pay a fixed coupon semi-annually. TIPS, however, provide variable payments, with coupons adjusted based on changes in the Consumer Price Index (CPI)1. For investors facing liabilities that rise with inflation, TIPS offer a hedging advantage that nominal bonds can't replicate.

It gets especially interesting when realized inflation differs from expectations.

2020-2021: Inflation Surprises Shift the Balance

The aftermath of the COVID-19 economic recovery brought a dramatic inflationary surge that few anticipated. At the end of 2020, the Cleveland Fed's one-year inflation expectation estimate stood at an unassuming 1.65%. However, CPI soared by 7% (seasonally adjusted) over the following year — a massive 5% surprise.

Yet even as inflation surged, markets clung to the narrative of "transitory" inflation. The Fed's commitment to low rates translated to both real and nominal bond yields remaining relatively flat throughout 2021. But TIPS had a card up their sleeve. The price adjustment tied to higher realized inflation boosted their performance, leading TIPS to outperform nominal Treasuries with similar maturities.

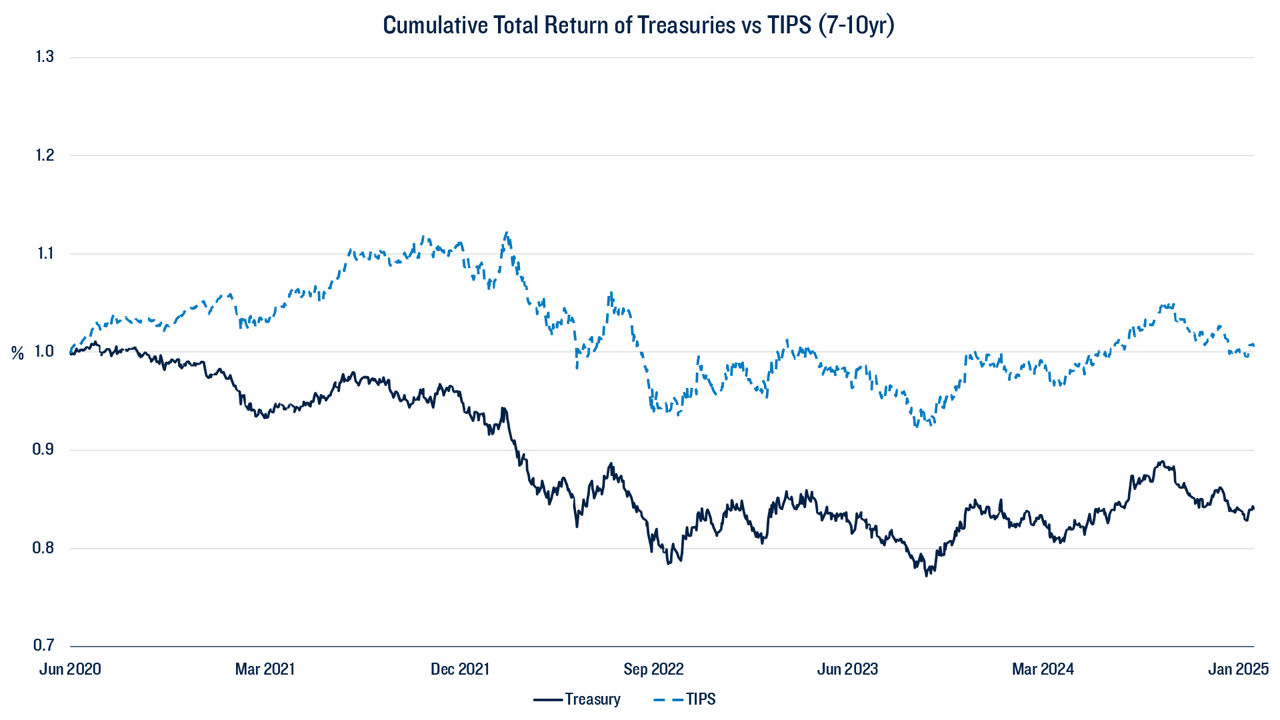

This dynamic is evident in Figure 1, which illustrates cumulative total returns from mid-2020 through the end of 2021. While the Bloomberg US Treasury 7-10yr Index declined, the Bloomberg US Government-Linked 7-10yr Index, which includes TIPS, rose approximately 10%.

