Will this Viral Phenomenon Stick Around?

Data Suggests that it is running out of gas.

- The word "meme" typically evokes images or videos with humorous, culturally relevant captions that spread like wildfire on social media. Few people expected that this meme concept would find its way into the investing world. So-called meme stocks became a topic of conversation for many investors in January 2021 when a handful of these names rose by astronomical margins, driven by a frenzy of retail investors. Institutional asset managers were forced to wrestle with the question of what to do with a meme stock that could represent a weighting of over 200 basis points in their benchmark!

- So, what defines a meme stock? There is no one concrete way to quantify meme stocks and there will always be some subjectivity in the process. For our evaluation, we considered the following on a monthly frequency:

- Stocks in the Russell 3000 Index

- Stock price increase of more than 25% on any given day

- Short float of >1/8th (12.5%) of shares outstanding

- Exclusion of IPO/SPAC stocks

- Investors' apparent disregard for fundamentals and notable social media chatter (Yes, it's a bit subjective!)

- Based on the above criteria, we identified 24 meme stocks in January 2021, when the meme phenomenon took center stage. However, meme stocks accounted for less than 1% of all the names in the Russell 3000 Index. Also, as seen in Exhibit 1 (below), the number of meme stocks we identified (based on our custom definition) decreased from a high of 24 in January to just one in October, indicating that retail investors lost their appetite for these stocks. So, while meme stocks took off in early 2021 few, if any, have recently emerged, suggesting the phenomenon may be transitory.

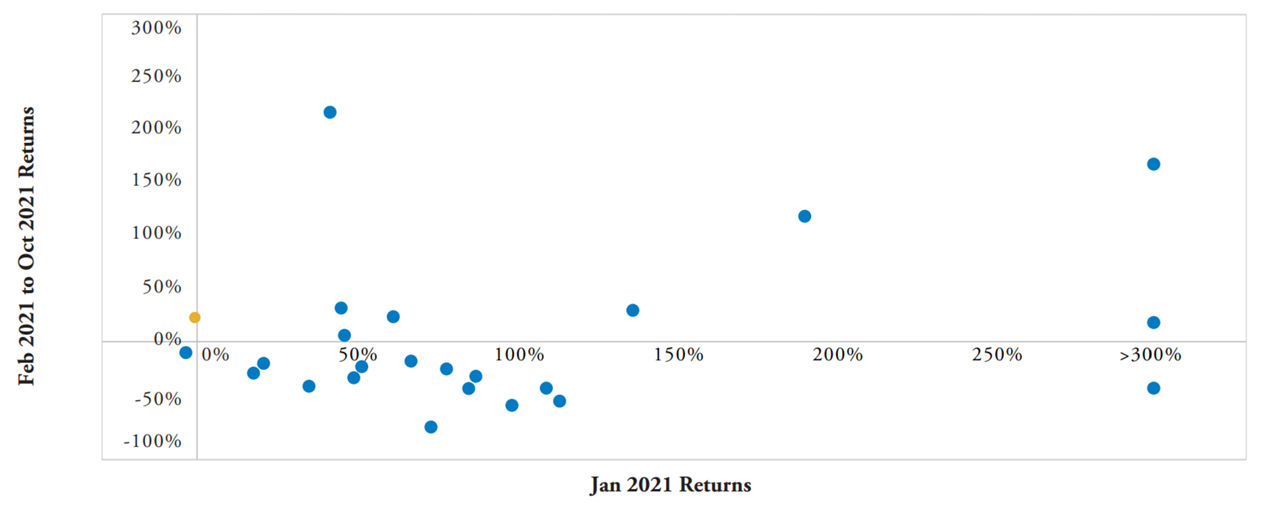

- In January 2021, the 24 meme stocks posted staggering returns with many rising well over 100% in that month alone. However, the overwhelming majority of these names significantly underperformed their benchmark, the Russell 3000 Index, over the next nine months, with two-thirds of the names posting negative returns (See Exhibit 2, below). In fact, three of the names were eliminated from the benchmark! As expected, we did see several outliers, but those were few and far between.

Exhibit 2: Meme Stock Returns

The Bottom Line:

- Meme-type stocks have been around for a while, but were historically coined short squeezes. This is the first time that we have witnessed organized, social media-based investing imparting a significant impact on the stock prices of medium- to large-sized firms. But despite the earlier hype, investor interest, along with the stock prices for a majority of meme stocks, has evaporated. Returns have declined significantly and no new meme stocks are being created, indicating that that this is a fad and not an ongoing investment phenomenon. At the least, we would not recommend creating a portfolio based on online forum discussions. At PGIM Quantitative Solutions, we build portfolios using fundamental measures that are more persistent and that we believe will perform better over the long run. Our portfolios have avoided the volatility associated with meme stocks and we will continue to invest in stocks that are cheaper than the market with strong growth and quality attributes