Key Updates in This Quarter's Forecasts

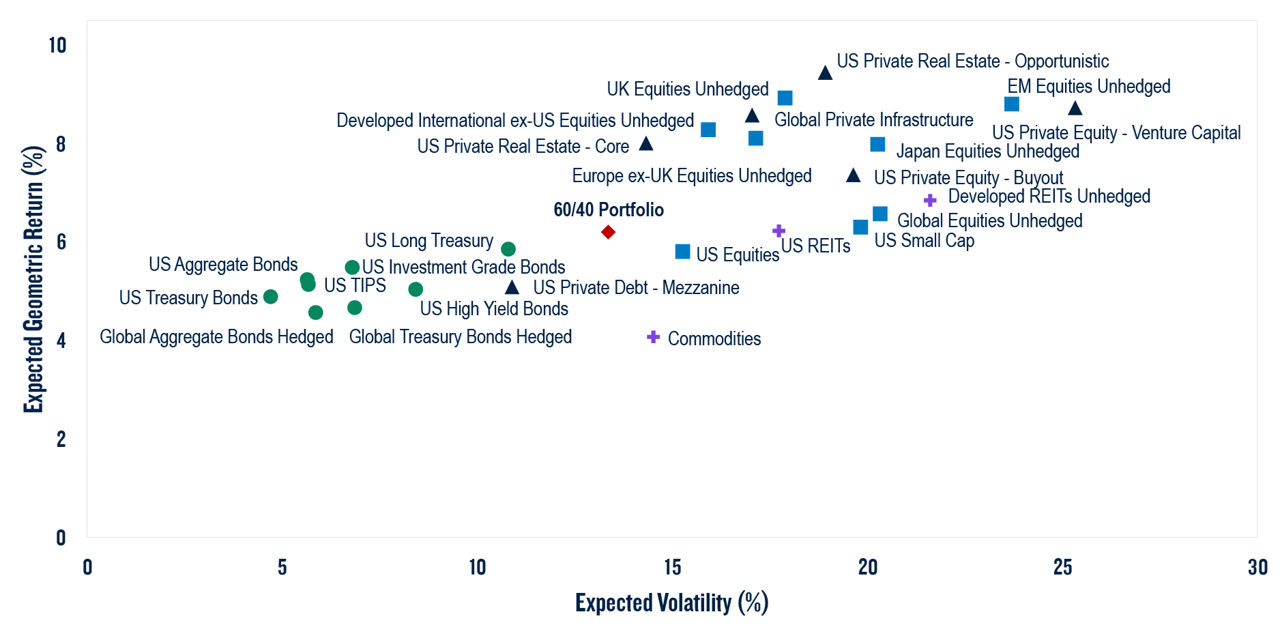

Our long-term outlook for fixed income assets shifted significantly higher from last quarter, coincident with the increase in sovereign

interest rates in Q4 2024. Adjustments to our 10-year annualized return forecasts include:

- US Aggregate Bonds: Revised to 5.23% from 4.09% last quarter.

- US Long Treasury Bonds: Revised to 5.84% from 4.26% last quarter.

- Global Aggregate Bonds Hedged: Revised to 4.56% from 3.85% last quarter.

Our 10-year forecasts for equity markets outside the US continue to exceed those of large-capitalization US equities, primarily attributable to more favorable valuations:

- US Large-Cap Equities: Forecasted at 5.79%.

- International Equities ex-US: Forecasted at 8.27%.

- Emerging Markets Equities: Forecasted at 8.79%.

This quarter's portfolio rebalancing recommendations include:

- Reduction in US Equity allocation.

- Reduction in Commodity allocation.

- Increase in Fixed Income exposure.

Note: Forecasts may not be achieved and are not a guarantee or reliable indicator of future results