Figure 1: TIPS Outperform Amid 2020-2021 Inflationary Surge

When Inflation Surprises, TIPS Shine

The connection between inflation surprises and TIPS outperformance is also clear in Figure 2, which tracks rolling one-year total returns of TIPS versus nominal Treasuries alongside the US Citi Inflation Surprise Index. Typically, when inflation surprises on the upside, TIPS tend to outperform Treasuries. On the flip side, in periods with little or no inflation surprises, performance between the two tends to be very similar.

Figure 2: TIPS Outperformance Tracks Inflation Surprises in H2 2020-2021

TIPS in 2022 and Beyond

While TIPS outperformed in the back half of 2020 and into 2021, they weren't immune to the bond market sell-off of 2022, during which the Treasury index fell roughly -15% and the TIPS index dropped by around -14%. A slim 1% outperformance isn't nothing, but it's also not something to write home about.

Why the similar results? By 2022, both markets and the Fed recognized that inflation wasn't transitory and significant interest rate hikes would be needed to rein in inflation, which drove nominal yields sharply higher. However, breakeven inflation remained relatively contained,2 reflecting confidence in the Fed's ability to restore price stability. Consequently, rising nominal yields translated into rising real yields3. Since TIPS and nominal Treasuries shared comparable duration profiles, both indices had similar performance.

Tipping the Scales of Inflation Hedging

While TIPS exposure isn't a panacea for inflation hedging, they serve as a powerful complement to a broader strategy, delivering results when conditions align with their unique benefits. When inflation takes an unexpected turn, TIPS can deliver returns that outshine traditional Treasuries, providing a key edge in volatile environments. By understanding their role and limitations, investors can position TIPS as a strategic tool to capture upside opportunities while effectively navigating inflation risks.

1 Coupons are paid based on the adjusted face value Ft=F0(Pt/P0), where Ft is the face value at time t and Pt is the CPI at time t.

Modifying the quasi-real bond proposal from Eagle and Domian (Eagle, D. M., & Domian, D. L. (1995). Quasi-real bonds: inflation-indexing that retains the government's hedge against aggregate-supply shocks. Applied Economics Letters, 2(12), 487-490. https://doi.org/10.1080/135048595356943), the alternative formula FtQ=F0(Pt/P0)/(1+g)t , where g

is the projected inflation rate through the horizon (which could be obtained from TIPS of similar maturity), would only adjust the face value for price level surprises. If the price level grows consistent with initial expectations, then the coupon structure would mimic nominal bonds. It would permanently adjust in reaction to price level shocks.

2 It is not the case that shorter-term breakeven inflation remained contained.

3 This behavior is also consistent with the Taylor principle, which says that central banks should raise policy rates more than proportionally to inflation to maintain stability.

This material is intended for Professional Investors only. All investments involve risk, including the possible loss of capital. Past performance is not a guarantee or a reliable indicator of future results.

PGIM Quantitative Solutions LLC (PGIM Quantitative Solutions or PGIM Quant) is an SEC-registered investment adviser and a wholly-owned subsidiary of PGIM, Inc. (PGIM) the principal asset management business of Prudential Financial, Inc. (PFI) of the United States of America. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc, which is headquartered in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom.

The comments, opinions and estimates contained herein are based on and/or derived from publicly available information from sources that PGIM Quantitative Solutions believes to be reliable. We do not guarantee the accuracy of such sources of information and have no obligation to provide updates or changes to these materials. This material is for informational purposes and sets forth our views as of the date of this presentation. The underlying assumptions and our views are subject to change.

