Institutional investors are allocating more capital and resources to unlisted infrastructure investments for their purported stable and high income returns, relatively low correlation with other asset classes, and suitability for hedging long-duration liabilities. These characteristics, along with investor attention to their nation’s welfare, evolving regulatory requirements, and ongoing trends in the energy transition, have amplified the appeal of such investments.

Using an asset-level infrastructure dataset, we extend our previous study in infrastructure performance, valuation and return attribution. We define the various components of infrastructure asset returns, distinguishing between price and income returns. We further examine how underlying drivers, e.g., sales growth, valuation multiple expansion/contraction, drive infrastructure price returns, and then compare how these drivers affect public markets. We also evaluate how infrastructure assets respond to macroeconomic factors (e.g., inflation) and correlate with broader public market returns. Lastly, we discuss the pros and cons of an asset pricing methodology used for calculating infrastructure index returns.

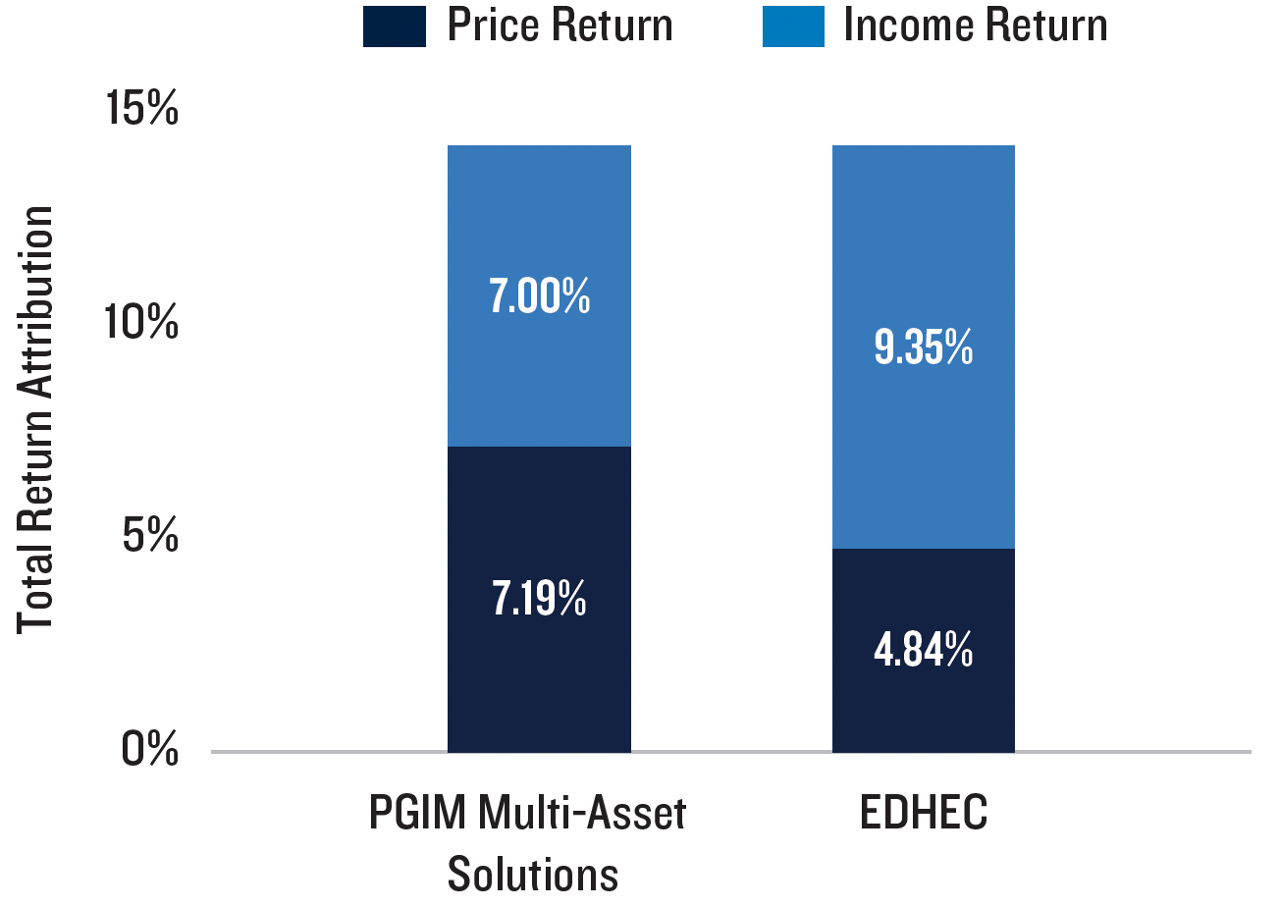

Due to the different approach between PMA and EDHECinfra in total return decomposition, there is a difference in return attribution – sometimes a substantial difference – even though the total returns are the same. From 2007 to 2022, our income return component is 7.0%/y, with price return contributing 7.2%/y. In contrast, EDHECinfra produces a much higher income return component of 9.4%/y and a lower price return of 4.8%/y.