These materials are neither intended as investment advice nor an offer or solicitation with respect to the purchase or sale of any security or financial instrument. These materials are not intended to be an offer with respect to the provision of investment management services. The opinions expressed herein do not take into account individual client circumstances, objectives, or needs and are therefore not intended to serve as investment recommendations. No determination has been made regarding the suitability of particular strategies to particular clients or prospects. The financial indices referenced herein is provided for informational purposes only. You cannot invest directly in an index. The statistical data regarding such indices has been obtained from sources believed to be reliable but has not been independently verified.

Certain information contained herein may constitute “forward-looking statements,” (including observations about markets and industry and regulatory trends as of the original date of this document). Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making any decisions. No representation or warranty is made as to future performance or such forward-looking statements.

In the United Kingdom, information is issued by PGIM Limited with registered office: Grand Buildings, 1-3 Strand, Trafalgar Square, London, WC2N 5HR. PGIM Limited is authorised and regulated by the Financial Conduct Authority (“FCA”) of the United Kingdom (Firm Reference Number 193418). In the European Economic Area (“EEA”), information is issued by PGIM Netherlands B.V. with registered office: Eduard van Beinumstraat 6 1077CZ, Amsterdam, The Netherlands. PGIM Netherlands B.V. is authorised by the Autoriteit Financiële Markten (“AFM”) in the Netherlands (Registration number 15003620) and operating on the basis of a European passport. In certain EEA countries, information is, where permitted, presented by PGIM Limited in reliance of provisions, exemptions or licenses available to PGIM Limited under temporary permission arrangements following the exit of the United Kingdom from the European Union. These materials are issued by PGIM Limited and/or PGIM Netherlands B.V. to persons who are professional clients as defined under the rules of the FCA and/or to persons who are professional clients as defined in the relevant local implementation of Directive 2014/65/EU (MiFID II). PGIM Quantitative Solutions LLC, PGIM Limited and/or PGIM Netherlands B.V. are indirect, wholly-owned subsidiaries of PGIM, Inc. (“PGIM”).

In Australia, these materials are distributed by PGIM (Australia) Pty Ltd (“PGIM Australia”) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). PGIM Australia is a representative of PGIM Limited, which is exempt from the requirement to hold an Australian Financial Services License under the Australian Corporations Act 2001 in respect of financial services. PGIM Limited is exempt by virtue of its regulation by the Financial Conduct Authority (Reg: 193418) under the laws of the United Kingdom and the application of ASIC Class Order 03/1099. The laws of the United Kingdom differ from Australian laws. PGIM Limited’s registered office is Grand Buildings, 1-3 The Strand, Trafalgar Square, London, WC2N 5HR.

In Switzerland, information issued by PGIM Limited, through its Representative Office in Zurich with registered office: Kappelergasse 14, CH-8001 Zurich, Switzerland. PGIM Limited, Representative Office in Zurich is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA and these materials are issued to persons who are professional or institutional clients within the meaning of Art.4 para 3 and 4 FinSA in Switzerland.

In Canada, PGIM Quantitative Solutions LLC relies upon the “International Advisor Exemption” pursuant to National Instrument 31-103 in certain provinces of Canada.

In Singapore, information is issued by PGIM (Singapore) Pte. Ltd. (“PGIM Singapore”), a regulated entity with the Monetary Authority of Singapore under a Capital Markets Services License to conduct fund management and an exempt financial adviser. This material is issued by PGIM Singapore for the general information of “institutional investors” pursuant to Section 304 of the Securities and Futures Act 2001 of Singapore (the “SFA”) and “accredited investors” and other relevant persons in accordance with the conditions specified in Section 305 of the SFA.

In Hong Kong, information is provided by PGIM (Hong Kong) Limited, a regulated entity with the Securities & Futures Commission in Hong Kong to professional investors as defined in Section 1 of Part 1 of Schedule 1 of the Securities and Futures Ordinance (Cap.571).