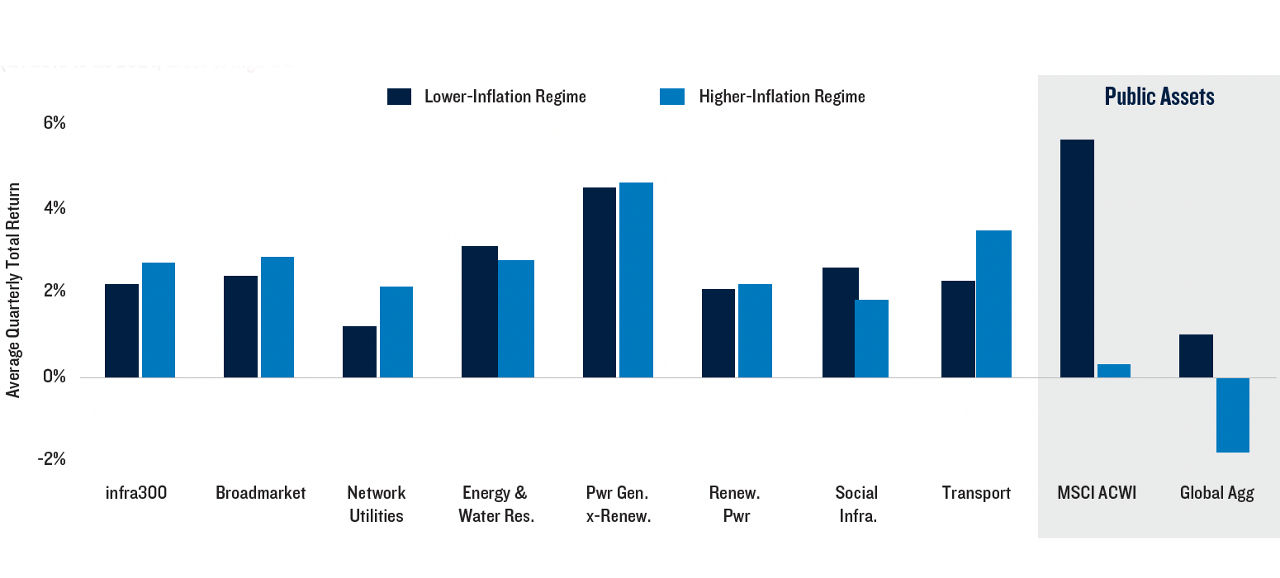

Recent inflationary pressures have ignited interest in infrastructure as a potential inflation hedge. But what is the empirical evidence for this potential? From Q4 2019 to Q3 2024, did infrastructure equity perform better during higher (CPI ≥ 4%) vs. lower (CPI < 4%) inflation periods? We found that infrastructure equity performance varied noticeably across inflation regimes. Certain sectors, such as Network Utilities and Transport, exhibited some of the most pronounced differences, with their quarterly returns increasing by more than a percentage point in higher-inflation vs. lower-inflation environments. In addition, infrastructure equity performed better than stocks (MSCI ACWI) and bonds (Bloomberg Global Aggregate), on average, during periods of higher inflation.

Total Return Attribution Comparison

(2007 to 2022, Gross of Mgmt. Cost)

Average Quarterly Total Return

(EDHEC Infrastructure Indices, Lower-Inflation Regime (CPI < 4%) vs. Higher-Inflation Regime (CPI >= 4%))

Five key takeaways for CIOs, asset allocators, and risk managers:

- High infrastructure equity income returns (and low price returns) – relative to public equity markets – have confounded investors. We review and clarify what "income return" means for an infrastructure equity asset.

- Using an asset-level dataset, we break down infrastructure returns into income and price components, and find that infrastructure equity assets have, indeed, provided higher income returns (around 4-5%/y, net of costs) compared to public equity.

- Infrastructure investments do carry significant asset-selection (i.e., idiosyncratic) risk which might be effectively diversified with 10 or more equity assets.

- Measuring price returns is challenging due to limited data. Bayesian techniques can help estimate periodic valuations and returns, but need careful interpretation.

- Infrastructure has historically outperformed stocks and bonds during inflationary periods, supporting its role as a potential inflation hedge.