In Japan, the investment management capabilities and services described in the attached materials are offered by PGIM Japan Co., Ltd (PGIMJ), a Japanese registered investment adviser (Director-General of the Kanto Local Finance Bureau (FIBO) No. 392). Retention of PGIMJ for the actual provision of such investment advisory services may only be affected pursuant to the terms of an investment management contract executed directly between PGIMJ and the party desiring such services, it is anticipated that PGIMJ would delegate certain investment management services to its US-registered investment advisory affiliate.

In Korea, PGIM Quantitative Solutions LLC holds cross-border discretionary investment management and investment advisory licenses under the Korea Financial Investment Services and Capital Markets Act (“FSCMA”), and is registered in such capacities with the Financial Services Commission of Korea. These materials are intended solely for Qualified Professional Investors as defined under the FSCMA and should not be given or shown to any other persons.

These materials are not intended for distribution to, or use by, any person in any jurisdiction where such distribution would be contrary to local or international law or regulation. The views and opinions herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients or prospects. No determination has been made regarding the appropriateness of any securities, financial instruments or strategies for particular clients or prospects. For any securities or financial instruments mentioned herein, the recipient(s) of this report must make its own independent decisions.

Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes and political and economic uncertainties. Emerging and developing market investments may be especially volatile. Investments in securities of growth companies may be especially volatile. Due to the recent global economic crisis that caused financial difficulties for many European Union countries, Eurozone investments may be subject to volatility and liquidity issues. Value investing involves the risk that undervalued securities may not appreciate as anticipated. Small and mid-sized company stock is typically more volatile than that of larger, more established businesses, as these stocks tend to be more sensitive to changes in earnings expectations and tend to have lower trading volumes than large-cap securities, creating potential for more erratic price movements. It may take a substantial period of time to realize a gain on an investment in a small or mid-sized company, if any gain is realized at all. Diversification does not guarantee profit or protect against loss. Emerging markets are countries that are beginning to emerge with increased consumer potential driven by rapid industrial expansion and economic growth. Investing in emerging markets is very risky due to the additional political, economic and currency risks associated with these underdeveloped geographic areas. Fixed-income investments are subject to interest rate risk, and their value will decline as interest rates rise. Unlike other investment vehicles, U.S. government securities and U.S. Treasury bills are backed by the full faith and credit of the U.S. government, are less volatile than equity investments, and provide a guaranteed return of principal at maturity. Treasury Inflation-Protected Securities (TIPS) are inflation-index bonds that may experience greater losses than other fixed income securities with similar durations and are more likely to cause fluctuations in a Portfolio’s income distribution. Investing in real estate poses risks related to an individual property, credit risk and interest rate fluctuations. High yield bonds, commonly known as junk bonds, are subject to a high level of credit and market risks. Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate and when sold may be worth more or less than the original cost.

PGIM Quantitative Solutions affiliates may develop and publish research that is independent of, and different than, the views and opinions contained herein. PGIM Quantitative Solutions personnel other than the author(s), such as sales, marketing and trading personnel, may provide oral or written market commentary or ideas to PGIM Quantitative Solutions’ clients or prospects or proprietary investment ideas that differ from the views expressed herein. Additional information regarding actual and potential conflicts of interest is available in PGIM Quantitative Solutions’ Form ADV Part 2A. Asset allocation is a method of diversification that positions assets among major investment categories. Asset allocation can be used to manage investment risk and potentially enhance returns. However, use of asset allocation does not guarantee a profit or protect against a loss.

© 2025 PGIM Quantitative Solutions. All rights reserved. PGIM, PGIM Quantitative Solutions, the PGIM Quantitative Solutions logo and the Rock design are service marks of PFI and its related entities, registered in many jurisdictions worldwide.

Collapse Section